Motorola 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

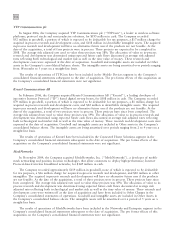

TTP Communications plc

In August 2006, the Company acquired TTP Communications plc (""TTPCom''), a leader in wireless software

platforms, protocol stacks and semiconductor solutions, for $193 million in cash. The Company recorded

$52 million in goodwill, a portion of which is expected to be deductible for tax purposes, a $17 million charge for

acquired in-process research and development costs, and $118 million in identifiable intangible assets. The acquired

in-process research and development will have no alternative future uses if the products are not feasible. At the

date of the acquisition, a total of four projects were in process. These projects are expected to be completed in

2008. The average risk adjusted rate used to value these projects was 18%. The allocation of value to in-process

research and development was determined using expected future cash flows discounted at average risk adjusted

rates reflecting both technological and market risk as well as the time value of money. These research and

development costs were expensed at the date of acquisition. Goodwill and intangible assets are included in Other

assets in the Company's consolidated balance sheets. The intangible assets are being amortized over periods ranging

from 18 months to 5 years on a straight-line basis.

The results of operations of TTPCom have been included in the Mobile Devices segment in the Company's

consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this acquisition on

the Company's consolidated financial statements were not significant.

Kreatel Communications AB

In February 2006, the Company acquired Kreatel Communications AB (""Kreatel''), a leading developer of

innovative Internet Protocol (""IP'') based digital set-top boxes, for $108 million in cash. The Company recorded

$79 million in goodwill, a portion of which is expected to be deductible for tax purposes, a $1 million charge for

acquired in-process research and development costs, and $22 million in identifiable intangible assets. The acquired

in-process research and development will have no alternative future uses if the products are not feasible. At the

date of the acquisition, a total of two projects were in process. These projects have since been completed. The

average risk adjusted rate used to value these projects was 19%. The allocation of value to in-process research and

development was determined using expected future cash flows discounted at average risk adjusted rates reflecting

both technological and market risk as well as the time value of money. These research and development costs were

expensed at the date of acquisition. Goodwill and intangible assets are included in Other assets in the Company's

consolidated balance sheets. The intangible assets are being amortized over periods ranging from 2 to 4 years on a

straight-line basis.

The results of operations of Kreatel have been included in the Connected Home Solutions segment in the

Company's consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this

acquisition on the Company's consolidated financial statements were not significant.

MeshNetworks

In November 2004, the Company acquired MeshNetworks, Inc. (""MeshNetworks''), a developer of mobile

mesh networking and position location technologies that allow customers to deploy high-performance, Internet

Protocol-based wireless broadband networks, for $169 million in cash.

The Company recorded approximately $119 million in goodwill, none of which is expected to be deductible

for tax purposes, a $16 million charge for acquired in-process research and development, and $20 million in other

intangibles. The acquired in-process research and development will have no alternative future uses if the products

are not feasible. At the date of the acquisition, a total of three projects were in process. These projects have since

been completed. The average risk adjusted rate used to value these projects was 45%. The allocation of value to in-

process research and development was determined using expected future cash flows discounted at average risk

adjusted rates reflecting both technological and market risk as well as the time value of money. These research and

development costs were written off at the date of acquisition and have been included in Other Charges in the

Company's consolidated statements of operations. Goodwill and intangible assets are included in Other Assets in

the Company's consolidated balance sheets. The intangible assets will be amortized over a period of 5 years on a

straight-line basis.

The results of operations of MeshNetworks have been included in the Networks and Enterprise segment in the

Company's consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this

acquisition on the Company's consolidated financial statements were not significant.