Motorola 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

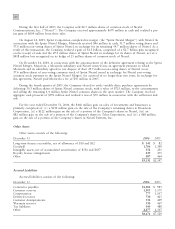

provisions of SFAS No. 133, ""Accounting for Derivative Instruments and Hedging Activities''. Accordingly, to

reflect the change in fair value of the Sprint Nextel Derivative, the Company recorded a net gain of $99 million for

the year ended December 31, 2006, included in Other income (expense) in the Company's consolidated statements

of operations. In December 2006, the Sprint Nextel Derivative was terminated and settled in cash and the

37.6 million shares of Sprint Nextel were converted to common shares and sold. The Company received aggregate

cash proceeds of approximately $820 million from the settlement of the Sprint Nextel Derivative and the

subsequent sale of the 37.6 million Sprint Nextel shares. The Company recognized a loss of $126 million in

connection with the sale of the remaining shares of Sprint Nextel common stock. As described above, the

Company recorded a net gain of $99 million in connection with the Sprint Nextel Derivative.

Prior to the merger of Sprint Corporation (""Sprint'') and Nextel Communications, Inc. (""Nextel''), the

Company had entered into variable share forward purchase agreements (the ""Variable Forwards'') to hedge its

Nextel common stock. The Company did not designate the Variable Forwards as a hedge of the Sprint Nextel

shares received as a result of the merger. Accordingly, the Company recorded $51 million of gains for the year

ended December 31, 2005 reflecting the change in value of the Variable Forwards. The Variable Forwards were

settled during the fourth quarter of 2005.

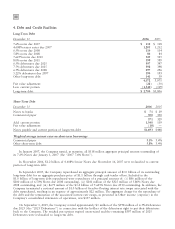

Fair Value of Financial Instruments

The Company's financial instruments include cash equivalents, Sigma Funds, short-term investments, accounts

receivable, long-term finance receivables, accounts payable, accrued liabilities, notes payable, long-term debt, foreign

currency contracts and other financing commitments.

Using available market information, the Company determined that the fair value of long-term debt at

December 31, 2006 was $4.3 billion, compared to a carrying value of $4.1 billion. Since considerable judgment is

required in interpreting market information, the fair value of the long-term debt is not necessarily indicative of the

amount which could be realized in a current market exchange.

The fair values of the other financial instruments were not materially different from their carrying or contract

values at December 31, 2006.

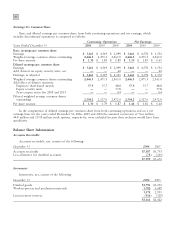

6. Income Taxes

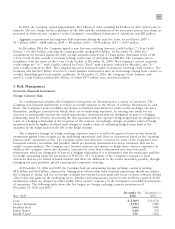

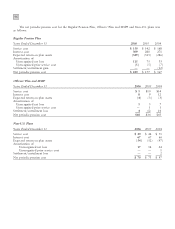

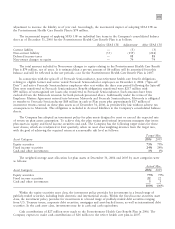

Components of earnings (loss) from continuing operations before income taxes are as follows:

Years Ended December 31

2006

2005 2004

United States $1,034 $3,232 $ 853

Other nations 3,576 3,180 2,259

$4,610 $6,412 $3,112

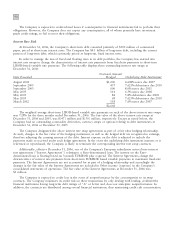

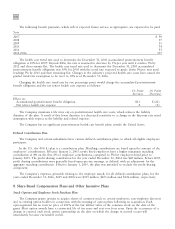

Components of income tax expense (benefit) are as follows:

Years Ended December 31

2006

2005 2004

United States $10 $ 240 $ 44

Other nations 488 638 458

States (U.S.) 13 15 6

Current income tax expense 511 893 508

United States 892 891 504

Other nations (147) (42) (94)

States (U.S.) 93 151 95

Deferred income tax expense 838 1,000 505

Total income tax expense $1,349 $1,893 $1,013

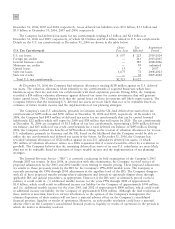

Deferred tax charges (benefits) that were recorded within Non-owner changes to equity in the Company's

consolidated balance sheets resulted primarily from fair value adjustments to available-for-sale securities, losses on

derivative instruments and retirement benefit adjustments. The adjustments were $(182) million, $(753) million

and $(189) million for the years ended December 31, 2006, 2005 and 2004, respectively. Except for certain