Motorola 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

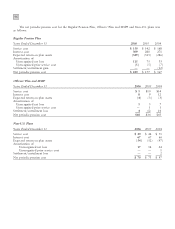

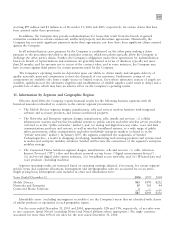

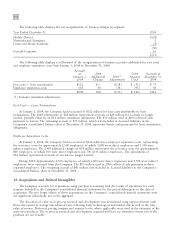

106

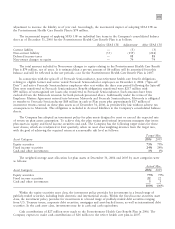

respective earnings per share for each period presented as if the Company had applied the fair value recognition

provisions to share-based employee compensation prior to 2006 (in millions, except per share amounts):

Continuing Operations Net Earnings

Years Ended December 31

2006

2005 2004

2006

2005 2004

Earnings:

Earnings, as reported $3,261 $4,519 $2,099 $3,661 $4,578 $1,532

Add: Share-based employee compensation expense

included in reported earnings, net of related tax

effects n/a 915n/a 919

Deduct: Share-based employee compensation expense

determined under fair value-based method for all

awards, net of related tax effects n/a (170) (150) n/a (170) (188)

Pro forma earnings $3,261 $4,358 $1,964 $3,661 $4,417 $1,363

Basic earnings per common share:

As reported $ 1.33 $ 1.83 $ 0.89 $ 1.50 $ 1.85 $ 0.65

Pro forma $ n/a $ 1.76 $ 0.83 $ n/a $ 1.79 $ 0.58

Diluted earnings per common share:

As reported $ 1.30 $ 1.79 $ 0.87 $ 1.46 $ 1.81 $ 0.64

Pro forma $ n/a $ 1.72 $ 0.81 $ n/a $ 1.75 $ 0.57

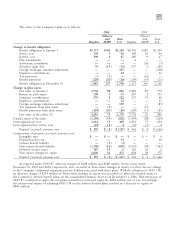

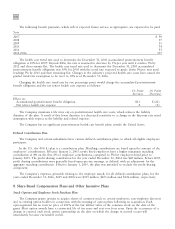

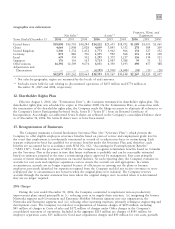

Prior to adopting SFAS 123R, the Company presented all tax benefits resulting from the exercise of stock

options as operating cash flows in the statements of cash flows. As a result, $210 million and $51 million of excess

tax benefits for 2005 and 2004, respectively, have been classified as an operating cash inflow. SFAS 123R requires

cash flows resulting from excess tax benefits to be classified as a part of cash flows from financing activities. Excess

tax benefits are realized tax benefits from tax deductions for exercised options in excess of the deferred tax asset

attributable to stock compensation costs for such options. As a result of adopting SFAS 123R, $165 million of

excess tax benefits for 2006 have been classified as a financing cash inflow.

Motorola Incentive Plan

The Motorola Incentive Plan provides eligible employees with an annual payment, calculated as a percentage

of an employee's eligible earnings, in the year after the close of the current calendar year if specified business goals

are met. The provisions for awards under these incentive plans for the years ended December 31, 2006, 2005 and

2004 were $268 million, $548 million and $771 million, respectively.

Mid-Range Incentive Plan

The Mid-Range Incentive Plan (""MRIP'') rewarded participating elected officers for the Company's

achievement of outstanding performance during the period, based on two performance objectives measured over

two-year cycles. The provision for MRIP for the years ended December 31, 2005 and 2004 was $19 million and

$56 million, respectively.

Long-Range Incentive Plan

In 2005, a Long-Range Incentive Plan (""LRIP'') was introduced to replace MRIP. LRIP rewards participating

elected officers for the Company's achievement of outstanding performance during the period, based on two

performance objectives measured over three-year cycles. The provision for LRIP for the years ended December 31,

2006 and 2005 was $16 million and $15 million, respectively.