Motorola 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

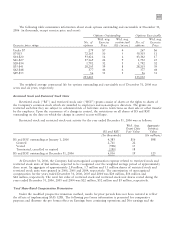

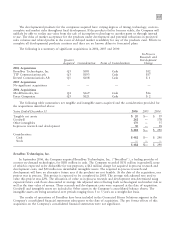

price of the equipment. Periodically, the Company makes commitments to provide financing to purchasers in

connection with the sale of equipment. However, the Company's obligation to provide financing is often

conditioned on the issuance of a letter of credit in favor of the Company by a reputable bank to support the

purchaser's credit or a pre-existing commitment from a reputable bank to purchase the receivable from the

Company. The Company had outstanding commitments to extend credit to third-parties totaling $398 million at

December 31, 2006, compared to $689 million at December 31, 2005. Of these amounts, $262 million was

supported by letters of credit or by bank commitments to purchase receivables at December 31, 2006, compared to

$594 million at December 31, 2005.

In addition to providing direct financing to certain equipment customers, the Company also assists customers in

obtaining financing directly from banks and other sources to fund equipment purchases. The Company had

committed to provide financial guarantees relating to customer financing totaling $122 million and $140 million at

December 31, 2006 and December 31, 2005, respectively (including $19 million and $66 million, respectively,

relating to the sale of short-term receivables). Customer financing guarantees outstanding were $47 million and

$79 million at December 31, 2006 and 2005, respectively (including $2 million and $42 million, respectively,

relating to the sale of short-term receivables).

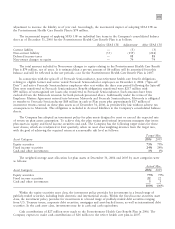

10. Commitments and Contingencies

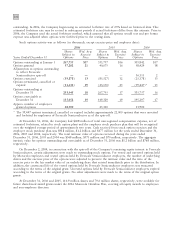

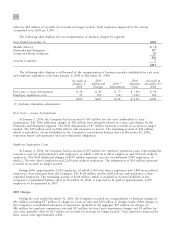

Leases

The Company owns most of its major facilities, but does lease certain office, factory and warehouse space,

land, and information technology and other equipment under principally non-cancelable operating leases. Rental

expense, net of sublease income for the years ended December 31, 2006, 2005 and 2004 was $241 million,

$250 million and $205 million, respectively. At December 31, 2006, future minimum lease obligations, net of

minimum sublease rentals, for the next five years and beyond are as follows: 2007 Ì $351 million; 2008 Ì

$281 million; 2009 Ì $209 million; 2010 Ì $178 million; 2011 Ì $158 million; beyond Ì $1.2 billion.

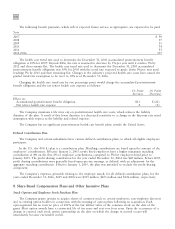

Legal

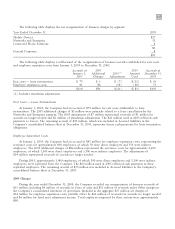

Iridium Program: The Company has been named as one of several defendants in putative class action

securities lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite

communications business, which on March 15, 2001, were consolidated in the federal district court in the District

of Columbia under Freeland v. Iridium World Communications, Inc., et al., originally filed on April 22, 1999.

Plaintiffs motion for class certification was granted on January 9, 2006 and the trial is scheduled to begin on

May 22, 2008.

The Company was sued by the Official Committee of the Unsecured Creditors of Iridium in the Bankruptcy

Court for the Southern District of New York on July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola

asserts claims for breach of contract, warranty, fiduciary duty and fraudulent transfer and preferences, and seeks in

excess of $4 billion in damages. Trial began on the solvency portion of these claims on October 23, 2006.

The Company has not reserved for any potential liability that may arise as a result of the litigation described

above related to the Iridium program. While the still pending cases are in various stages and the outcomes are not

predictable, an unfavorable outcome of one or more of these cases could have a material adverse effect on the

Company's consolidated financial position, liquidity or results of operations.

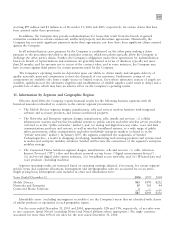

Other: The Company is a defendant in various other suits, claims and investigations that arise in the normal

course of business. In the opinion of management, and other than as discussed above with respect to the Iridium

cases, the ultimate disposition of these matters will not have a material adverse effect on the Company's

consolidated financial position, liquidity or results of operations.

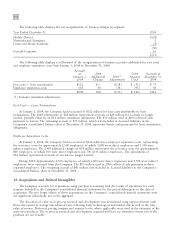

Other

The Company is also a party to a variety of agreements pursuant to which it is obligated to indemnify the

other party with respect to certain matters. Some of these obligations arise as a result of divestitures of the

Company's assets or businesses and require the Company to hold the other party harmless against losses arising

from the settlement of these pending obligations. The total amount of indemnification under these types of

provisions at December 31, 2006 and 2005 was $169 million and $28 million, respectively, with the Company