Motorola 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

subsequent sale of the 37.6 million Sprint Nextel shares. The Company recognized a loss of $126 million in

connection with the sale of the remaining shares of Sprint Nextel common stock. As described above, the

Company recorded a net gain of $99 million in connection with the Sprint Nextel Derivative.

Prior to the merger of Sprint Corporation (""Sprint'') and Nextel Communications, Inc. (""Nextel''), the

Company had entered into variable share forward purchase agreements (the ""Variable Forwards'') to hedge its

Nextel common stock. The Company did not designate the Variable Forwards as a hedge of the Sprint Nextel

shares received as a result of the merger. Accordingly, the Company recorded $51 million of gains for the year

ended December 31, 2005 reflecting the change in value of the Variable Forwards. The Variable Forwards were

settled during the fourth quarter of 2005.

Fair Value of Financial Instruments

The Company's financial instruments include cash equivalents, Sigma Funds, short-term investments, accounts

receivable, long-term finance receivables, accounts payable, accrued liabilities, notes payable, long-term debt, foreign

currency contracts and other financing commitments.

Using available market information, the Company determined that the fair value of long-term debt at

December 31, 2006 was $4.3 billion, compared to a carrying value of $4.1 billion. Since considerable judgment is

required in interpreting market information, the fair value of the long-term debt is not necessarily indicative of the

amount which could be realized in a current market exchange.

The fair values of the other financial instruments were not materially different from their carrying or contract

values at December 31, 2006.

Equity Price Market Risk

At December 31, 2006, the Company's available-for-sale securities portfolio had an approximate fair market

value of $130 million which represented a cost basis of $70 million and a net unrealized gain of $60 million. The

value of the available-for-sale securities would change by $13 million as of year-end 2006 if the price of the stock

in each of the publicly-traded companies were to change by 10%. These equity securities are held for purposes

other than trading.

Interest Rate Risk

At December 31, 2006, the Company's short-term debt consisted primarily of $300 million of commercial

paper, priced at short-term interest rates. The Company has $4.1 billion of long-term debt, including the current

portion of long-term debt, which is primarily priced at long-term, fixed interest rates.

In order to manage the mix of fixed and floating rates in its debt portfolio, the Company has entered into

interest rate swaps to change the characteristics of interest rate payments from fixed-rate payments to short-term

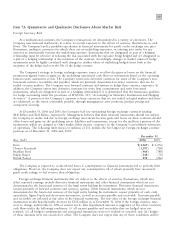

LIBOR-based variable rate payments. The following table displays these outstanding interest rate swaps at

December 31, 2006:

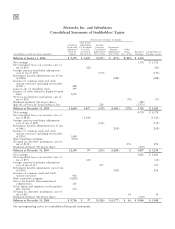

Notional Amount

Hedged Underlying Debt

Date Executed (in millions) Instrument

August 2004 $1,200 4.608% notes due 2007

September 2003 457 7.625% debentures due 2010

September 2003 600 8.0% notes due 2011

May 2003 114 6.5% notes due 2008

May 2003 84 5.8% debentures due 2008

May 2003 69 7.625% debentures due 2010

March 2002 118 7.6% notes due 2007

$2,642

The weighted average short-term LIBOR-based variable rate payments on each of the above interest rate swaps

was 7.29% for the three months ended December 31, 2006. The fair value of the above interest rate swaps at

December 31, 2006 and December 31, 2005, was $(47) million and $(50) million, respectively. The fair value of