Motorola 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

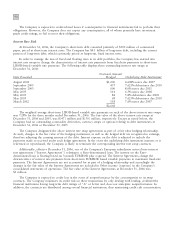

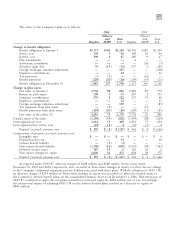

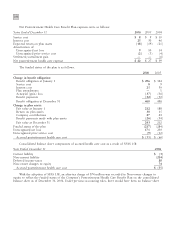

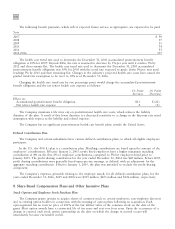

Net Postretirement Health Care Benefit Plan expenses were as follows:

Years Ended December 31

2006

2005 2004

Service cost $8 $9 $10

Interest cost 25 30 46

Expected return on plan assets (18) (19) (21)

Amortization of:

Unrecognized net loss 910 14

Unrecognized prior service cost (2) (3) (4)

Settlement/curtailment gain Ì Ì (6)

Net postretirement health care expense $22 $27 $39

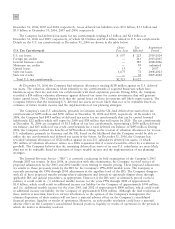

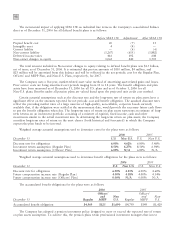

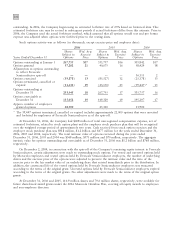

The funded status of the plan is as follows.

2006

2005

Change in benefit obligation:

Benefit obligation at January 1 $ 496 $ 544

Service cost 89

Interest cost 25 30

Plan amendments Ì1

Actuarial (gain) loss (37) (36)

Benefit payments (32) (52)

Benefit obligation at December 31 460 496

Change in plan assets:

Fair value at January 1 212 188

Return on plan assets 30 15

Company contributions 27 43

Benefit payments made with plan assets (26) (34)

Fair value at December 31 243 212

Funded status of the plan (217) (284)

Unrecognized net loss 171 230

Unrecognized prior service cost (9) (12)

Accrued postretirement health care cost $ (55) $ (66)

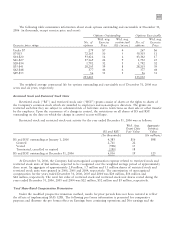

Consolidated balance sheet components of accrued health care cost as a result of SFAS 158:

Year Ended December 31

2006

Current liability $ (3)

Non-current liability (214)

Deferred income taxes 88

Non-owner changes to equity 74

Accrued postretirement health care cost $ (55)

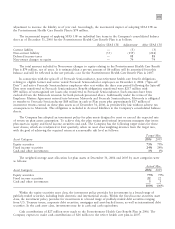

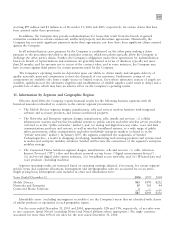

With the adoption of SFAS 158, an after-tax charge of $74 million was recorded in Non-owner changes to

equity to reflect the funded status of the Company's Postretirement Health Care Benefit Plan on the consolidated

balance sheet as of December 31, 2006. Under previous accounting rules, there would have been no balance sheet