Motorola 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

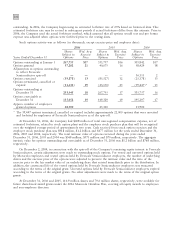

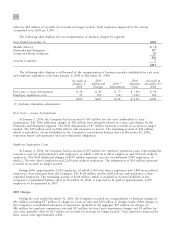

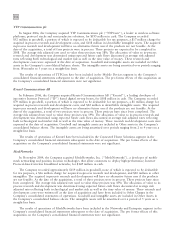

The following table displays the net reorganization of business charges by segment:

Year Ended December 31, 2004

Mobile Devices $(28)

Networks and Enterprise 2

Connected Home Solutions (4)

(30)

General Corporate 15

$(15)

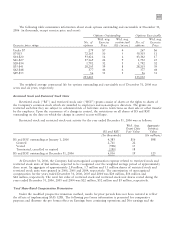

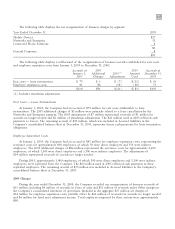

The following table displays a rollforward of the reorganization of business accruals established for exit costs

and employee separation costs from January 1, 2004 to December 31, 2004:

Accruals

at 2004 2004 Accruals at

January 1, Additional 2004(1) Amount December 31,

2004 Charges Adjustments Used 2004

Exit costs Ì lease terminations $122 $Ì $(18) $ (31) $ 73

Employee separation costs 116 54 (34) (95) 41

$238 $54 $(52) $(126) $114

(1) Includes translation adjustments.

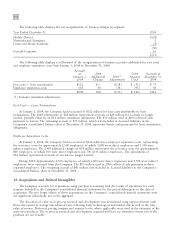

Exit Costs Ì Lease Terminations

At January 1, 2004, the Company had an accrual of $122 million for exit costs attributable to lease

terminations. The 2004 adjustments of $18 million represented reversals of $29 million for accruals no longer

needed, partially offset by an $11 million translation adjustment. The $31 million used in 2004 reflected cash

payments to lessors. The remaining accrual of $73 million, which was included in Accrued liabilities in the

Company's consolidated balance sheet at December 31, 2004, represents future cash payments for lease termination

obligations.

Employee Separation Costs

At January 1, 2004, the Company had an accrual of $116 million for employee separation costs, representing

the severance costs for approximately 2,100 employees, of which 1,000 were direct employees and 1,100 were

indirect employees. The 2004 additional charges of $54 million represented the severance costs for approximately

800 employees, of which 100 were direct employees and 700 were indirect employees. The adjustments of

$34 million represented reversals of accruals no longer needed.

During 2004, approximately 2,500 employees, of which 1,000 were direct employees and 1,500 were indirect

employees, were separated from the Company. The $95 million used in 2004 reflected cash payments to these

separated employees. The remaining accrual of $41 million was included in Accrued liabilities in the Company's

consolidated balance sheet at December 31, 2004.

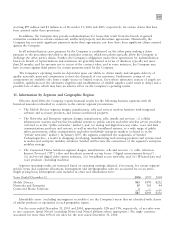

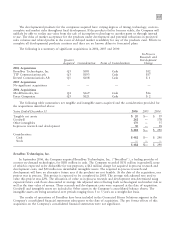

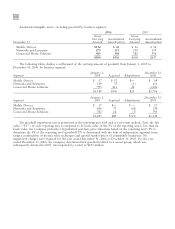

14. Acquisitions and Related Intangibles

The Company accounts for acquisitions using purchase accounting with the results of operations for each

acquiree included in the Company's consolidated financial statements for the period subsequent to the date of

acquisition. The pro forma effects of these acquisitions on the Company's consolidated financial statements were

not significant individually nor in the aggregate.

The allocation of value to in-process research and development was determined using expected future cash

flows discounted at average risk adjusted rates reflecting both technological and market risk as well as the time

value of money. Historical pricing, margins and expense levels, where applicable, were used in the valuation of the

in-process products. The in-process research and development acquired will have no alternative future uses if the

products are not feasible.