Motorola 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

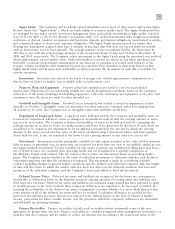

87

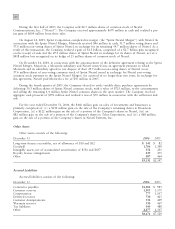

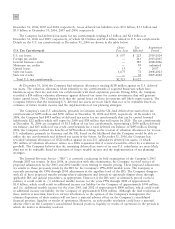

Other Liabilities

Other liabilities consists of the following:

December 31

2006

2005

Defined benefit plans $1,882 $1,644

Postretirement health care benefit plan 214 66

Royalty license arrangement 300 315

Deferred revenue 273 78

Other 653 624

$3,322 $2,727

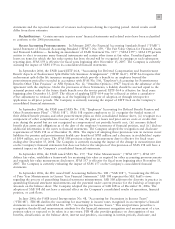

Stockholders' Equity Information

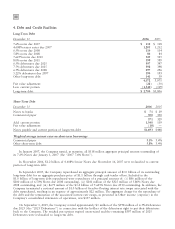

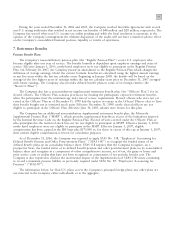

Comprehensive Earnings (Loss)

Net unrealized gains (losses) on securities included in Comprehensive earnings (loss) are comprised of the

following:

Years Ended December 31

2006

2005

Gross unrealized gains (losses) on securities, net of tax $31 $ (204)

Less: Realized gains, net of tax 91 1,116

Net unrealized losses on securities, net of tax $(60) $(1,320)

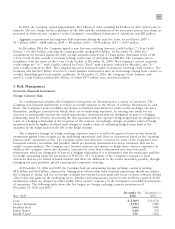

Share Repurchase Program

In May 2005, the Board of Directors authorized the Company to purchase up to $4.0 billion of its outstanding

shares of common stock over a period of up to 36 months ending in May 2008, subject to market conditions (the

""2005 Stock Repurchase Program''). In July 2006, the Company entered into an accelerated stock buyback

agreement to repurchase approximately $1.2 billion of its outstanding common stock (the ""ASB''). In October

2006, the Company received the final distribution of shares under the ASB. The total shares purchased under the

ASB were 50.5 million shares. The ASB completed the 2005 Stock Repurchase Program.

On July 24, 2006, the Board of Directors authorized the Company to repurchase up to an additional

$4.5 billion of its outstanding shares of common stock over a period of up to 36 months ending in June 2009,

subject to market conditions (the ""2006 Stock Repurchase Program''). In the fourth quarter of 2006, the Company

purchased $700 million of shares under the 2006 Stock Repurchase Program.

The Company repurchased a total of 171.7 million common shares (including shares received under the ASB)

at a cost of $3.8 billion in 2006. The Company repurchased a total of 41.7 million common shares at a cost of

$874 million in 2005. All repurchased shares have been retired.