Motorola 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

9. Financing Arrangements

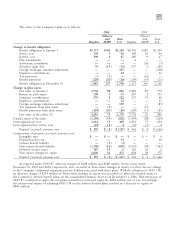

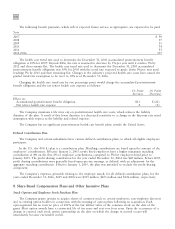

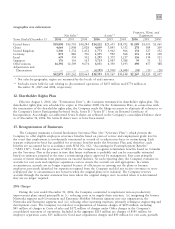

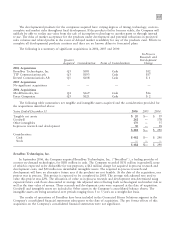

Finance receivables consist of the following:

December 31

2006

2005

Gross finance receivables $ 279 $ 272

Less allowance for losses (10) (12)

269 260

Less current portion (124) (178)

Long-term finance receivables $ 145 $82

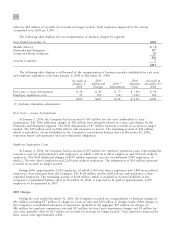

Current finance receivables are included in Accounts receivable and long-term finance receivables are included

in Other assets in the Company's consolidated balance sheets. Interest income recognized on finance receivables for

the years ended December 31, 2006, 2005 and 2004 was $9 million, $7 million and $9 million, respectively.

Impaired finance receivables totaled $1 million and $10 million at December 31, 2006 and 2005, respectively, with

$1 million and $10 million allowance for losses at December 31, 2006 and 2005, respectively. Interest income on

impaired finance receivables is recognized as cash is collected and totaled less than $1 million for the year ended

December 31, 2006 and 2005 and $2 million for the year ended December 31, 2004.

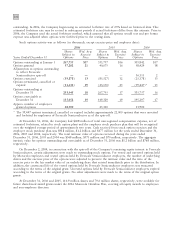

On October 28, 2005, the Company entered into an agreement to resolve disputes regarding Telsim Mobil

Telekomunikasyon Hizmetleri A.S. (""Telsim'') with Telsim and the government of Turkey. The government of

Turkey and the Turkish Savings and Deposit Insurance Fund (""TMSF'') are third-party beneficiaries of the

settlement agreement. In settlement of its claims, the Company received $410 million in cash in 2006 and

$500 million in cash in 2005. The Company is permitted to, and will continue to, enforce its U.S. court judgment

against the Uzan family, except in Turkey and three other countries.

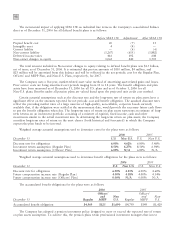

From time to time, the Company sells short-term receivables, long-term loans and lease receivables under sales-

type leases (collectively, ""finance receivables'') to third parties in transactions that qualify as ""true-sales.'' Certain

of these finance receivables are sold to third parties on a one-time, non-recourse basis, while others are sold to

third parties under committed facilities that involve contractual commitments from these parties to purchase

qualifying receivables up to an outstanding monetary limit. Committed facilities may be revolving in nature. Certain

sales may be made through separate legal entities that are also consolidated by the Company. The Company may or

may not retain the obligation to service the sold finance receivables.

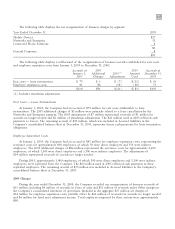

In the aggregate, at December 31, 2006, these committed facilities provided for up to $1.3 billion to be

outstanding with the third parties at any time, as compared to up to $1.1 billion provided at December 31, 2005

and up to $724 million provided at December 31, 2004. As of December 31, 2006, $817 million of these

committed facilities were utilized, compared to $585 million utilized at December 31, 2005 and $305 million

utilized at December 31, 2004. Certain events could cause one of these facilities to terminate. In addition, before

receivables can be sold under certain of the committed facilities, they may need to meet contractual requirements,

such as credit quality or insurability.

Total finance receivables sold by the Company were $6.4 billion in 2006 (including $6.2 billion of short-term

receivables), compared to $4.5 billion sold in 2005 (including $4.2 billion of short-term receivables) and

$3.8 billion sold in 2004 (including $3.8 billion of short-term receivables). As of December 31, 2006, there were

$1.1 billion of receivables outstanding under these programs for which the Company retained servicing obligations

(including $789 million of short-term receivables), compared to $1.0 billion outstanding at December 31, 2005

(including $838 million of short-term receivables) and $720 million outstanding at December 31, 2004 (including

$589 of short-term receivables).

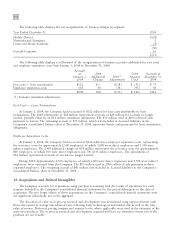

Under certain of the receivables programs, the value of the receivables sold is covered by credit insurance

obtained from independent insurance companies, less deductibles or self-insurance requirements under the policies

(with the Company retaining credit exposure for the remaining portion). The Company's total credit exposure to

outstanding short-term receivables that have been sold was $19 million at December 31, 2006 as compared to

$66 million at December 31, 2005. A reserve of $4 million was recorded for potential losses on sold receivables at

both December 31, 2006 and December 31, 2005.

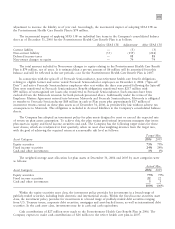

Certain purchasers of the Company's infrastructure equipment continue to request that suppliers provide

financing in connection with equipment purchases. These requests may include all or a portion of the purchase