Motorola 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

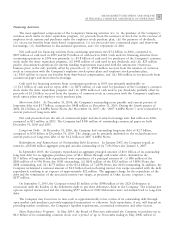

$2.0 billion in proceeds in 2006 were primarily comprised of: (i) $856 million in net proceeds from the sale of the

automotive electronics business, (ii) $820 million from the sale of the Company's remaining shares in Sprint Nextel

Corporation (""Sprint Nextel'') and the termination and cash settlement of a zero-cost collar derivative relating to

these Sprint Nextel shares (the ""Sprint Nextel Derivative''), and (iii) $175 million from the sale of the Company's

remaining shares in Telus Corporation. The $1.5 billion in proceeds generated in 2005 were primarily comprised of:

(i) $679 million from the sale of a portion of the Company's shares in Nextel Communications, Inc. (""Nextel'')

during the first half of 2005, (ii) $391 million from the sale of a portion of the Company's shares in Sprint Nextel

during the fourth quarter of 2005, (iii) $232 million from the sale of a portion of the Company's shares in

Semiconductor Manufacturing International Corporation, and (iv) $96 million received in connection with the

merger of Sprint Corporation and Nextel.

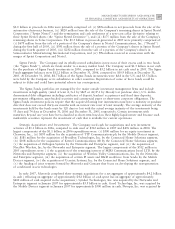

Sigma Funds: The Company and its wholly-owned subsidiaries invest most of their excess cash in two funds

(the ""Sigma Funds''), which are funds similar to a money market fund. The Company used $1.3 billion in net cash

for the purchase of Sigma Funds investments in 2006, compared to $3.2 billion in net cash used in 2005. The Sigma

Funds aggregate balances were $12.2 billion at December 31, 2006, compared to $10.9 billion at December 31,

2005. At December 31, 2006, $8.7 billion of the Sigma Funds investments were held in the U.S. and $3.5 billion

were held by the Company or its subsidiaries in other countries. Repatriation of some of these funds could be

subject to delay and could have potential adverse tax consequences.

The Sigma Funds portfolios are managed by five major outside investment management firms and include

investments in high quality (rated at least A/A-1 by S&P or A2/P-1 by Moody's at purchase date), U.S. dollar-

denominated debt obligations including certificates of deposit, bankers' acceptances and fixed time deposits,

government obligations, asset-backed securities and commercial paper or short-term corporate obligations. The

Sigma Funds investment policies require that the acquired floating rate instruments must have a maturity at purchase

date that does not exceed thirty-six months with an interest rate reset at least annually. The average maturity of the

investments held by the funds must be 120 days or less with the actual average maturity of the investments being

53 days and 74 days at December 31, 2006 and December 31, 2005, respectively. Certain investments with

maturities beyond one year have been classified as short-term based on their highly-liquid nature and because such

marketable securities represent the investment of cash that is available for current operations.

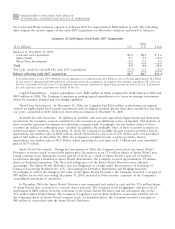

Strategic Acquisitions and Investments: The Company used cash for acquisitions and new investment

activities of $1.1 billion in 2006, compared to cash used of $312 million in 2005 and $476 million in 2004. The

largest components of the $1.1 billion in 2006 expenditures were: (i) $300 million for an equity investment in

Clearwire, Inc., (ii) $193 million for the acquisition of TTP Communications plc by the Mobile Devices segment,

(iii) $181 million for the acquisition of Broadbus Technologies, Inc. by the Connected Home Solutions segment,

(iv) $108 million for the acquisition of Kreatel Communications AB by the Connected Home Solutions segment,

(v) the acquisition of Orthogon Systems by the Networks and Enterprise segment, and (vi) the acquisition of

NextNet Wireless, Inc. by the Networks and Enterprise segment. The largest components of the $312 million in

2005 expenditures were: (i) the acquisition of the remaining interest of MIRS Communications Israel LTD. by the

Networks and Enterprise segment, (ii) the acquisition of Wireless Valley Communications, Inc. by the Networks

and Enterprise segment, (iii) the acquisition of certain IP assets and R&D workforce from Sendo by the Mobile

Devices segment, (iv) the acquisition of Ucentric Systems, Inc. by the Connected Home Solutions segment, and

(v) the funding of joint ventures formed by Motorola and Comcast that focus on developing the next-generation

of conditional access technologies

In early 2007, Motorola completed three strategic acquisitions for a net aggregate of approximately $4.2 billion

in cash (reflecting an aggregate of approximately $4.6 billion of cash spent less an aggregate of approximately

$400 million of cash acquired in the acquisitions). Symbol Technologies, Inc. was acquired by the Networks and

Enterprise segment in January 2007 for approximately $3.9 billion in cash. Good Technology, Inc. was acquired by

the Mobile Devices segment in January 2007 for approximately $500 million in cash. Netopia, Inc. was acquired by