Motorola 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

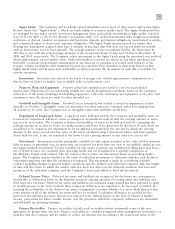

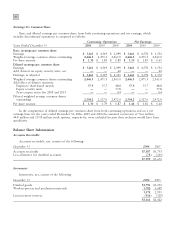

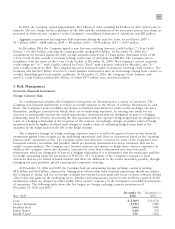

Other Current Assets

Other current assets consists of the following:

December 31

2006

2005

Contractor receivables $1,349 $1,240

Costs in excess of billings 505 495

Contract related deferred costs 369 255

Other 710 506

$2,933 $2,496

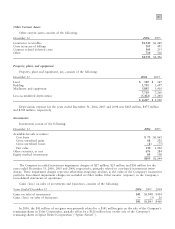

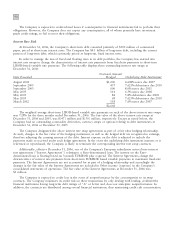

Property, plant, and equipment

Property, plant and equipment, net, consists of the following:

December 31

2006

2005

Land $ 129 $ 147

Building 1,705 1,697

Machinery and equipment 5,885 5,416

7,719 7,260

Less accumulated depreciation (5,452) (5,240)

$ 2,267 $ 2,020

Depreciation expense for the years ended December 31, 2006, 2005 and 2004 was $463 million, $473 million

and $502 million, respectively.

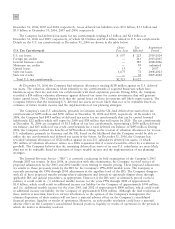

Investments

Investments consist of the following:

December 31

2006

2005

Available-for-sale securities:

Cost basis $70 $1,065

Gross unrealized gains 68 232

Gross unrealized losses (8) (75)

Fair value 130 1,222

Other securities, at cost 676 284

Equity method investments 89 138

$895 $1,644

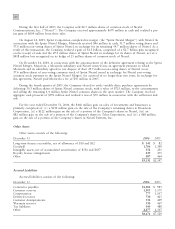

The Company recorded investment impairment charges of $27 million, $25 million and $36 million for the

years ended December 31, 2006, 2005 and 2004, respectively, primarily related to cost-based investments write-

downs. These impairment charges represent other-than-temporary declines in the value of the Company's investment

portfolio. Investment impairment charges are included in Other within Other income (expense) in the Company's

consolidated statements of operations.

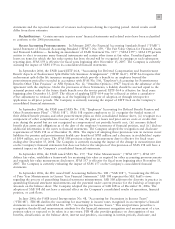

Gains (loss) on sales of investments and businesses, consists of the following:

Years Ended December 31

2006

2005 2004

Gains on sales of investments $41 $1,848 $434

Gains (loss) on sales of businesses Ì(3) 26

$41 $1,845 $460

In 2006, the $41 million of net gains was primarily related to a $141 million gain on the sale of the Company's

remaining shares in Telus Corporation, partially offset by a $126 million loss on the sale of the Company's

remaining shares in Sprint Nextel Corporation (""Sprint Nextel'').