Medtronic 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

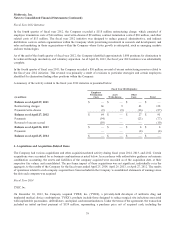

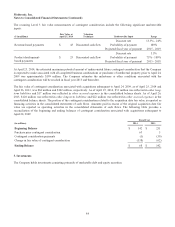

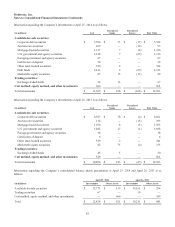

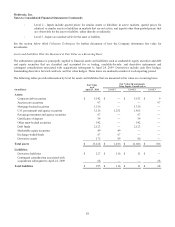

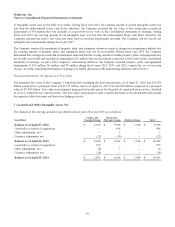

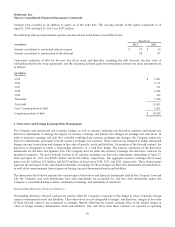

Fair Value

as of

April 26, 2013

Fair Value Measurements

Using Inputs Considered as

(in millions) Level 1 Level 2 Level 3

Assets:

Corporate debt securities $ 4,661 $ — $ 4,651 $ 10

Auction rate securities 103 — — 103

Mortgage-backed securities 1,053 — 1,039 14

U.S. government and agency securities 3,898 1,833 2,065 —

Foreign government and agency securities 38 — 38 —

Certificates of deposit 6 — 6 —

Other asset-backed securities 541 — 541 —

Marketable equity securities 155 155 — —

Exchange-traded funds 50 50 — —

Derivative assets 394 213 181 —

Total assets $ 10,899 $ 2,251 $ 8,521 $ 127

Liabilities:

Derivative liabilities $ 58 $ 40 $ 18 $ —

Contingent consideration associated with

acquisitions subsequent to April 24, 2009 142 — — 142

Total liabilities $ 200 $ 40 $ 18 $ 142

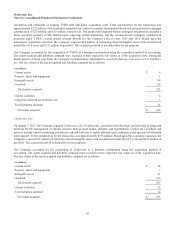

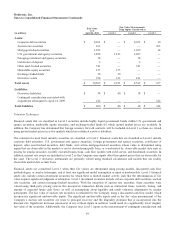

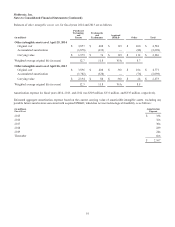

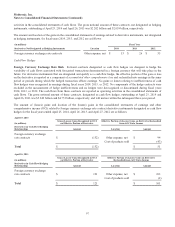

Valuation Techniques

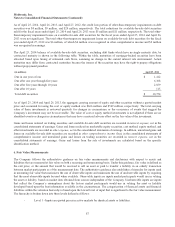

Financial assets that are classified as Level 1 securities include highly liquid government bonds within U.S. government and

agency securities, marketable equity securities, and exchange-traded funds for which quoted market prices are available. In

addition, the Company has determined that foreign currency forward contracts will be included in Level 1 as these are valued

using quoted market prices in active markets which have identical assets or liabilities.

The valuation for most fixed maturity securities are classified as Level 2. Financial assets that are classified as Level 2 include

corporate debt securities, U.S. government and agency securities, foreign government and agency securities, certificates of

deposit, other asset-backed securities, debt funds, and certain mortgage-backed securities whose value is determined using

inputs that are observable in the market or can be derived principally from, or corroborated by, observable market data such as

pricing for similar securities, recently executed transactions, cash flow models with yield curves, and benchmark securities. In

addition, interest rate swaps are included in Level 2 as the Company uses inputs other than quoted prices that are observable for

the asset. The Level 2 derivative instruments are primarily valued using standard calculations and models that use readily

observable market data as their basis.

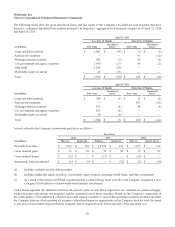

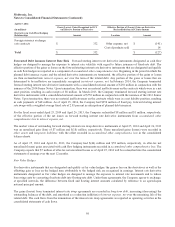

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow

methodologies, or similar techniques, and at least one significant model assumption or input is unobservable. Level 3 financial

assets also include certain investment securities for which there is limited market activity such that the determination of fair

value requires significant judgment or estimation. Level 3 investment securities include certain corporate debt securities, auction

rate securities, and certain mortgage-backed securities. With the exception of auction rate securities, these securities were

valued using third-party pricing sources that incorporate transaction details such as contractual terms, maturity, timing, and

amount of expected future cash flows, as well as assumptions about liquidity and credit valuation adjustments by market

participants. The fair value of auction rate securities is estimated by the Company using a discounted cash flow model, which

incorporates significant unobservable inputs. The significant unobservable inputs used in the fair value measurement of the

Company’s auction rate securities are years to principal recovery and the illiquidity premium that is incorporated into the

discount rate. Significant increases (decreases) in any of those inputs in isolation would result in a significantly lower (higher)

fair value of the securities. Additionally, the Company uses Level 3 inputs in the measurement of contingent consideration and

89