Medtronic 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

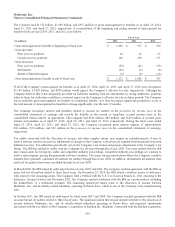

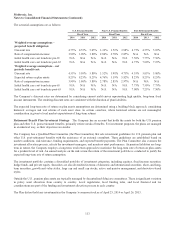

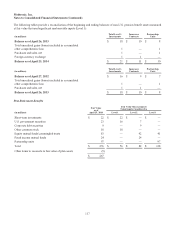

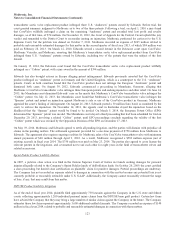

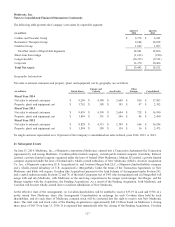

Retiree benefit payments, which reflect expected future service, are anticipated to be paid as follows:

(in millions)

U.S. Pension

Benefits

Non-U.S.

Pension Benefits Post-Retirement Benefits

Fiscal Year

Gross

Payments

Gross

Payments

Gross

Payments

Gross Medicare

Part D Receipts

2015 $ 59 $ 36 $ 12 $ —

2016 69 30 14 —

2017 78 31 16 —

2018 88 33 18 —

2019 98 32 20 —

2020 – 2024 659 187 137 —

Total $ 1,051 $ 349 $ 217 $ —

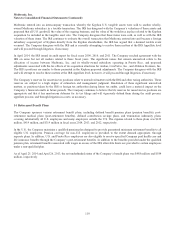

In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act (PPACA) and the Health Care

and Education Affordability Reconciliation Act (Reconciliation Act). Included among the major provisions of these laws is a

change in the tax treatment of the Medicare Part D subsidy. The subsidy came into existence with the enactment of the Medicare

Modernization Act (MMA) in 2003 and is available to sponsors of retiree health benefit plans with a prescription drug benefit

that is actuarially equivalent to the benefit provided by the Medicare Part D program. Prior to the enactment of the PPACA and

the Reconciliation Act, the Company was allowed to deduct the full cost of its retiree drug plans without reduction for subsidies

received.

Under U.S. GAAP, the Company records a liability on its balance sheet for the expected cost of earned future retiree health

benefits. When the MMA was enacted in 2003, this liability was reduced to reflect expected future subsidies from the Medicare

Part D program. In addition, the Company recorded a reduction to the deferred tax liability on the balance sheet for the value of

future tax deductions for these retiree health benefits. Each year, as additional benefits are earned and benefit payments are

made, the Company adjusts the post-retirement benefits liability and deferred tax liability.

After the passage of the PPACA and the Reconciliation Act, the Company must reduce the tax deduction for retiree drug

benefits paid by the amount of the Medicare Part D subsidy beginning in 2013. U.S. GAAP requires the impact of a change in

tax law to be recognized immediately in the income statement in the period that includes the enactment date, regardless of the

effective date of the change in tax law. As a result of this change in tax law, the Company recorded a non-cash charge of

$15 million in fiscal year 2010 to increase the deferred tax liability. As a result of this legislation, the Company will be

evaluating prospective changes to the active and retiree health care benefits offered by the Company.

The Company’s U.S. qualified defined benefit plans are funded in excess of 80 percent and, therefore, the Company expects that

the plans will not be subject to the “at risk” funding requirements of the Pension Protection Act and that the law will not have a

material impact on future contributions.

The initial health care cost trend rates for post-retirement benefit plans was 7.50 percent for pre-65 and 6.75 percent for post-65

at April 25, 2014. Based on actuarial data, the trend rates are expected to decline to 5.0 percent over a five-year period.

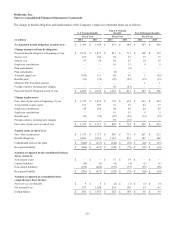

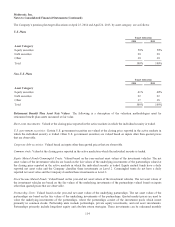

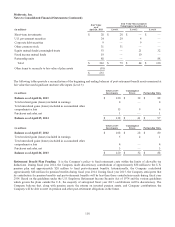

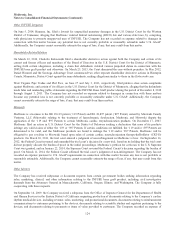

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A one-

percentage-point change in assumed health care cost trend rates would have the following effects:

(in millions)

One-Percentage-

Point Increase

One-Percentage-

Point Decrease

Effect on post-retirement benefit cost $ 1 $ (1)

Effect on post-retirement benefit obligation 11 (9)

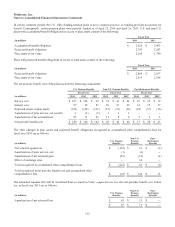

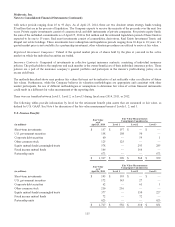

Defined Contribution Savings Plans The Company has defined contribution savings plans that cover substantially all U.S.

employees and certain non-U.S. employees. The general purpose of these plans is to provide additional financial security during

retirement by providing employees with an incentive to make regular savings. Company contributions to the plans are based on

employee contributions and Company performance and since fiscal year 2006, the entire match has been made in cash. Expense

under these plans was $145 million, $163 million, and $106 million in fiscal years 2014, 2013, and 2012, respectively.

119