Medtronic 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

reference to agreed-upon notional principal amounts. Changes in the fair value of the derivative instrument are recorded in

interest expense, net, and are offset by changes in the fair value on the underlying debt instrument. The cash flows from these

contracts are reported as operating activities in the consolidated statements of cash flows. The gains (losses) from terminated

interest rate swap agreements are recorded in long-term debt, increasing (decreasing) the outstanding balances of the debt, and

amortized as a reduction (addition) of interest expense, net over the remaining life of the related debt. The cash flows from the

termination of the interest rate swap agreements are reported as operating activities in the consolidated statements of cash flows.

In addition, the Company has collateral credit agreements with its primary derivative counterparties. Under these agreements,

either party is required to post eligible collateral when the market value of transactions covered by the agreement exceeds

specific thresholds, thus limiting credit exposure for both parties.

Earnings Per Share Basic earnings per share is computed based on the weighted average number of common shares

outstanding. Diluted earnings per share is computed based on the weighted average number of common shares outstanding,

increased by the number of additional shares that would have been outstanding had the potentially dilutive common shares been

issued, and reduced by the number of shares the Company could have repurchased from the proceeds from issuance of the

potentially dilutive shares. Potentially dilutive shares of common stock include stock options and other stock-based awards

granted under stock-based compensation plans and shares committed to be purchased under the employee stock purchase plan.

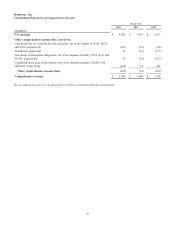

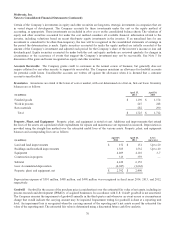

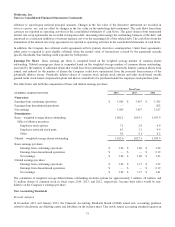

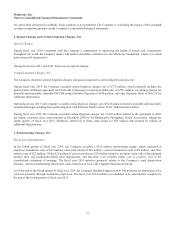

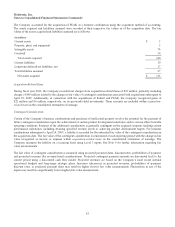

The table below sets forth the computation of basic and diluted earnings per share:

Fiscal Year

(in millions, except per share data) 2014 2013 2012

Numerator:

Earnings from continuing operations $ 3,065 $ 3,467 $ 3,415

Earnings from discontinued operations — — 202

Net earnings 3,065 3,467 3,617

Denominator:

Basic – weighted average shares outstanding 1,002.1 1,019.3 1,053.9

Effect of dilutive securities:

Employee stock options 7.1 2.8 0.9

Employee restricted stock units 4.3 5.3 4.9

Other 0.1 0.1 0.2

Diluted – weighted average shares outstanding 1,013.6 1,027.5 1,059.9

Basic earnings per share:

Earnings from continuing operations $ 3.06 $ 3.40 $ 3.24

Earnings from discontinued operations $ — $ — $ 0.19

Net earnings $ 3.06 $ 3.40 $ 3.43

Diluted earnings per share:

Earnings from continuing operations $ 3.02 $ 3.37 $ 3.22

Earnings from discontinued operations $ — $ — $ 0.19

Net earnings $ 3.02 $ 3.37 $ 3.41

The calculation of weighted average diluted shares outstanding excludes options for approximately 5 million, 38 million, and

51 million shares of common stock in fiscal years 2014, 2013, and 2012, respectively, because their effect would be anti-

dilutive on the Company’s earnings per share.

New Accounting Standards

Recently Adopted

In December 2011 and January 2013, the Financial Accounting Standards Board (FASB) issued new accounting guidance

related to disclosures on offsetting assets and liabilities on the balance sheet. This newly issued accounting standard requires an

75