Medtronic 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

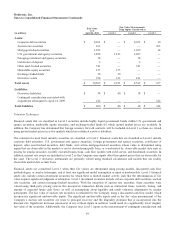

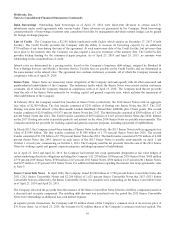

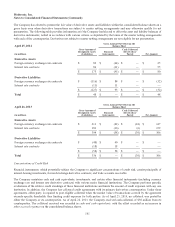

Bank Borrowings Outstanding bank borrowings as of April 25, 2014 were short-term advances to certain non-U.S.

subsidiaries under credit agreements with various banks. These advances are guaranteed by the Company. Bank borrowings

consist primarily of borrowings at interest rates considered favorable by management and where natural hedges can be gained

for foreign exchange purposes.

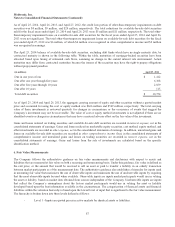

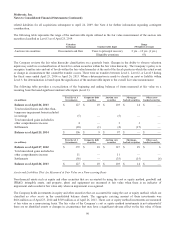

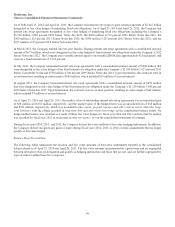

Line of Credit The Company has a $2.250 billion syndicated credit facility which expires on December 17, 2017 (Credit

Facility). The Credit Facility provides the Company with the ability to increase its borrowing capacity by an additional

$750 million at any time during the term of the agreement. At each anniversary date of the Credit Facility, but not more than

twice prior to the maturity date, the Company can also request a one-year extension of the maturity date. The Credit Facility

provides backup funding for the commercial paper program. As of April 25, 2014 and April 26, 2013, no amounts were

outstanding on the committed line of credit.

Interest rates are determined by a pricing matrix, based on the Company’s long-term debt ratings, assigned by Standard &

Poor’s Ratings Services and Moody’s Investors Service. Facility fees are payable on the Credit Facility and are determined in

the same manner as the interest rates. The agreement also contains customary covenants, all of which the Company remains in

compliance with as of April 25, 2014.

Senior Notes Senior Notes are unsecured, senior obligations of the Company and rank equally with all other unsecured and

unsubordinated indebtedness of the Company. The indentures under which the Senior Notes were issued contain customary

covenants, all of which the Company remains in compliance with as of April 25, 2014. The Company used the net proceeds

from the sale of the Senior Notes primarily for working capital and general corporate uses, which includes the repayment of

other indebtedness of the Company.

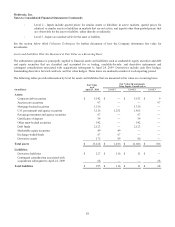

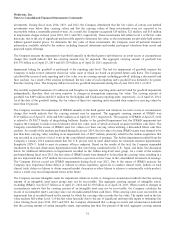

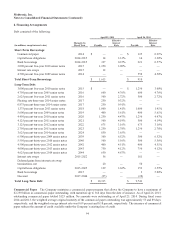

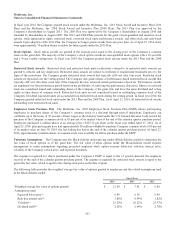

In February 2014, the Company issued four tranches of Senior Notes (collectively, the 2014 Senior Notes) with an aggregate

face value of $2.000 billion. The first tranche consisted of $250 million of floating rate Senior Notes due 2017. The 2017

floating rate notes bear interest at the three-month London InterBank Offered Rate (LIBOR) plus 9 basis points. The second

tranche consisted of $250 million of 0.875 percent Senior Notes due 2017. The third tranche consisted of $850 million of 3.625

percent Senior Notes due 2024. The fourth tranche consisted of $650 million of 4.625 percent Senior Notes due 2044. Interest

on the 2017 floating rate notes is payable quarterly and interest on the other 2014 Senior Notes are payable semi-annually. The

Company used the net proceeds for working capital and general corporate purposes, including repayment of indebtedness.

In March 2013, the Company issued three tranches of Senior Notes (collectively, the 2013 Senior Notes) with an aggregate face

value of $3.000 billion. The first tranche consisted of $1.000 billion of 1.375 percent Senior Notes due 2018. The second

tranche consisted of $1.250 billion of 2.750 percent Senior Notes due 2023. The third tranche consisted of $750 million of 4.000

percent Senior Notes due 2043. Interest on each series of the 2013 Senior Notes is payable semi-annually on April 1 and

October 1 of each year, commencing on October 1, 2013. The Company used the net proceeds from the sale of the 2013 Senior

Notes for working capital and general corporate purposes, including repayment of indebtedness.

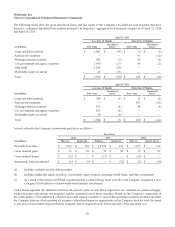

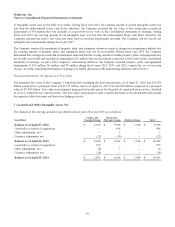

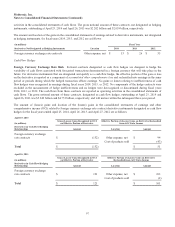

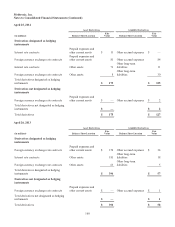

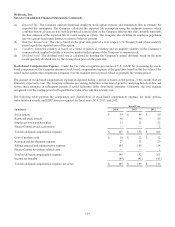

As of April 25, 2014 and April 26, 2013, the Company had interest rate swap agreements designated as fair value hedges of

certain underlying fixed-rate obligations including the Company’s $1.250 billion 3.000 percent 2010 Senior Notes, $600 million

4.750 percent 2005 Senior Notes, $500 million 2.625 percent 2011 Senior Notes, $500 million 4.125 percent 2011 Senior Notes,

and $675 million 3.125 percent 2012 Senior Notes. For additional information regarding the interest rate swap agreements, refer

to Note 9.

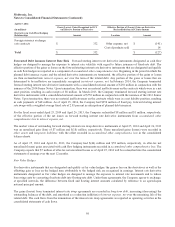

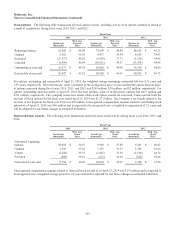

Senior Convertible Notes In April 2006, the Company issued $2.200 billion of 1.500 percent Senior Convertible Notes due

2011 (2011 Senior Convertible Notes) and $2.200 billion of 1.625 percent Senior Convertible Notes due 2013 (2013 Senior

Convertible Notes) (collectively, the Senior Convertible Notes). No amounts were outstanding on the Senior Convertible Notes

as of April 25, 2014 and April 26, 2013.

The Company allocated the proceeds from the issuance of the Senior Convertible Notes between a liability component (issued at

a discount) and an equity component. The resulting debt discount was amortized over the period the 2013 Senior Convertible

Notes were outstanding as additional non-cash interest expense.

In separate private transactions, the Company sold 82 million shares of the Company’s common stock at an exercise price of

$76.56 per share. As of April 25, 2014, the warrants for 82 million shares of the Company’s common stock had expired. The

95