Medtronic 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Continued and future acceptance of the Endurant II AAA Stent Graft System. Our Endurant II AAA Stent

Graft System was launched in Europe in the third quarter of fiscal year 2012, in the U.S. in the first quarter of

fiscal year 2013, and in Japan in the first quarter of fiscal year 2014.

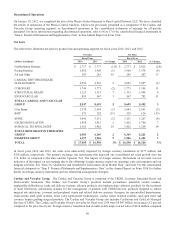

Restorative Therapies Group The Restorative Therapies Group is composed of the Spine, Neuromodulation, and Surgical

Technologies businesses. The Restorative Therapies Group includes products for various areas of the spine, bone graft

substitutes, biologic products, trauma, implantable neurostimulation therapies and drug delivery systems for the treatment of

chronic pain, movement disorders, obsessive-compulsive disorder (OCD), overactive bladder, urinary retention, fecal

incontinence and gastroparesis, products to treat conditions of the ear, nose, and throat, and systems that incorporate advanced

energy surgical instruments. Additionally, this group manufactures and sells image-guided surgery and intra-operative imaging

systems. The Restorative Therapies Group’s net sales for fiscal year 2014 were $6.501 billion, an increase of 2 percent over the

prior fiscal year. Foreign currency translation had an unfavorable impact on net sales of approximately $58 million when

compared to the prior fiscal year. The Restorative Therapies Group’s performance for fiscal year 2014 was favorably impacted

by strong net sales in Surgical Technologies and growth in Neuromodulation, partially offset by declines in Spine, primarily

driven by BMP and BKP. See the more detailed discussion of each business’s performance below.

Spine net sales for fiscal year 2014 were $3.041 billion, a decrease of 3 percent over the prior fiscal year. The decrease in

Spine’s net sales for fiscal year 2014 was primarily driven by declines in BMP and BKP of 11 percent and 9 percent,

respectively, and unfavorable foreign currency translation. Net sales in BKP for fiscal year 2014 declined 9 percent compared to

the prior fiscal year due to increased competition, pricing pressures, and reimbursement challenges with select payers.

Significant declines in U.S. sales of INFUSE bone graft have continued since the June 2011 articles in The Spine Journal, as

further described in the Restorative Therapies Group’s looking ahead discussion below. In addition, some surgeons continue to

reduce their usage through both patient selection and the use of smaller kits. Core Spine net sales declined 1 percent for fiscal

year 2014 compared to the same period in the prior fiscal year primarily due to unfavorable foreign currency translation and

negative performance in BKP as discussed above, which were substantially offset by recent launches of our new products and

therapies, including product line extensions to our Vertex platform and BRYAN artificial cervical disc, as well as the continued

adoption of other biologics products. The global Core Spine markets were relatively flat on a year-over-year basis. During fiscal

year 2014, Core Spine benefited from our focus on enabling technologies, including the O-Arm imaging system, StealthStation

navigation, and Powerease powered surgical instruments. Our Kanghui orthopedics business in China continues to perform well

and offset the revenues in the previous year from our former joint venture with Shandong Weigao Group Medical Polymer

Company Limited.

Neuromodulation net sales for fiscal year 2014 were $1.898 billion, an increase of 5 percent over the prior fiscal year. The

increase in net sales was primarily due to 8 percent growth in international markets, strong global growth of our Activa DBS

systems for movement disorders driven by new implant growth, and strong performance from our conditionally safe SureScan

MRI system. We received U.S. FDA approval for our conditionally safe SureScan MRI system earlier than anticipated and

transitioned manufacturing in the first quarter of fiscal year 2014 to the SureScan MRI system, resulting in supply constraints

which continued through early in the second fiscal quarter of 2014. Growth in sales of our InterStim Therapy for overactive

bladder, urinary retention, and bowel incontinence continued during fiscal year 2014, although at a slower rate compared to the

prior fiscal year as a result of increased competition from non-device therapies.

Surgical Technologies net sales for fiscal year 2014 were $1.562 billion, an increase of 10 percent over the prior fiscal year. The

increase in net sales was driven by continued worldwide net sales growth across the portfolio of ENT, Neurosurgery, and

Advanced Energy, partially offset by unfavorable foreign currency translation. Growth was driven by strong sales of navigation,

power systems, monitoring, Aquamantys Transcollation, PEAK PlasmaBlade technologies, and Strata adjustable valves.

Additionally, net sales growth was positively impacted by the late fiscal year 2013 launches of the Trivantage EMG tube in the

U.S. and Indigo high-speed otologic drill internationally.

The Restorative Therapies Group’s net sales for fiscal year 2013 were $6.369 billion, an increase of 2 percent over the prior

fiscal year. Foreign currency translation had an unfavorable impact on net sales of approximately $78 million when compared to

the prior fiscal year. The Restorative Therapies Group’s performance was a result of strong net sales in Surgical Technologies,

as well as solid growth in Neuromodulation, partially offset by declines in Spine, primarily driven by BMP and BKP. The

Restorative Therapies Group’s performance was favorably affected by the recent launches and continued adoption of new

products, strong sales of capital equipment, the acquisitions of Salient and PEAK in the second quarter of fiscal year 2012, and

continued signs of stabilization in the U.S. Core Spine market, and negatively affected by continued pricing and competitive

pressures. See the more detailed discussion of each business’s performance below.

44