Medtronic 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.with the prior year. The U.S. and Western Europe markets were adversely affected by a number of factors, including

competition and pricing pressures. The continued acceptance of our shock reduction and lead integrity alert technologies, our

recently launched Viva/Brava family of CRT-D devices, increasing lead-to-port ratios, and share gains partially offset the

decline in net sales of our defibrillation system products. Worldwide net sales of our pacing system products declined primarily

due to unfavorable foreign currency translation, declines in the U.S. market caused by pricing pressures and declining implant

volumes, and to a lesser extent, pricing pressures in the Western Europe market. The decline in net sales of our pacing system

products was partially offset by international share gains driven mostly by the launch of our Advisa DR MRI SureScan

pacemaker in Japan in the second quarter of fiscal year 2013. Worldwide net sales of our AF Solutions products increased

primarily due to the continued global acceptance of the Arctic Front system.

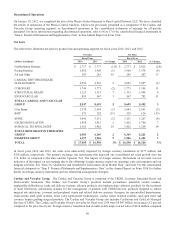

Coronary net sales for fiscal year 2013 were $1.773 billion, an increase of 11 percent compared to the prior fiscal year. The

increase in Coronary net sales was primarily due to the continued strength of our Resolute Integrity drug-eluting coronary stent.

We launched Resolute Integrity in Japan in the second quarter of fiscal year 2013 and in the U.S. in the fourth quarter of fiscal

year 2012. Resolute Integrity’s deliverability and unique diabetes indication has continued to receive strong customer

acceptance and we received U.S. FDA approval for longer lengths of this product in the fourth quarter of fiscal year 2013.

Growth was partially offset by unfavorable foreign currency translation as well as pricing pressures and competitive launches in

Western Europe.

Structural Heart net sales for fiscal year 2013 were $1.133 billion, an increase of 4 percent compared to the prior fiscal year.

The increase in Structural Heart net sales was primarily driven by strong sales of transcatheter aortic heart valves and growth in

our cardiopulmonary product lines driven principally by a competitor’s supply disruption. Growth was partially offset by

unfavorable foreign currency translation and slowing market growth rates and increased competitive pressure for transcatheter

aortic heart valves in Western Europe.

Endovascular net sales for fiscal year 2013 were $867 million, an increase of 11 percent compared to the prior fiscal year. The

increase in Endovascular net sales was led by new product launches. Growth was driven by the Endurant Abdominal Aortic

Aneurysm (AAA) Stent Graft System, which launched in Japan in the third quarter of fiscal year 2012, as well as the Valiant

Captivia Thoracic Stent Graft System, which launched in the U.S. in the fourth quarter of fiscal year 2012 and in Japan and

China in the first quarter of fiscal year 2013. Strong worldwide sales of our peripheral stent products and drug-eluting balloons

also contributed to the growth. Growth was partially offset by unfavorable foreign currency translation and increased

competitive pressure in the U.S.

Looking ahead, we expect our Cardiac and Vascular Group could be impacted by the following:

•Increasing competition, fluctuations in foreign currency, and continued pricing pressures. We have seen a

reduction of pricing pressure in fiscal year 2014 with the launch of several new products and believe our new

technologies may continue to partially mitigate near-term pricing pressures.

•The launch of Reveal LINQ, our next-generation insertable cardiac monitor, in international and U.S. markets

in the third and fourth quarters of fiscal year 2014, respectively.

•Continued and future growth from the Arctic Front system, including the second generation Arctic Front

Advance Cardiac Cryoballoon launched in the second quarter of fiscal year 2013. The Arctic Front system is a

cryoballoon indicated for the treatment of drug refractory paroxysmal atrial fibrillation. The cryoballoon

treatment involves a minimally invasive procedure that efficiently creates circumferential lesions around the

pulmonary vein, which studies have indicated is the source of erratic electrical signals that cause irregular

heartbeat.

•Integration of TYRX into the Cardiac and Vascular Group. TYRX was acquired in January 2014. We believe

that this proprietary technology reduces infections that can result from device implants. We intend to leverage

this technology initially in CRDM, and ultimately in other businesses such as Neuromodulation.

•Continued acceptance and future growth from the Evera family of ICDs, which received CE Mark approval in

February 2013 and U.S. FDA and Japan PMDA approval in May 2013. The Evera family of ICDs have

increased battery longevity, advanced shock reduction technology, and a contoured shape with thin, smooth

edges that better fits inside the body. We received CE Mark approval for our Evera MRI SureScan ICD, the

only ICD system approved for full-body MRI scans, late in the fourth quarter of fiscal year 2014.

42