Medtronic 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

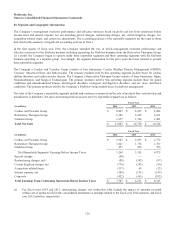

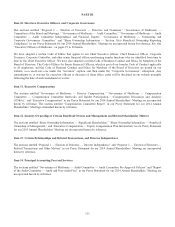

20. Segment and Geographic Information

The Company’s management evaluates performance and allocates resources based on profit and loss from operations before

income taxes and interest expense, net, not including special charges, restructuring charges, net, certain litigation charges, net,

acquisition-related items, and certain tax adjustments. The accounting policies of the reportable segments are the same as those

described in the summary of significant accounting policies in Note 1.

In the first quarter of fiscal year 2014, the Company amended the way in which management evaluates performance and

allocates resources for the Diabetes business including separating the Diabetes business from the Restorative Therapies Group.

As a result, the Company began to operate under three reportable segments and three operating segments with the Diabetes

business operating as a separate group. Accordingly, the segment information for the prior years has been restated to present

three reportable segments.

The Company’s Cardiac and Vascular Group consists of four businesses: Cardiac Rhythm Disease Management (CRDM),

Coronary, Structural Heart, and Endovascular. The primary products sold by this operating segment include those for cardiac

rhythm disorders and cardiovascular disease. The Company’s Restorative Therapies Group consists of three businesses: Spine,

Neuromodulation, and Surgical Technologies. The primary products sold by this operating segment include those for spinal

conditions and musculoskeletal trauma, neurological disorders, urological and digestive disorders, and ear, nose, and throat

conditions. The primary products sold by the Company’s Diabetes Group include those for diabetes management.

Net sales of the Company’s reportable segments include end-customer revenues from the sale of products they each develop and

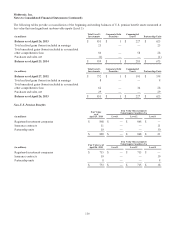

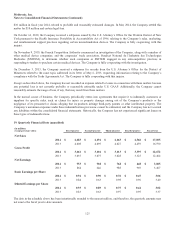

manufacture or distribute. Net sales and earnings before income taxes by reportable segment are as follows:

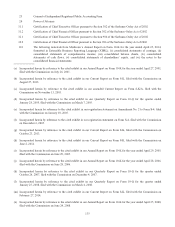

Fiscal Year

(in millions) 2014 2013 2012

Cardiac and Vascular Group $ 8,847 $ 8,695 $ 8,482

Restorative Therapies Group 6,501 6,369 6,221

Diabetes Group 1,657 1,526 1,481

Total Net Sales $ 17,005 $ 16,590 $ 16,184

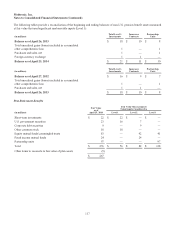

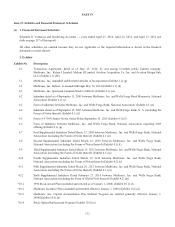

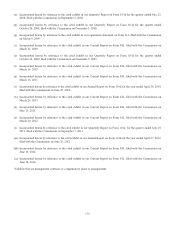

Fiscal Year

(in millions) 2014 2013 2012

Cardiac and Vascular Group $ 2,982 $ 2,935 $ 2,772

Restorative Therapies Group 1,821 1,778 1,707

Diabetes Group 457 432 396

Total Reportable Segments’ Earnings Before Income Taxes 5,260 5,145 4,875

Special charges (40) — —

Restructuring charges, net(a) (88) (182) (87)

Certain litigation charges, net (770) (245) (90)

Acquisition-related items (117) 49 (12)

Interest expense, net (108) (151) (149)

Corporate (432) (365) (392)

Total Earnings From Continuing Operations Before Income Taxes $ 3,705 $ 4,251 $ 4,145

(a) For fiscal years 2014 and 2013, restructuring charges, net within this table include the impact of amounts recorded

within cost of products sold in the consolidated statements of earnings related to the fiscal year 2014 initiative and fiscal

year 2013 initiative, respectively.

126