Medtronic 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

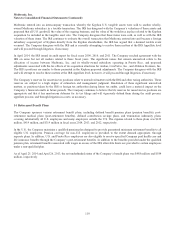

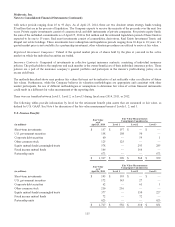

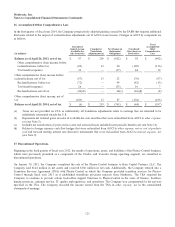

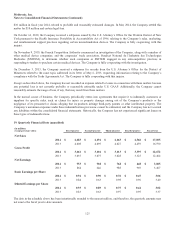

Effective May 1, 2005, the Company froze participation in the existing defined benefit pension plan in the U.S. and

implemented two new plans including an additional defined benefit pension plan and a new defined contribution pension plan,

respectively: the Personal Pension Account (PPA) and the Personal Investment Account (PIA). Employees in the U.S. hired on

or after May 1, 2005 have the option to participate in either the PPA or the PIA. Participants in the PPA receive an annual

allocation of their salary and bonus on which they will receive an annual guaranteed rate of return which is based on the ten-

year Treasury bond rate. Participants in the PIA also receive an annual allocation of their salary and bonus; however, they are

allowed to determine how to invest their funds among identified fund alternatives. The cost associated with the PPA is included

in U.S. Pension Benefits in the tables presented earlier. The defined contribution cost associated with the PIA was

approximately $50 million, $50 million, and $48 million in fiscal years 2014, 2013, and 2012, respectively.

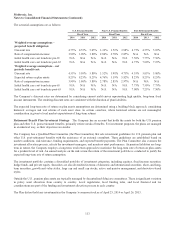

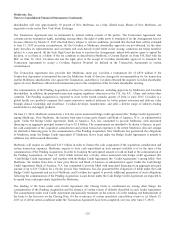

15. Leases

The Company leases office, manufacturing, and research facilities and warehouses, as well as transportation, data processing,

and other equipment under capital and operating leases. A substantial number of these leases contain options that allow the

Company to renew at the fair rental value on the date of renewal.

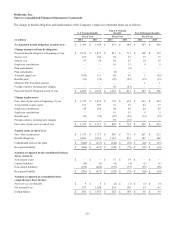

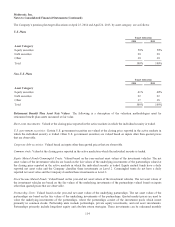

Future minimum payments under capitalized leases and non-cancelable operating leases at April 25, 2014 are:

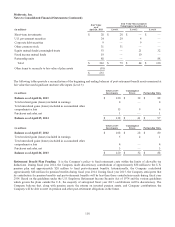

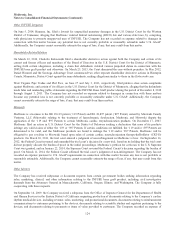

(in millions)

Fiscal Year

Capitalized

Leases

Operating

Leases

2015 $ 18 $ 112

2016 17 77

2017 34 45

2018 22 21

2019 22 13

Thereafter 64 23

Total minimum lease payments $ 177 $ 291

Less amounts representing interest (24) N/A

Present value of net minimum lease payments $ 153 N/A

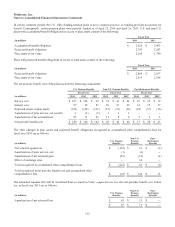

Rent expense for all operating leases, including discontinued operations in prior years, was $150 million, $140 million, and

$153 million in fiscal years 2014, 2013, and 2012, respectively.

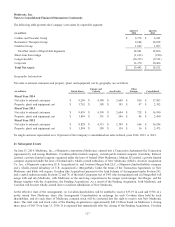

In April 2012, the Company entered into a $165 million sale-leaseback agreement with a financial institution whereby certain

manufacturing equipment was sold to the financial institution and is being leased by the Company over a ten-year period. The

transaction was recorded as a capital lease and is included in the table above. Payments for the remaining balance of the sale-

leaseback agreement are due monthly for the first five years, and then annually, for the remaining five years. The lease provides

for an early buyout option whereby the Company, at its option, could repurchase the equipment at a pre-determined fair market

value in calendar year 2017.

120