Medtronic 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On August 7, 2013, we acquired Cardiocom, a privately-held developer and provider of integrated solutions for the management

of chronic diseases such as heart failure, diabetes, and hypertension. Cardiocom’s products and services include remote

monitoring and patient-centered software to enable efficient care coordination and specialized telehealth nurse support. Total

consideration for the transaction was approximately $193 million.

Fiscal Year 2013

On November 1, 2012, we acquired Kanghui, a Chinese manufacturer and distributor of orthopedic products in trauma, spine,

and joint reconstruction. Total consideration for the transaction was approximately $816 million. The total value of the

transaction, net of Kanghui’s cash, was approximately $797 million.

Fiscal Year 2012

On August 31, 2011, we acquired Salient. Salient develops and markets devices for haemostatic sealing of soft tissue and bone

incorporating advanced energy technology. Salient’s devices are used in a variety of surgical procedures including orthopedic

surgery, spine, open abdominal, and thoracic procedures. Total consideration for the transaction was approximately

$497 million. We had previously invested in Salient and held an 8.9 percent ownership position in the company. In connection

with the acquisition of Salient, we recognized a gain on our previously-held investment of $32 million, which was recorded

within acquisition-related items in the consolidated statements of earnings in the second quarter of fiscal year 2012. Net of this

ownership position, the transaction value was approximately $452 million.

On August 31, 2011, we acquired PEAK. PEAK develops and markets tissue dissection devices incorporating advanced energy

technology. Total consideration for the transaction was approximately $113 million. We had previously invested in PEAK and

held an 18.9 percent ownership position in the company. In connection with the acquisition of PEAK, we recognized a gain on

our previously-held investment of $6 million, which was recorded within acquisition-related items in the consolidated

statements of earnings in the second quarter of fiscal year 2012. Net of this ownership position, the transaction value was

approximately $96 million.

The pro forma impact of the above acquisitions was not significant, individually or in the aggregate, to our results for the fiscal

years ended April 25, 2014, April 26, 2013, or April 27, 2012. The results of operations related to each company acquired have

been included in our consolidated statements of earnings since the date each company was acquired.

In addition to the acquisitions above, we periodically acquire certain tangible or intangible assets from enterprises that do not

otherwise qualify for accounting as a business combination. These transactions are reflected in the consolidated statements of

cash flows as a component of investing activities under other investing activities, net.

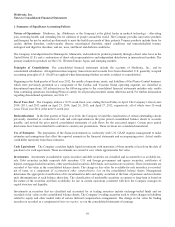

New Accounting Pronouncements

Information regarding new accounting pronouncements is included in Note 1 to the consolidated financial statements in “Item 8.

Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

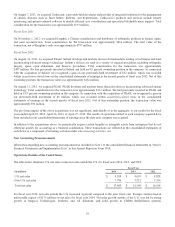

Operations Outside of the United States

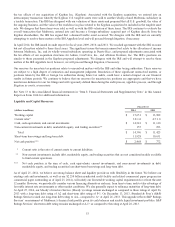

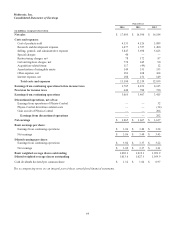

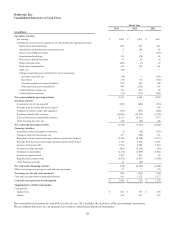

The table below illustrates U.S. net sales versus net sales outside the U.S. for fiscal years 2014, 2013, and 2012:

Fiscal Year

(in millions) 2014 2013 2012

U.S. net sales $ 9,209 $ 9,059 $ 8,828

Non-U.S. net sales 7,796 7,531 7,356

Total net sales $ 17,005 $ 16,590 $ 16,184

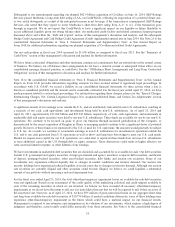

For fiscal year 2014, net sales outside the U.S. increased 4 percent compared to the prior fiscal year. Foreign currency had an

unfavorable impact of $175 million on net sales for fiscal year 2014. Net sales growth outside of the U.S. was led by strong

growth in Surgical Technologies, Diabetes, and AF Solutions, and solid growth in CRDM defibrillation systems,

59