Medtronic 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

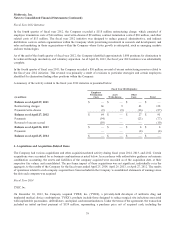

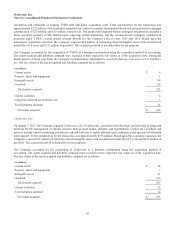

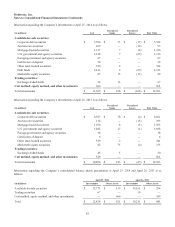

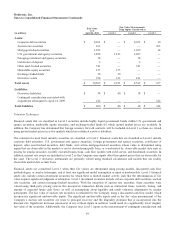

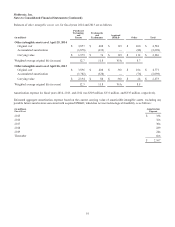

Information regarding the Company’s investments at April 25, 2014 is as follows:

(in millions) Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Available-for-sale securities:

Corporate debt securities $ 5,504 $ 55 $ (17) $ 5,542

Auction rate securities 109 — (12) 97

Mortgage-backed securities 1,337 7 (8) 1,336

U.S. government and agency securities 3,138 7 (29) 3,116

Foreign government and agency securities 67——67

Certificates of deposit 54——54

Other asset-backed securities 540 2 — 542

Debt funds 2,143 9 (29) 2,123

Marketable equity securities 47 15 (13) 49

Trading securities:

Exchange-traded funds 54 13 — 67

Cost method, equity method, and other investments 666 — — NA

Total investments $ 13,659 $ 108 $ (108) $ 12,993

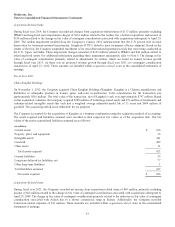

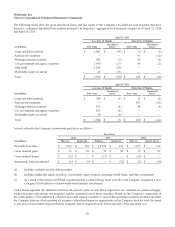

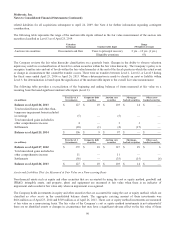

Information regarding the Company’s investments at April 26, 2013 is as follows:

(in millions) Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Available-for-sale securities:

Corporate debt securities $ 4,587 $ 78 $ (4) $ 4,661

Auction rate securities 118 — (15) 103

Mortgage-backed securities 1,050 8 (5) 1,053

U.S. government and agency securities 3,882 17 (1) 3,898

Foreign government and agency securities 38——38

Certificates of deposit 6 — — 6

Other asset-backed securities 539 2 — 541

Marketable equity securities 82 75 (2) 155

Trading securities:

Exchange-traded funds 45 5 — 50

Cost method, equity method, and other investments 549 — — NA

Total investments $ 10,896 $ 185 $ (27) $ 10,505

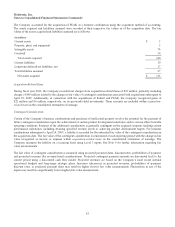

Information regarding the Company’s consolidated balance sheets presentation at April 25, 2014 and April 26, 2013 is as

follows:

April 25, 2014 April 26, 2013

(in millions) Investments Other Assets Investments Other Assets

Available-for-sale securities $ 12,771 $ 155 $ 10,161 $ 294

Trading securities 67 — 50 —

Cost method, equity method, and other investments — 666 — 549

Total $ 12,838 $ 821 $ 10,211 $ 843

85