Medtronic 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Subsequent to our announcement regarding our planned $42.9 billion acquisition of Covidien, on June 16, 2014, S&P Ratings

Services placed Medtronic’s long-term debt rating of AA- on CreditWatch, reflecting its expectation of a potential future one-

or two- notch downgrade, as a result of the anticipated increase in net leverage, if the transaction is consummated. S&P Ratings

Services also noted that they expect to lower Medtronic’s short-term debt rating from A-1+ to A-1 if the transaction goes

through as expected. We do not expect this CreditWatch to have a significant impact on our liquidity or future flexibility to

access additional liquidity given our strong balance sheet, our syndicated credit facility and related commercial paper program

discussed above and within the “Debt and Capital” section of this management’s discussion and analysis, and the subsequent

Bridge Credit Agreement and Cash Bridge Credit Agreement (Credit Agreements) entered into in June 2014. See Note 21 to the

consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on

Form 10-K for additional information regarding our planned acquisition of Covidien and related Credit Agreements.

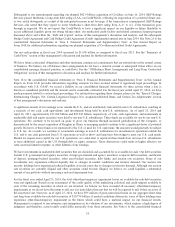

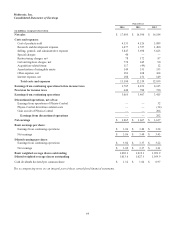

Our net cash position in fiscal year 2014 increased by $1.696 billion as compared to fiscal year 2013. See the “Summary of

Cash Flows” section of this management’s discussion and analysis for further information.

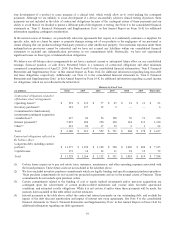

We have future contractual obligations and other minimum commercial commitments that are entered into in the normal course

of business. We believe our off-balance sheet arrangements do not have a material current or anticipated future effect on our

consolidated earnings, financial position, or cash flows. See the “Off-Balance Sheet Arrangements and Long-Term Contractual

Obligations” section of this management’s discussion and analysis for further information.

Note 18 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual

Report on Form 10-K provides information regarding amounts we have accrued related to significant legal proceedings. In

accordance with U.S. GAAP, we record a liability in our consolidated financial statements for these actions when a loss is

known or considered probable and the amount can be reasonably estimated. For the fiscal year ended April 25, 2014, we have

made payments related to certain legal proceedings. For information regarding these charges, please see the “Special Charges,

Restructuring Charges, Net, Certain Litigation Charges, Net, Acquisition-Related Items, and Certain Tax Adjustments” section

of this management’s discussion and analysis.

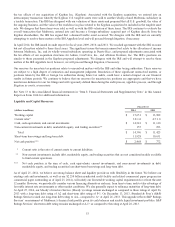

A significant amount of our earnings occur outside the U.S., and are indefinitely reinvested in non-U.S. subsidiaries, resulting in

a majority of our cash, cash equivalents, and investments being held by non-U.S. subsidiaries. As of April 25, 2014 and

April 26, 2013, approximately $13.968 billion and $10.930 billion, respectively, of cash, cash equivalents, and investments in

marketable debt and equity securities were held by our non-U.S. subsidiaries. These funds are available for use by our non-U.S.

operations. We continue to be focused on goals to grow our business through increased globalization of the Company, as

demonstrated by the recent acquisition of Kanghui in China, as emerging markets continue to be a significant driver of potential

growth. However, if these funds were repatriated to the U.S. or used for U.S. operations, the amounts would generally be subject

to U.S. tax. As a result, we continue to accumulate earnings in non-U.S. subsidiaries for investment in operations outside the

U.S. and to use cash generated from U.S. operations as well as short- and long-term borrowings to meet our U.S. cash needs.

Should we require more capital for our U.S. operations, we could elect to repatriate these funds from our non-U.S. subsidiaries

or raise additional capital in the U.S. through debt or equity issuances. These alternatives could result in higher effective tax

rates, increased interest expense, or other dilution of our earnings.

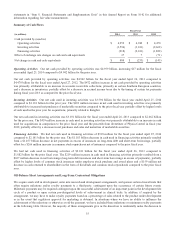

We have investments in marketable debt securities that are classified and accounted for as available-for-sale. Our debt securities

include U.S. government and agency securities, foreign government and agency securities, corporate debt securities, certificates

of deposit, mortgage-backed securities, other asset-backed securities, debt funds, and auction rate securities. Some of our

investments may experience reduced liquidity due to changes in market conditions and investor demand. Our auction rate

security holdings have experienced reduced liquidity in recent years due to changes in investor demand. Although our auction

rate securities are currently illiquid and other securities could become illiquid, we believe we could liquidate a substantial

amount of our portfolio without incurring a material impairment loss.

For the fiscal year ended April 25, 2014, the total other-than-temporary impairment losses on available-for-sale debt securities

were not significant. Based on our assessment of the credit quality of the underlying collateral and credit support available to

each of the remaining securities in which we are invested, we believe we have recorded all necessary other-than-temporary

impairments as we do not have the intent to sell, nor is it more likely than not that we will be required to sell, before recovery of

the amortized cost. However, as of April 25, 2014, we have $95 million of gross unrealized losses on our aggregate short-term

and long-term available-for-sale debt securities of $10.754 billion; if market conditions deteriorate, some of these holdings may

experience other-than-temporary impairment in the future which could have a material impact on our financial results.

Management is required to use estimates and assumptions in its valuation of our investments, which requires a high degree of

judgment, and therefore, actual results could differ materially from those estimates. See Note 6 to the consolidated financial

54