Medtronic 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medtronic, Inc.

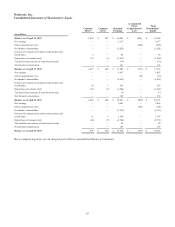

Notes to Consolidated Financial Statements (Continued)

cumulative translation adjustment (CTA) to unrealized gain (loss) on derivatives. The Company has applied this change

retrospectively to April 26, 2013 as a correction of the classification in the table above. In the first quarter of fiscal year 2014,

the Company prospectively adopted guidance issued that requires additional disclosure related to the impact of reclassification

adjustments out of accumulated other comprehensive income (loss) on net income. The required disclosures are included in

Note 16.

Refer to the consolidated statements of comprehensive income for additional information.

Derivatives U.S. GAAP requires companies to recognize all derivatives as assets and liabilities on the balance sheet and to

measure the instruments at fair value through earnings unless the derivative qualifies as a hedge. If the derivative is a hedge,

depending on the nature of the hedge and hedge effectiveness, changes in the fair value of the derivative will either be

recognized currently through earnings or recorded in other comprehensive income (loss) until the hedged item is recognized in

earnings upon settlement/termination. The changes in the fair value of the derivative are intended to offset the change in fair

value of the hedged asset, liability, or probable commitment. The Company evaluates hedge effectiveness at inception and on an

ongoing basis. If a derivative is no longer expected to be highly effective, hedge accounting is discontinued. Hedge

ineffectiveness, if any, is recorded in earnings.

The Company uses operational and economic hedges, as well as currency exchange rate derivative contracts and interest rate

derivative instruments, to manage the impact of currency exchange and interest rate changes on earnings and cash flows. In

order to minimize earnings and cash flow volatility resulting from currency exchange rate changes, the Company enters into

derivative instruments, principally forward currency exchange rate contracts. These contracts are designed to hedge anticipated

foreign currency transactions and changes in the value of specific assets and liabilities. At inception of the forward contract, the

derivative is designated as either a freestanding derivative or a cash flow hedge. The primary currencies of the derivative

instruments are the Euro and Japanese Yen. The Company does not enter into currency exchange rate derivative contracts for

speculative purposes. All derivative instruments are recorded at fair value on the consolidated balance sheets, as a component of

prepaid expenses and other current assets, other assets, other accrued expenses, or other long-term liabilities depending upon

the gain or loss position of the contract and contract maturity date.

Forward contracts designated as cash flow hedges are designed to hedge the variability of cash flows associated with forecasted

transactions denominated in a foreign currency that will take place in the future. For derivative instruments that are designated

and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative instrument is reported as a

component of accumulated other comprehensive loss. The effective portion of the gain or loss on the derivative instrument is

reclassified into earnings and is included in other expense, net or cost of products sold in the consolidated statements of

earnings, depending on the underlying transaction that is being hedged, in the same period or periods during which the hedged

transaction affects earnings. The cash flows from these contracts are reported as operating activities in the consolidated

statements of cash flows.

The Company uses freestanding derivative forward contracts to offset its exposure to the change in value of specific foreign

currency denominated assets and liabilities. These derivatives are not designated as hedges, and therefore, changes in the value

of these forward contracts are recognized in earnings, thereby offsetting the current earnings effect of the related change in

value of foreign currency denominated assets and liabilities.

The Company uses forward starting interest rate derivative instruments designated as cash flow hedges to manage the exposure

to interest rate volatility with regard to future issuances of fixed-rate debt. The effective portion of the gains or losses on the

forward starting interest rate derivative instruments that are designated and qualify as cash flow hedges are reported as a

component of accumulated other comprehensive loss. Beginning in the period in which the planned debt issuance occurs and the

related derivative instruments are terminated, the effective portion of the gains or losses are then reclassified into interest

expense, net over the term of the related debt. Any portion of the gains or losses that are determined to be ineffective are

immediately recognized in interest expense, net. The cash flows from these contracts are reported as operating activities in the

consolidated statements of cash flows.

The Company uses interest rate derivative instruments designated as fair value hedges to manage the exposure to interest rate

movements and to reduce borrowing costs by converting fixed-rate debt into floating-rate debt. Under these agreements, the

Company agrees to exchange, at specified intervals, the difference between fixed and floating interest amounts calculated by

74