Medtronic 2014 Annual Report Download - page 45

Download and view the complete annual report

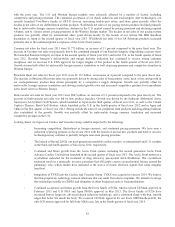

Please find page 45 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Transaction Agreement may be terminated by mutual written consent of the parties. The Transaction Agreement also

contains certain termination rights, including, among others, the right of either party to terminate if (a) the Arrangement has not

become effective by March 15, 2015 (the End Date), subject to certain conditions, provided that the End Date will be extended

to June 15, 2015 in certain circumstances, (b) the Covidien or Medtronic shareholder approvals are not obtained, (c) the other

party breaches its representations and covenants and such breach would result in the closing conditions not being satisfied,

subject to a cure period, (d) the Irish High Court declines to sanction the Arrangement, unless both parties agree to appeal the

decision, or (e) there is a failure of the tax condition as described in Medtronic’s Current Report on Form 8-K filed with the

SEC on June 16, 2014. Covidien also has the right, prior to the receipt of Covidien shareholder approval, to terminate the

Transaction Agreement to accept a Covidien Superior Proposal (as defined in the Transaction Agreement) in certain

circumstances.

The Transaction Agreement also provides that Medtronic must pay Covidien a termination fee of $850 million if the

Transaction Agreement is terminated because the Medtronic board of directors changes its recommendation for the transaction

and the Medtronic shareholders vote against the Transaction, and either (i) Covidien obtained the requisite Covidien shareholder

approval or (ii) Medtronic effected such termination prior to the completion of the Covidien shareholder meeting.

The consummation of the Pending Acquisition is subject to certain conditions, including approvals by Medtronic and Covidien

shareholders. In addition, the proposed transaction requires regulatory clearances in the U.S., the E.U., China, and certain other

countries. The Pending Acquisition is expected to close in the fourth calendar quarter of 2014 or early 2015.

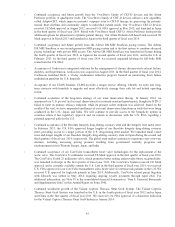

For further information regarding the Pending Acquisition, see the section entitled “Acquisition and Investments - Pending

Acquisition of Covidien plc” contained in “Item 1. Business,” the section entitled “Risks relating to our pending acquisition of

Covidien plc” contained in “Item 1A. Risk Factors,” and Note 21 to the consolidated financial statements in “Item 8. Financial

Statements and Supplementary Data” in this Annual Report on Form 10-K, and the full text of the Transaction Agreement, a

copy of which is filed as exhibit 2.1 to our Current Report on Form 8-K filed with the SEC on June 16, 2014.

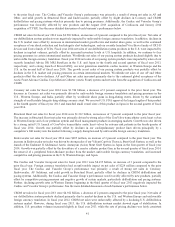

Critical Accounting Estimates

We have adopted various accounting policies to prepare the consolidated financial statements in accordance with accounting

principles generally accepted in the U.S. (U.S. GAAP). Our most significant accounting policies are disclosed in Note 1 to the

consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on

Form 10-K.

The preparation of the consolidated financial statements, in conformity with U.S. GAAP, requires us to make estimates and

assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Our estimates

and assumptions, including those related to bad debts, inventories, intangible assets, asset impairment, legal proceedings, in-

process research and development (IPR&D), contingent consideration, warranty obligations, product liability, self-insurance,

pension and post-retirement obligations, sales returns and discounts, stock-based compensation, valuation of equity and debt

securities, and income tax reserves are updated as appropriate, which in most cases is quarterly. We base our estimates on

historical experience, actuarial valuations, or various assumptions that are believed to be reasonable under the circumstances.

Estimates are considered to be critical if they meet both of the following criteria: (1) the estimate requires assumptions about

material matters that are uncertain at the time the accounting estimates are made, and (2) material changes in the estimates are

reasonably likely to occur from period to period. Our critical accounting estimates include the following:

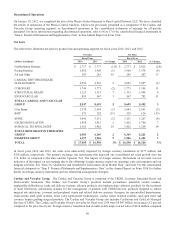

Legal Proceedings We are involved in a number of legal actions involving product liability, intellectual property disputes,

shareholder derivative actions, securities class actions, and other class actions. The outcomes of these legal actions are not

within our complete control and may not be known for prolonged periods of time. In some actions, the claimants seek damages,

as well as other relief (including injunctions barring the sale of products that are the subject of the lawsuit), that could require

significant expenditures or result in lost revenues. In accordance with U.S. GAAP, we record a liability in our consolidated

financial statements for loss contingencies when a loss is known or considered probable and the amount can be reasonably

estimated. If the reasonable estimate of a known or probable loss is a range, and no amount within the range is a better estimate

than any other, the minimum amount of the range is accrued. If a loss is reasonably possible, but not known or probable, and

can be reasonably estimated, the estimated loss or range of loss is disclosed in the notes to the consolidated financial statements.

When determining the estimated loss or range of loss, significant judgment is required to estimate the amount and timing of a

loss to be recorded. Estimates of probable losses resulting from litigation and governmental proceedings involving the Company

37