Medtronic 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

Fiscal Year 2012 Initiative

In the fourth quarter of fiscal year 2012, the Company recorded a $118 million restructuring charge, which consisted of

employee termination costs of $66 million, asset write-downs of $9 million, contract termination costs of $30 million, and other

related costs of $13 million. The fiscal year 2012 initiative was designed to reduce general, administrative, and indirect

distribution costs in certain organizations within the Company while prioritizing investment in research and development, and

sales and marketing in those organizations within the Company where faster growth is anticipated, such as emerging markets

and new technologies.

As of the end of the fourth quarter of fiscal year 2012, the Company identified approximately 1,000 positions for elimination to

be achieved through involuntary and voluntary separation. As of April 26, 2013, the fiscal year 2012 initiative was substantially

complete.

In the fourth quarter of fiscal year 2013, the Company recorded a $10 million reversal of excess restructuring reserves related to

the fiscal year 2012 initiative. This reversal was primarily a result of revisions to particular strategies and certain employees

identified for elimination finding other positions within the Company.

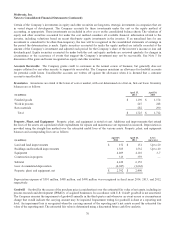

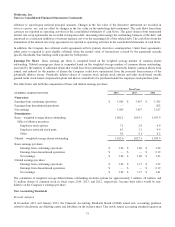

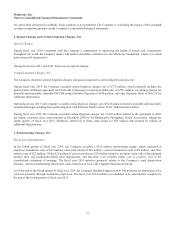

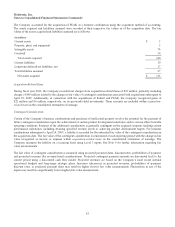

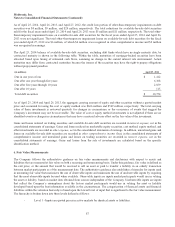

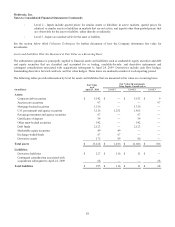

A summary of the activity related to the fiscal year 2012 initiative is presented below:

Fiscal Year 2012 Initiative

(in millions)

Employee

Termination

Costs

Asset

Write-downs

Other

Costs Total

Balance as of April 29, 2011 $—$—$—$—

Restructuring charges 66 9 43 118

Payments/write-downs (2) (9) (16) (27)

Balance as of April 27, 2012 $ 64$ —$ 27$ 91

Payments (54) — (23) (77)

Reversal of excess accrual (10) — — (10)

Balance as of April 26, 2013 $—$—$ 4$ 4

Payments — — (4) (4)

Balance as of April 25, 2014 $—$—$—$—

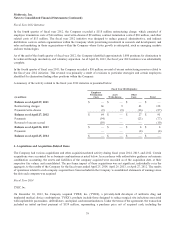

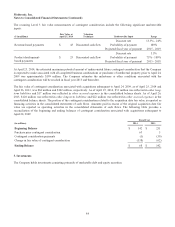

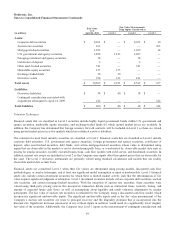

4. Acquisitions and Acquisition-Related Items

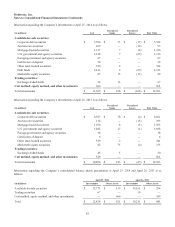

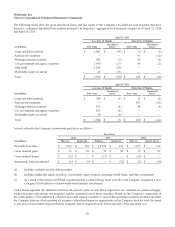

The Company had various acquisitions and other acquisition-related activity during fiscal years 2014, 2013, and 2012. Certain

acquisitions were accounted for as business combinations as noted below. In accordance with authoritative guidance on business

combination accounting, the assets and liabilities of the company acquired were recorded as of the acquisition date, at their

respective fair values, and consolidated. The pro forma impact of these acquisitions was not significant, individually or in the

aggregate, to the results of the Company for the fiscal years ended April 25, 2014, April 26, 2013, or April 27, 2012. The results

of operations related to each company acquired have been included in the Company’s consolidated statements of earnings since

the date each company was acquired.

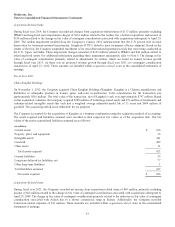

Fiscal Year 2014

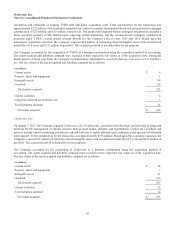

TYRX, Inc.

On December 30, 2013, the Company acquired TYRX, Inc. (TYRX), a privately-held developer of antibiotic drug and

implanted medical device combinations. TYRX’s products include those designed to reduce surgical site infections associated

with implantable pacemakers, defibrillators, and spinal cord neurostimulators. Under the terms of the agreement, the transaction

included an initial up-front payment of $159 million, representing a purchase price net of acquired cash, including the

79