Medtronic 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

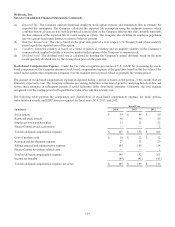

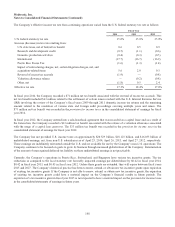

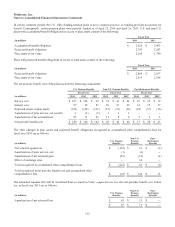

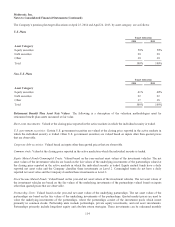

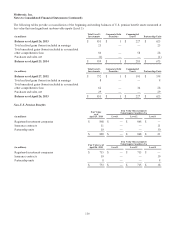

The Company’s pension plan target allocations at April 25, 2014 and April 26, 2013, by asset category, are as follows:

U.S. Plans

Target Allocation

2014 2013

Asset Category

Equity securities 50% 50%

Debt securities 20 20

Other 30 30

Total 100% 100%

Non-U.S. Plans

Target Allocation

2014 2013

Asset Category

Equity securities 41% 40%

Debt securities 22 22

Other 37 38

Total 100% 100%

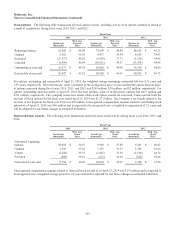

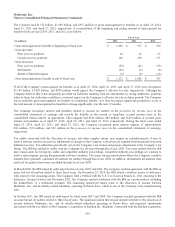

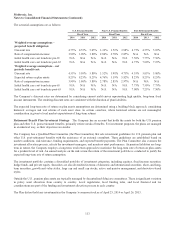

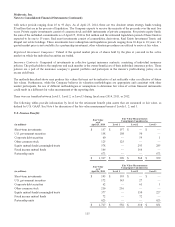

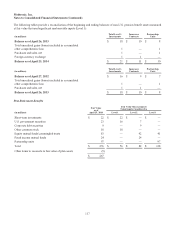

Retirement Benefit Plan Asset Fair Values The following is a description of the valuation methodologies used for

retirement benefit plan assets measured at fair value.

Short-term investments: Valued at the closing price reported in the active markets in which the individual security is traded.

U.S. government securities: Certain U.S. government securities are valued at the closing price reported in the active markets in

which the individual security is traded. Other U.S. government securities are valued based on inputs other than quoted prices

that are observable.

Corporate debt securities: Valued based on inputs other than quoted prices that are observable.

Common stock: Valued at the closing price reported in the active markets in which the individual security is traded.

Equity Mutual Funds/Commingled Trusts: Valued based on the year-end net asset values of the investment vehicles. The net

asset values of the investment vehicles are based on the fair values of the underlying investments of the partnerships valued at

the closing price reported in the active markets in which the individual security is traded. Equity mutual funds have a daily

reported net asset value and the Company classifies these investments as Level 2. Commingled trusts do not have a daily

reported net asset value and the Company classifies these investments as Level 3.

Fixed Income Mutual Funds: Valued based on the year-end net asset values of the investment vehicles. The net asset values of

the investment vehicles are based on the fair values of the underlying investments of the partnerships valued based on inputs

other than quoted prices that are observable.

Partnership Units: Valued based on the year-end net asset values of the underlying partnerships. The net asset values of the

partnerships are based on the fair values of the underlying investments of the partnerships. Quoted market prices are used to

value the underlying investments of the partnerships, where the partnerships consist of the investment pools which invest

primarily in common stocks. Partnership units include partnerships, private equity investments, and real asset investments.

Partnerships primarily include long/short equity and absolute return strategies. These investments can be redeemed monthly

114