Medtronic 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

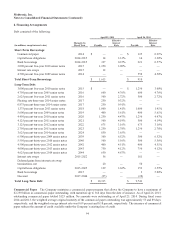

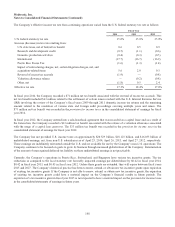

As of both April 25, 2014 and April 26, 2013, the Company had interest rate swaps in gross notional amounts of $2.625 billion

designated as fair value hedges of underlying fixed rate obligations. As of April 25, 2014 and April 26, 2013, the Company had

interest rate swap agreements designated as fair value hedges of underlying fixed rate obligations including the Company’s

$1.250 billion 3.000 percent 2010 Senior Notes due 2015, the $600 million 4.750 percent 2005 Senior Notes due 2016, the

$500 million 2.625 percent 2011 Senior Notes due 2016, the $500 million 4.125 percent 2011 Senior Notes due 2021, and the

$675 million 3.125 percent 2012 Senior Notes due 2022.

In March 2012, the Company entered into ten-year fixed-to-floating interest rate swap agreements with a consolidated notional

amount of $675 million, which were designated as fair value hedges of fixed interest rate obligations under the Company’s 2012

Senior Notes due 2022. The Company pays variable interest equal to one-month LIBOR plus approximately 92 basis points, and

receives a fixed interest rate of 3.125 percent.

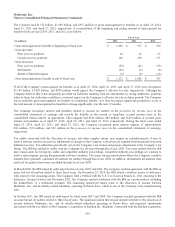

In July 2011, the Company terminated interest rate swap agreements with a consolidated notional amount of $900 million that

were designated as fair value hedges of the fixed interest rate obligation under the Company’s $2.200 billion 1.625 percent 2013

Senior Convertible Notes and $550 million 4.500 percent 2009 Senior Notes due 2014. Upon termination, the contracts were in

an asset position, resulting in cash receipts of $46 million, which included $10 million of accrued interest.

In August 2011, the Company terminated interest rate swap agreements with a consolidated notional amount of $650 million

that were designated as fair value hedges of the fixed interest rate obligation under the Company’s $1.250 billion 3.000 percent

2010 Senior Notes due 2015. Upon termination, the contracts were in an asset position, resulting in cash receipts of $42 million,

which included $7 million of accrued interest.

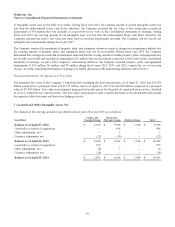

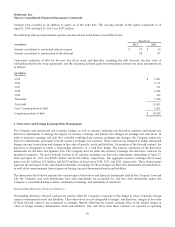

As of April 25, 2014 and April 26, 2013, the market value of outstanding interest rate swap agreements was an unrealized gain

of $68 million and $181 million, respectively, and the market value of the hedged items was an unrealized loss of $68 million

and $181 million, respectively, which was recorded in other assets, prepaid expenses and other current assets, and other long-

term liabilities with the offsets recorded in long-term debt and short-term borrowings on the consolidated balance sheets. No

hedge ineffectiveness was recorded as a result of these fair value hedges for fiscal year 2014 and 2013 and less than $1 million

was recorded for fiscal year 2012 as an increase in interest expense, net on the consolidated statements of earnings.

During fiscal years 2014, 2013, and 2012, the Company did not have any ineffective fair value hedging instruments. In addition,

the Company did not recognize any gains or losses during fiscal years 2014, 2013, or 2012 on firm commitments that no longer

qualify as fair value hedges.

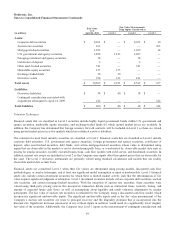

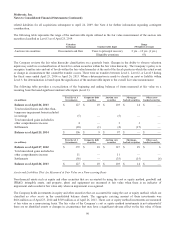

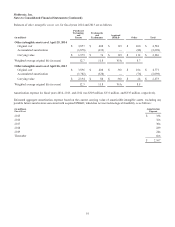

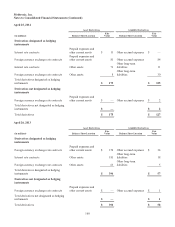

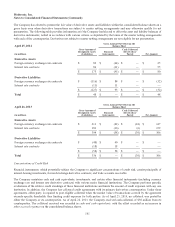

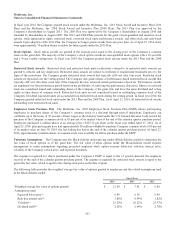

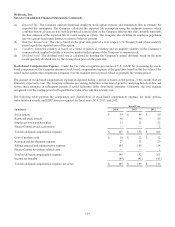

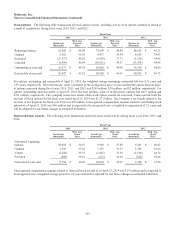

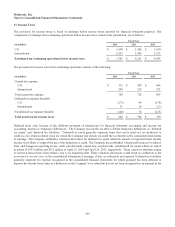

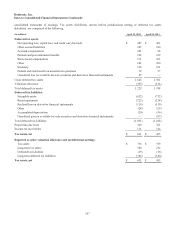

Balance Sheet Presentation

The following tables summarize the location and fair value amounts of derivative instruments reported in the consolidated

balance sheets as of April 25, 2014 and April 26, 2013. The fair value amounts are presented on a gross basis and are segregated

between derivatives that are designated and qualify as hedging instruments and those that are not, and are further segregated by

type of contract within those two categories.

99