Medtronic 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

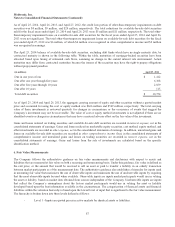

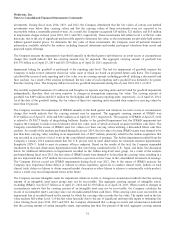

•Level 2 - Inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for

identical or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) that

are observable for the asset or liability, either directly or indirectly.

•Level 3 - Inputs are unobservable for the asset or liability.

See the section below titled Valuation Techniques for further discussion of how the Company determines fair value for

investments.

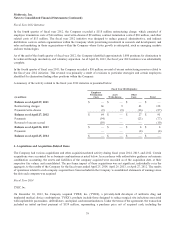

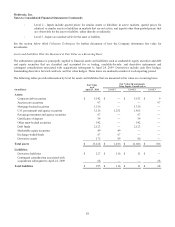

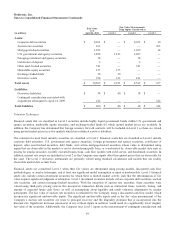

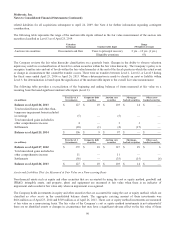

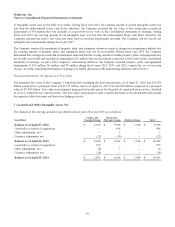

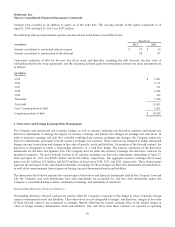

Assets and Liabilities That Are Measured at Fair Value on a Recurring Basis

The authoritative guidance is principally applied to financial assets and liabilities such as marketable equity securities and debt

and equity securities that are classified and accounted for as trading, available-for-sale, and derivative instruments and

contingent consideration associated with acquisitions subsequent to April 24, 2009. Derivatives include cash flow hedges,

freestanding derivative forward contracts, and fair value hedges. These items are marked-to-market at each reporting period.

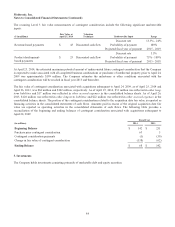

The following tables provide information by level for assets and liabilities that are measured at fair value on a recurring basis:

Fair Value

as of

April 25, 2014

Fair Value Measurements

Using Inputs Considered as

(in millions) Level 1 Level 2 Level 3

Assets:

Corporate debt securities $ 5,542 $ — $ 5,533 $ 9

Auction rate securities 97——97

Mortgage-backed securities 1,336 — 1,336 —

U.S. government and agency securities 3,116 1,251 1,865 —

Foreign government and agency securities 67 — 67 —

Certificates of deposit 54 — 54 —

Other asset-backed securities 542 — 542 —

Debt funds 2,123 — 2,123 —

Marketable equity securities 49 49 — —

Exchange-traded funds 67 67 — —

Derivative assets 175 89 86 —

Total assets $ 13,168 $ 1,456 $ 11,606 $ 106

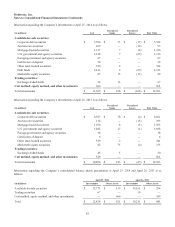

Liabilities:

Derivative liabilities $ 127 $ 116 $ 11 $ —

Contingent consideration associated with

acquisitions subsequent to April 24, 2009 68——68

Total liabilities $ 195 $ 116 $ 11 $ 68

88