Medtronic 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

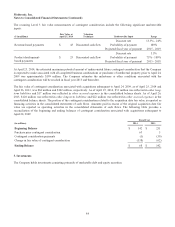

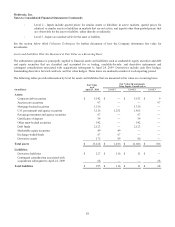

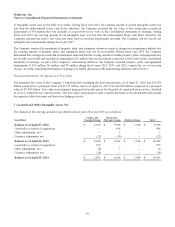

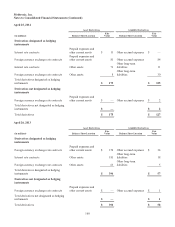

8. Financing Arrangements

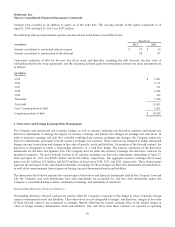

Debt consisted of the following:

April 25, 2014 April 26, 2013

(in millions, except interest rates)

Maturity by

Fiscal Year Payable

Effective

Interest

Rate Payable

Effective

Interest

Rate

Short-Term Borrowings:

Commercial paper 2014 $ — — $ 125 0.21%

Capital lease obligations 2014-2015 14 3.33% 14 3.30%

Bank borrowings 2014-2015 337 0.35% 221 0.57%

3.000 percent five-year 2010 senior notes 2015 1,250 3.00% — —

Interest rate swaps 2015 12 — — —

4.500 percent five-year 2009 senior notes 2014 — — 550 4.50%

Total Short-Term Borrowings $ 1,613 $ 910

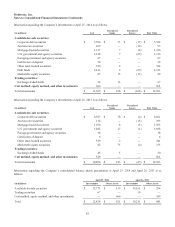

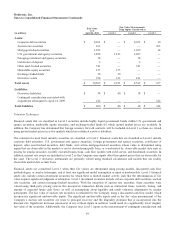

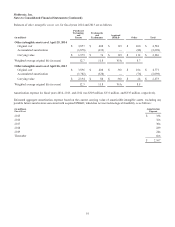

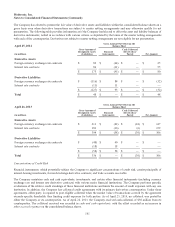

Long-Term Debt:

3.000 percent five-year 2010 senior notes 2015 $ — — $ 1,250 3.00%

4.750 percent ten-year 2005 senior notes 2016 600 4.76% 600 4.76%

2.625 percent five-year 2011 senior notes 2016 500 2.72% 500 2.72%

Floating rate three-year 2014 senior notes 2017 250 0.32% — —

0.875 percent three-year 2014 senior notes 2017 250 0.91% — —

1.375 percent five-year 2013 senior notes 2018 1,000 1.41% 1,000 1.41%

5.600 percent ten-year 2009 senior notes 2019 400 5.61% 400 5.61%

4.450 percent ten-year 2010 senior notes 2020 1,250 4.47% 1,250 4.47%

4.125 percent ten-year 2011 senior notes 2021 500 4.19% 500 4.19%

3.125 percent ten-year 2012 senior notes 2022 675 3.16% 675 3.16%

2.750 percent ten-year 2013 senior notes 2023 1,250 2.78% 1,250 2.78%

3.625 percent ten-year 2014 senior notes 2024 850 3.65% — —

6.500 percent thirty-year 2009 senior notes 2039 300 6.52% 300 6.52%

5.550 percent thirty-year 2010 senior notes 2040 500 5.56% 500 5.56%

4.500 percent thirty-year 2012 senior notes 2042 400 4.51% 400 4.51%

4.000 percent thirty-year 2013 senior notes 2043 750 4.12% 750 4.12%

4.625 percent thirty-year 2014 senior notes 2044 650 4.67% — —

Interest rate swaps 2015-2022 56 — 181 —

Deferred gains from interest rate swap

terminations, net — 20 — 50 —

Capital lease obligations 2015-2025 139 3.62% 152 3.59%

Bank borrowings 2015 — — 3 5.00%

Discount 2017-2044 (25) — (20) —

Total Long-Term Debt $ 10,315 $ 9,741

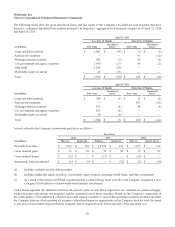

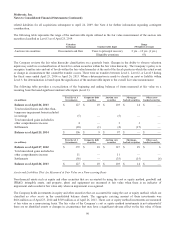

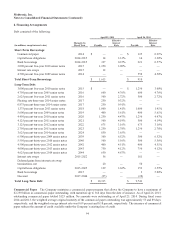

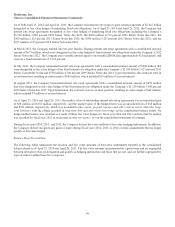

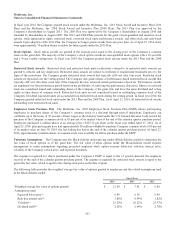

Commercial Paper The Company maintains a commercial paper program that allows the Company to have a maximum of

$2.250 billion in commercial paper outstanding, with maturities up to 364 days from the date of issuance. As of April 26, 2013,

outstanding commercial paper totaled $125 million. No amounts were outstanding as of April 25, 2014. During fiscal years

2014 and 2013, the weighted average original maturity of the commercial paper outstanding was approximately 53 and 89 days,

respectively, and the weighted average interest rate was 0.09 percent and 0.18 percent, respectively. The issuance of commercial

paper reduces the amount of credit available under the Company’s existing line of credit.

94