Medtronic 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Furthermore, we expect our development activities to help reduce patient care costs and the length of hospital stays in the future.

In addition to our investment in research and development, we continue to access new technologies in areas served by our

existing businesses, as well as in new areas, through acquisitions, licensing agreements, alliances, and certain strategic equity

investments.

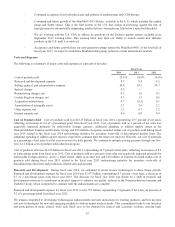

Selling, General, and Administrative Fiscal year 2014 selling, general, and administrative expense was $5.847 billion,

representing 34.4 percent of net sales, reflecting an increase of 0.1 of a percentage point from fiscal year 2013. This increase

was primarily driven by unfavorable foreign currency. Fiscal year 2013 selling, general, and, administrative expense was $5.698

billion, representing 34.3 percent of net sales, reflecting a decrease of 0.4 of a percentage point from fiscal year 2012. This

decrease was driven by several initiatives focused on leveraging our expenses.

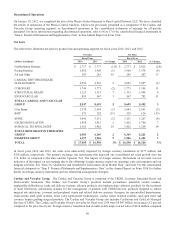

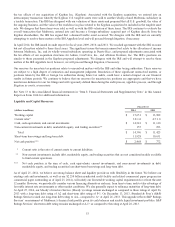

Special Charges, Restructuring Charges, Net, Certain Litigation Charges, Net, Acquisition-Related Items, and Certain

Tax Adjustments We believe that in order to properly understand our short-term and long-term financial trends, investors

may find it useful to consider the impact of special charges, restructuring charges, net, certain litigation charges, net,

acquisition-related items, and certain tax adjustments. Special charges, restructuring charges, net, certain litigation charges, net,

acquisition-related items, and certain tax adjustments recorded during fiscal years 2014, 2013, and 2012 were as follows:

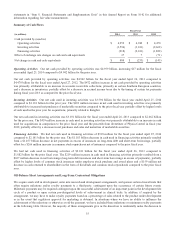

Fiscal Year

(in millions) 2014 2013 2012

Special charges $ 40 $ — $ —

Restructuring charges, net(1) 88 182 87

Certain litigation charges, net 770 245 90

Acquisition-related items 117 (49) 12

Total special charges, restructuring charges, net, certain litigation charges,

net, and acquisition-related items 1,015 378 189

Net tax impact of special charges, restructuring charges, net, certain

litigation charges, net, acquisition-related items, and certain tax

adjustments(1) (212) (47) (56)

Total special charges, restructuring charges, net, certain litigation charges,

net, acquisition-related items, and certain tax adjustments, net of tax(1) $ 803 $ 331 $ 133

(1) For fiscal years 2014 and 2013, restructuring charges, net and the related tax impact within this table include the impact

of amounts recorded within cost of products sold in the consolidated statements of earnings related to the fiscal year

2014 initiative and fiscal year 2013 initiative, respectively.

Special Charges During fiscal year 2014, consistent with the our commitment to improving the health of people and

communities throughout the world, we made a $40 million charitable contribution to the Medtronic Foundation, which is a

related party non-profit organization.

During fiscal years 2013 and 2012, there were no special charges.

Restructuring Charges, Net

Fiscal Year 2014 Initiative

In the fourth quarter of fiscal year 2014, we recorded a $116 million restructuring charge, which consisted of employee

termination costs of $65 million, asset write-downs of $26 million, contract termination costs of $3 million, and other related

costs of $22 million. Of the $26 million of asset write-downs, $10 million related to inventory write-offs of discontinued

product lines and production-related asset impairments, and therefore, was recorded within cost of products sold in the

consolidated statements of earnings. The fiscal year 2014 initiative primarily relates to our renal denervation business, certain

manufacturing shut-downs, and a reduction of back-office support functions in Europe.

As of the end of the fourth quarter of fiscal year 2014, we identified approximately 600 positions for elimination to be achieved

primarily through involuntary separation. The fiscal year 2014 initiative is scheduled to be substantially complete by the end of

the fourth quarter of fiscal year 2015 and is expected to produce annualized operating savings of approximately $60 to

$75 million. These savings will arise mostly from reduced compensation expense. In the first quarter of fiscal year 2015, we

expect to incur an additional restructuring charge of $25 to $40 million, primarily related to contract termination fees.

48