Medtronic 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

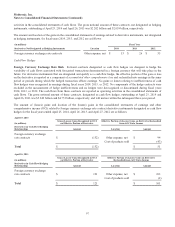

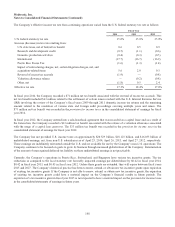

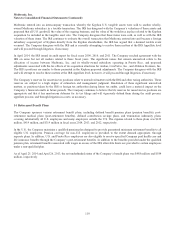

consolidated statements of earnings. Tax assets (liabilities), shown before jurisdictional netting of deferred tax assets

(liabilities), are comprised of the following:

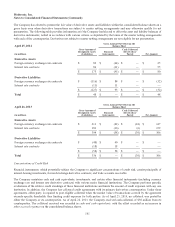

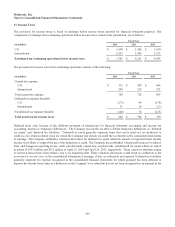

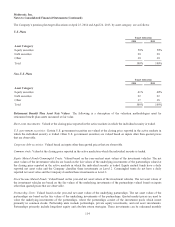

(in millions) April 25, 2014 April 26, 2013

Deferred tax assets:

Net operating loss, capital loss, and credit carryforwards $ 487 $ 423

Other accrued liabilities 205 140

Accrued compensation 201 98

Pension and post-retirement benefits 194 239

Stock-based compensation 171 223

Other 142 200

Inventory 118 121

Federal and state benefit on uncertain tax positions 79 57

Unrealized loss on available-for-sale securities and derivative financial instruments 29 —

Gross deferred tax assets 1,626 1,501

Valuation allowance (397) (313)

Total deferred tax assets 1,229 1,188

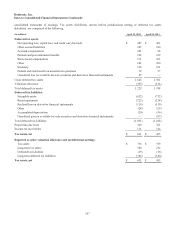

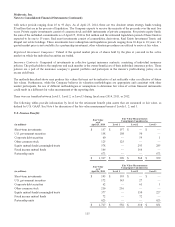

Deferred tax liabilities:

Intangible assets (652) (712)

Basis impairment (225) (214)

Realized loss on derivative financial instruments (110) (110)

Other (24) (29)

Accumulated depreciation (20) (56)

Unrealized gain on available-for-sale securities and derivative financial instruments — (87)

Total deferred tax liabilities (1,031) (1,208)

Prepaid income taxes 320 321

Income tax receivables 113 114

Tax assets, net $ 631 $ 415

Reported as (after valuation allowance and jurisdictional netting):

Tax assets $ 736 $ 539

Long-term tax assets 300 232

Deferred tax liabilities (19) (16)

Long-term deferred tax liabilities (386) (340)

Tax assets, net $ 631 $ 415

107