Medtronic 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Medtronic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Medtronic, Inc.

Notes to Consolidated Financial Statements (Continued)

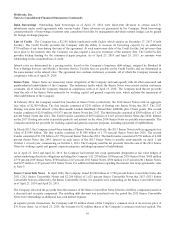

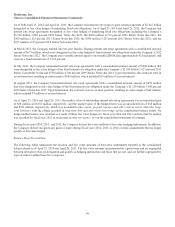

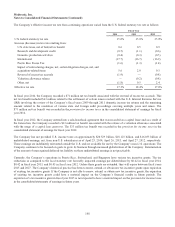

Global concentrations of credit risk with respect to trade accounts receivable are limited due to the large number of customers

and their dispersion across many geographic areas. The Company monitors the creditworthiness of its customers to which it

grants credit terms in the normal course of business. However, a significant amount of trade receivables are with hospitals that

are dependent upon governmental health care systems in many countries. The current economic conditions in many countries

outside the U.S. (particularly the economic challenges faced by Italy, Spain, Portugal, and Greece), may continue to increase the

average length of time it takes the Company to collect on its outstanding trade receivables in these countries as certain payment

patterns have been impacted. As of April 25, 2014 and April 26, 2013, the Company’s aggregate accounts receivable balance for

Italy, Spain, Portugal, and Greece, net of the allowance for doubtful accounts, was $628 million and $770 million, respectively.

The Company continues to monitor the creditworthiness of customers located in these and other geographic areas. In the past,

accounts receivable balances with certain customers in these countries have accumulated over time and were subsequently

settled as large lump-sum payments. In the fourth quarter of fiscal year 2014, the Company received a $106 million payment in

Spain. In the first quarter of fiscal year 2013, the Company received a $212 million payment in Spain. Although the Company

does not currently foresee a significant credit risk associated with the outstanding accounts receivable, repayment is dependent

upon the financial stability of the economies of these countries. For certain Greece distributors, collectability is not reasonably

assured for revenue transactions and the Company defers revenue recognition until all revenue recognition criteria are met. As

of April 25, 2014 and April 26, 2013, the Company’s deferred revenue balance for certain Greece distributors was $15 million

and $21 million, respectively. As of April 25, 2014 and April 26, 2013, no one customer represented more than 10% of the

Company’s outstanding accounts receivable.

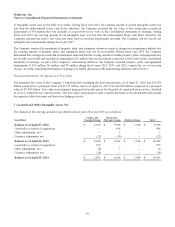

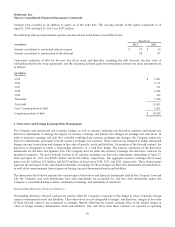

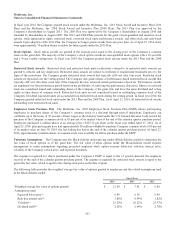

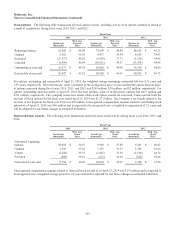

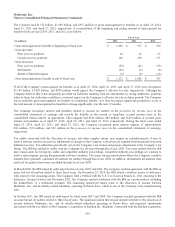

10. Interest Expense, Net

Interest income and interest expense for fiscal years 2014, 2013, and 2012 are as follows:

Fiscal Year

(in millions) 2014 2013 2012

Interest income $ (271) $ (237) $ (200)

Interest expense 379 388 349

Interest expense, net $ 108 $ 151 $ 149

Interest income includes interest earned on the Company’s cash, cash equivalents and investments, the net realized and

unrealized gain or loss on trading securities, ineffectiveness on interest rate derivative instruments, and the net realized gain or

loss on the sale or impairment of available-for-sale debt securities. See Note 5 for further discussion of these items.

Interest expense includes the expense associated with the interest on the Company’s outstanding borrowings, including short-

and long-term instruments, ineffectiveness on interest rate derivative instruments, amortization of terminated interest rate swap

agreements, and the amortization of debt issuance costs and debt discounts.

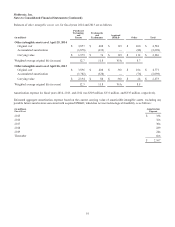

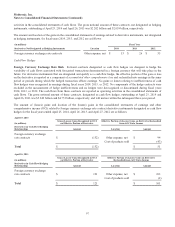

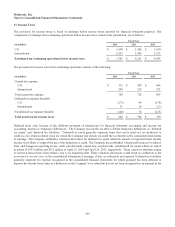

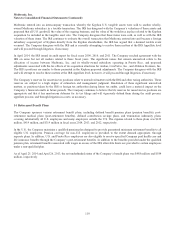

11. Shareholders’ Equity

Shares are repurchased from time to time to support the Company’s stock-based compensation programs and to return capital to

shareholders. In June 2013 and June 2011, the Company’s Board of Directors authorized the repurchase of 80 million and

75 million shares of the Company’s common stock, respectively. During fiscal years 2014 and 2013, the Company repurchased

approximately 47.8 million and 31.2 million shares at an average price of $53.37 and $39.97, respectively. As of April 25, 2014,

the Company had used the entire amount authorized under the June 2011 repurchase program and 20.6 million of the 80 million

shares authorized under the June 2013 repurchase program, leaving 59.4 million shares available for future repurchases. The

Company accounts for repurchases of common stock using the par value method and shares repurchased are canceled.

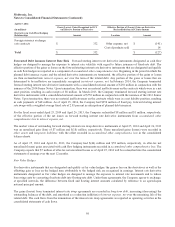

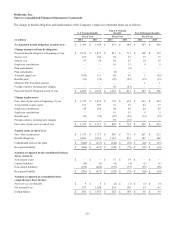

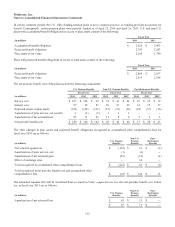

12. Stock Purchase and Award Plans

The Company measures stock-based compensation expense at the grant date based on the fair value of the award and recognizes

the compensation expense over the requisite service period, which is generally the vesting period.

102