Kodak 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

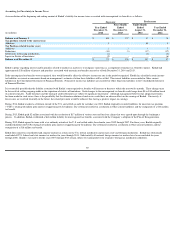

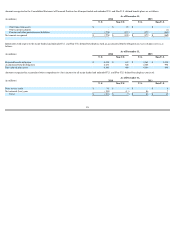

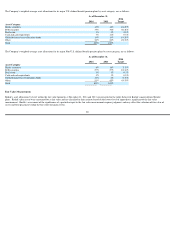

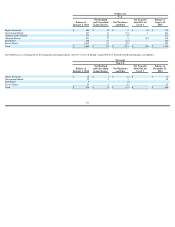

The Company's weighted-average asset allocations for its major U.S. defined benefit pension plans by asset category, are as follows:

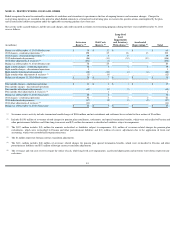

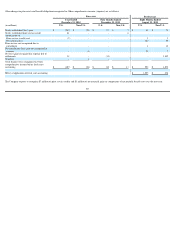

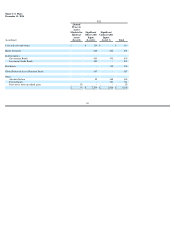

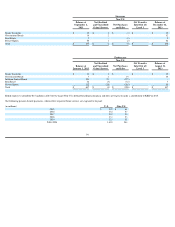

The Company's weighted-average asset allocations for its major Non-U.S. defined benefit pension plans by asset category, are as follows:

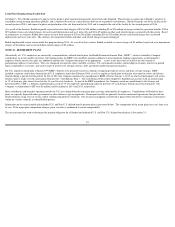

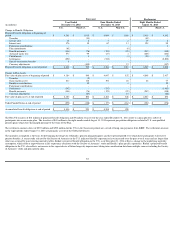

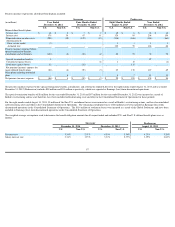

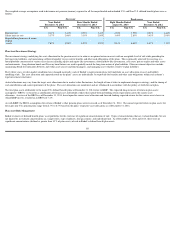

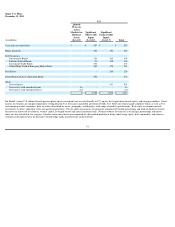

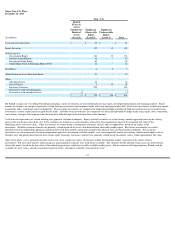

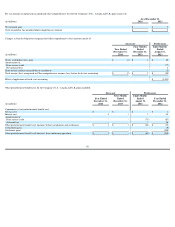

Fair Value Measurements

Kodak’s asset allocations by level within the fair value hierarchy at December 31, 2014 and 2013 are presented in the tables below for Kodak’s major defined benefit

plans. Kodak’s plan assets were accounted for at fair value and are classified in their entirety based on the lowest level of input that is significant to the fair value

measurement. Kodak’s assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair value of

assets and their placement within the fair value hierarchy levels.

As of December 31,

2014

2013

2014

Target

Asset Category

Equity securities

15

%

16

%

10

-

20

%

Debt securities

35

%

30

%

30

-

40

%

Real estate

3

%

5

%

2

-

8

%

Cash and cash equivalents

3

%

14

%

0

-

6

%

Global balanced asset allocation funds

14

%

13

%

10

-

20

%

Other

30

%

22

%

25

-

35

%

Total

100

%

100

%

As of December 31,

2014

2013

2014

Target

Asset Category

Equity securities

6

%

18

%

2

-

12

%

Debt securities

27

%

27

%

22

-

32

%

Real estate

1

%

1

%

0

-

3

%

Cash and cash equivalents

4

%

3

%

0

-

8

%

Global balanced asset allocation funds

11

%

6

%

5

-

15

%

Other

51

%

45

%

45-

55

%

Total

100

%

100

%

89