Kodak 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

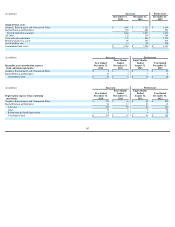

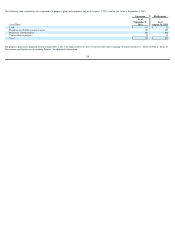

The following table reconciles the enterprise value to the estimated fair value of Successor common stock as of the Effective Date:

The fair value of debt and capitalized lease obligations represents $44 million of short term borrowings, $14 million of capitalized lease obligations and $676 million of long-

term debt. The fair value of long-term debt was determined based on a market approach utilizing market yields and was estimated to be approximately 97% of par value. The

fair value of capitalized lease obligations was determined based on market rents while the fair value of short term debt approximated its carrying value.

The fair value of pension and other post retirement obligations was determined based on a discounted cash flow method of expected cash contributions/benefit payments for

the period of September 1, 2013 to December 31, 2099. The expected cash contributions were discounted to present value using a discount rate of 3.5%.

The fair value of the warrants was estimated using a Black-Scholes pricing model with the following assumptions: implied stock price of $14.11; strike price of $14.93 for

125% warrants and $16.12 for 135% warrants; expected volatility of 47% for 125% warrants and 48% for 135% warrants; expected dividend rate of 0.0%; risk free interest

rate of 1.67%; expiration date of five years.

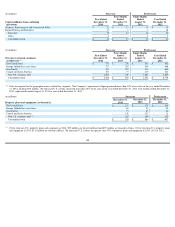

The following table reconciles the enterprise value to the estimated reorganization value as of the Effective Date:

The fair value of non-debt liabilities represents total liabilities of the Successor Company on the Effective Date less Short term borrowings and current portion of long-term

debt, Long-term debt, net of current portion, $14 million in capital lease obligations and $18 million in other non-operating liabilities.

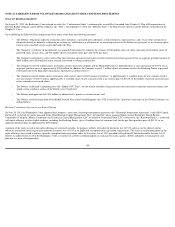

Consolidated Statement of Financial Position

The adjustments set forth in the following consolidated Statement of Financial Position reflect the effect of the consummation of the transactions contemplated by the Plan

(reflected in the column “Reorganization Adjustments”) as well as fair value adjustments as a result of the adoption of fresh start accounting (reflected in the column “Fresh

Start Adjustments”). The explanatory notes highlight methods used to determine fair values or other amounts of the assets and liabilities as well as significant assumptions or

inputs.

(in millions, except share and per share value)

Enterprise value

$

1,000

Plus: Cash and cash equivalents

898

Less: Other non

-

operating liabilities

18

Less: Fair value of debt and capitalized lease obligations

734

Less: Fair value of pension and other postretirement obligations

533

Less: Fair value of warrants

24

Fair value of Successor common stock

$

589

Shares outstanding at September 3, 2013

41,753,211

Per share value

$

14.11

(in millions)

Enterprise value

$

1,000

Plus: Cash and cash equivalents

898

Plus: Fair value of noncontrolling interests

10

Plus: Fair value of non

-

debt liabilities

2,088

Less: Fair value of pension and other postretirement obligations

533

Reorganization value of Successor assets

$

3,463

113