Kodak 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

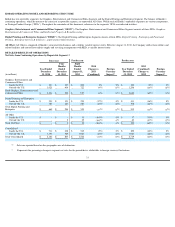

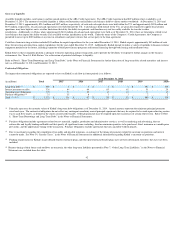

Gross Profit

Current Year

The increase in the Digital Printing and Enterprise Segment gross profit percent for the year ended December 31, 2014 was primarily due to improvements in manufacturing

and other costs due to the prior year being adversely impacted by the revaluation of inventory from the application of fresh start accounting (+4pp). This was offset by

consumer ink sales constituting a lower percentage of the segment’s gross profit dollars (-4pp).

Prior Year

The increase in the Digital Printing and Enterprise Segment gross profit percent for year ended December 31, 2013 was primarily due to favorable price/mix within

Consumer Inkjet Systems due to a greater proportion of consumer ink sales in the current year (+10pp). Increased manufacturing and other costs due to the revaluation

of inventory from the application of fresh start accounting (-5pp) was largely offset by cost reductions within Digital Printing (+3pp) due to increase in scale and

productivity improvement initiatives.

Selling, General and Administrative Expenses

The decreases in SG&A from 2013 to 2014 and 2012 to 2013 were the result of cost reduction actions. For 2012 to 2013 this included the change in strategy for Consumer

Inkjet Systems

.

Research and Development Costs

The decrease in R&D from 2012 to 2013 was primarily attributable to cost reduction actions resulting from focusing development activities on core products and certain

products reaching the commercialization stage.

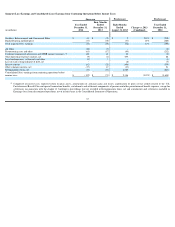

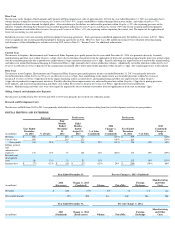

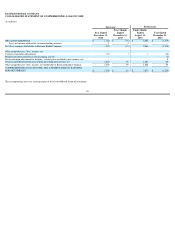

RESTRUCTURING COSTS AND OTHER

2014

Restructuring actions taken in 2014 included steps toward exiting a plate manufacturing facility in the UK, as described in further detail below. In addition, actions were

initiated to reduce Kodak’s cost structure as part of its commitment to drive sustainable profitability and included a workforce reduction in France, manufacturing capacity

reductions in the U.S., a research and development site consolidation in the U.S., and various targeted reductions in service, sales, research and development and other

administrative functions.

As a result of these actions, for the year ended December 31, 2014 Kodak recorded $61 million of charges, including $2 million for accelerated depreciation which were

reported in Cost of revenues and $59 million which were reported as Restructuring costs and other in the accompanying Consolidated Statement of Operations.

The Company made cash payments related to restructuring of approximately $52 million for the year ended December 31, 2014.

The restructuring actions implemented in 2014 are expected to generate future annual cash savings of approximately $77 million. These savings are expected to reduce future

annual Cost of revenues, SG&A and R&D expenses by $29 million, $38 million and $10 million, respectively. Kodak expects the majority of the annual savings to be in effect

by the end of 2015 as actions are completed.

Leeds Plate Manufacturing Facility Exit

On March 3, 2014, Kodak announced a plan to exit its prepress plate manufacturing facility located in Leeds, England. This decision was pursuant to Kodak’s initiative to

consolidate manufacturing operations globally, and is expected to result in a more efficient delivery of its products and solutions. Kodak began the exit of the facility in the

second quarter of 2014, and expects to phase out production at the site from mid-to-late 2015 and to complete the exit of the facility by the second quarter of 2016.

As a result of the decision, Kodak originally expected to incur total charges of $30 to $40 million, including $8 to $10 million of charges related to separation benefits, $20 to

$25 million of non-cash related charges for accelerated depreciation and asset write-offs and $2 to $5 million in other cash related charges associated with this action. Based

on refinements in estimates, Kodak now expects to incur total charges of $20 to $30 million, including $10 to $15 million of non-cash related charges for accelerated

depreciation and asset write-offs. The estimates for separation benefits and other cash related charges remain unchanged.

Kodak implemented certain actions under this program during 2014. As a result of these actions, Kodak recorded severance charges of $3 million, long-

lived asset impairment

charges of $2 million, and accelerated depreciation charges of $2 million.

2013

For the four months ended December 31, 2013, Kodak recorded $17 million of charges reported as Restructuring costs and other in the accompanying Consolidated Statement

of Operations. For the eight months ended August 31, 2013, Kodak recorded $52 million of charges, including $4 million for accelerated depreciation and $2 million for

inventory write-downs which were reported in Cost of revenues, $43 million reported as Restructuring costs and other and $3 million which were reported as Earnings (loss)

from discontinued operations in the accompanying Consolidated Statement of Operations.

2012

For the year ended December 31, 2012, Kodak recorded $271 million of charges, including $13 million of charges for accelerated depreciation and $4 million of charges

for inventory write-downs, which were reported in Cost of revenues, $39 million that was reported as Earnings (loss) from discontinued operations and $215 million of

charges that were reported as Restructuring costs and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2012.

40