Kodak 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

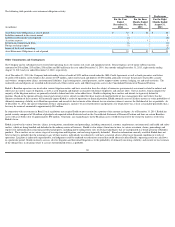

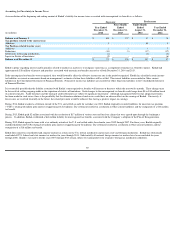

In the event of a default under the Company’s Term Credit Agreements, the ABL Credit Agreement, or a default under any derivative contract or similar obligation of

Kodak, subject to certain minimum thresholds, the derivative counterparties would have the right, although not the obligation, to require immediate settlement of some or

all open derivative contracts at their then-current fair value, but with liability positions netted against asset positions with the same counterparty. At December 31, 2014,

Kodak had open derivative contracts in liability positions with a total fair value of $1 million.

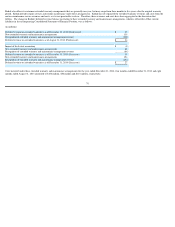

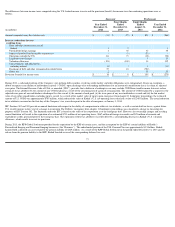

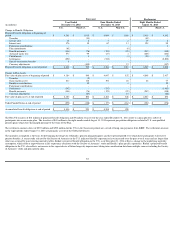

The location and amounts of gains and losses related to derivatives reported in the Consolidated Statement of Operations are shown in the following tables:

Foreign Currency Forward Contracts

Kodak’s foreign currency forward contracts used to mitigate currency risk related to existing foreign currency denominated assets and liabilities are not designated as

hedges, and are marked to market through net (loss) earnings at the same time that the exposed assets and liabilities are re-measured through net (loss) earnings (both in

Other (charges) income, net in the Consolidated Statement of Operations). The notional amount of such contracts open at December 31, 2014 and 2013 was

approximately $334 million and $536 million, respectively. The majority of the contracts of this type held by Kodak are denominated in euros.

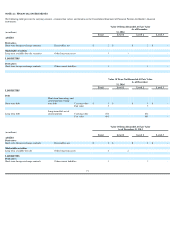

Derivatives Not Designated as Hedging Instruments, Foreign Exchange Contracts

Location of Gain or (Loss) Recognized in Income on Derivatives

Gain (Loss) Recognized in Income on Derivative

Successor

Predecessor

(in millions)

For the Year

Ended

December 31,

2014

For the Four

Months Ended

December 31,

2013

For the Eight

Months Ended

August 31,

2013

For the Year

Ended

December 31,

2012

Other (charges) income, net

$

10

$

(14

)

$

2

$

-

74