Kodak 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

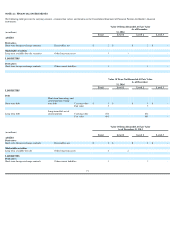

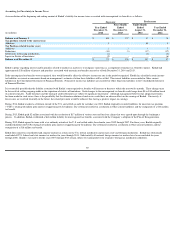

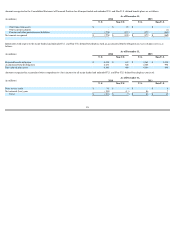

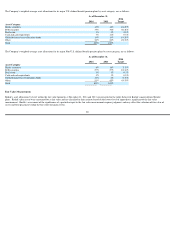

NOTE 15: RESTRUCTURING COSTS AND OTHER

Kodak recognizes the need to continually rationalize its workforce and streamline its operations in the face of ongoing business and economic changes. Charges for

restructuring initiatives are recorded in the period in which Kodak commits to a formalized restructuring plan, or executes the specific actions contemplated by the plan

and all criteria for liability recognition under the applicable accounting guidance have been met.

The activity in the accrued balances and the non-cash charges and credits incurred in relation to restructuring programs during the three years ended December 31, 2014

were as follows:

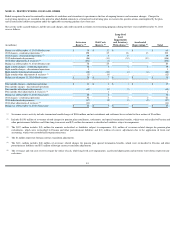

(in millions)

Severance

Reserve

(6)

Exit Costs

Reserve

(6)

Long

-

lived

Asset

Impairments

and Inventory

Write-downs

(6)

Accelerated

Depreciation

(6)

Total

Balance as of December 31, 2011 (Predecessor):

$

38

$

22

$

-

$

-

$

60

2012 charges

-

continuing operations

(1)

158

35

26

13

232

2012 charges

-

discontinued operations

(1)

29

2

8

-

39

2012 utilization/cash payments

(86

)

(13

)

(34

)

(13

)

(146

)

2012 other adjustments & reclasses

(2)

(101

)

(1

)

-

-

(102

)

Balance as of December 31, 2012 (Predecessor):

38

45

-

-

83

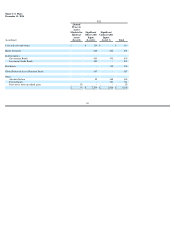

Eight months charges

-

continuing operations

38

3

4

4

49

Eight months charges

-

discontinued operations

3

-

-

-

3

Eight months utilization/cash payments

(48

)

(32

)

(4

)

(4

)

(88

)

Eight months other adjustments & reclasses

(3)

(3

)

(9

)

-

-

(12

)

Balance as of August 31, 2013 (Predecessor):

$

28

$

7

$

-

$

-

$

35

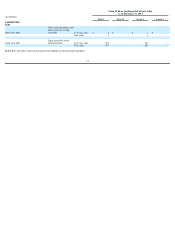

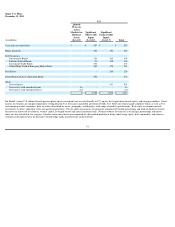

Four months charges

-

continuing operations

$

13

$

3

$

1

$

-

$

17

Four months charges

-

discontinued operations

-

-

-

-

-

Four months utilization/cash payments

(15

)

(3

)

(1

)

-

(19

)

Four months other adjustments & reclasses

(4)

-

1

-

-

1

Balance as of December 31, 2013 (Successor):

26

8

-

-

34

2014 charges

-

continuing operations

54

2

3

2

61

2014 utilization/cash payments

(47

)

(5

)

(3

)

(2

)

(57

)

2014 other adjustments & reclasses

(5)

(11

)

-

-

-

(11

)

Balance as of December 31, 2014 (Successor):

$

22

$

5

$

-

$

-

$

27

(1)

Severance reserve activity includes termination benefit charges of $186 million, and net curtailment and settlement losses related to these actions of $1 million.

(2)

Includes $(100) million of severance related charges for pension plan curtailments, settlements, and special termination benefits, which were reclassified to Pension and

other postretirement liabilities and Other long

-

term assets and $(2) million for amounts reclassified as Liabilities subject to compromise.

(3)

The $(12) million includes $(5) million for amounts reclassified as Liabilities subject to compromise, $(4) million of severance-

related charges for pension plan

curtailments, which were reclassified to Pension and other postretirement liabilities and $(3) million of reserve adjustments due to the application of fresh start

accounting, which were recorded in Reorganization items.

(4)

The $1 million represents foreign currency translation adjustments.

(5)

The $(11) million includes $(8) million of severance related charges for pension plan special termination benefits, which were reclassified to Pension and other

postretirement liabilities and $(3) million of foreign currency translation adjustments.

(6)

The severance and exit costs reserves require the outlay of cash, while long-lived asset impairments, accelerated depreciation and inventory write-downs represent non-

cash items.

81