Kodak 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

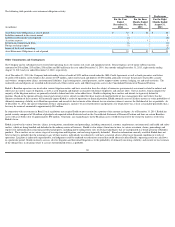

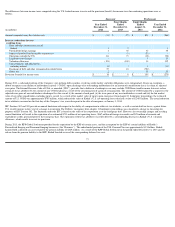

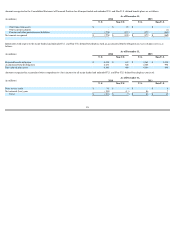

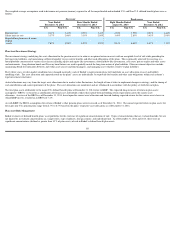

During the eight months ended August 31, 2013, Kodak determined that it was more likely than not that a portion of its deferred tax assets outside the U.S. would not be

realized due to changes in the business resulting from the KPP Global Settlement and the related sale of the Business. As a result, Kodak recorded a tax provision of $100

million associated with the establishment of a valuation allowance on those deferred tax assets.

Additionally, during the eight months ended August 31, 2013, Kodak determined that it was more likely than not that a portion of the deferred tax assets outside the U.S.

would not be realized due to the change in Kodak’s business as a result of restructuring associated with the emergence from bankruptcy and accordingly, recorded a provision

of $46 million associated with the establishment of a valuation allowance on those deferred tax assets.

During 2012, Kodak determined that it was more likely than not that a portion of the deferred tax assets outside the U.S. would not be realized due to reduced manufacturing

volumes negatively impacting profitability in a location outside the U.S. and accordingly, recorded a provision of $30 million, associated with the establishment of a valuation

allowance on those deferred tax assets.

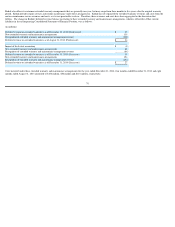

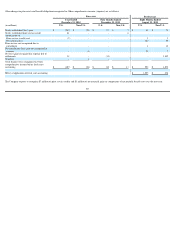

In March 2011, Kodak filed a Request for Competent Authority Assistance with the United States Internal Revenue Service (“IRS”). The request related to a potential double

taxation issue with respect to certain patent licensing royalty payments received by Kodak in 2012 and 2011. In the twelve months ended December 31, 2012, Kodak received

notification that the IRS had reached agreement with the Korean National Tax Service (“NTS”) with regards to Kodak’s March 2011 request. As a result of the agreement

reached by the IRS and NTS, Kodak was due a partial refund of Korean withholding taxes in the amount of $123 million. Kodak had previously agreed with the licensees that

made the royalty payments that any refunds of the related Korean withholding taxes would be shared equally between Kodak and the licensees. The licensees’ share ($61

million) of the Korean withholding tax refund has therefore been reported as a licensing revenue reduction in Sales in the Consolidated Statement of Operations.

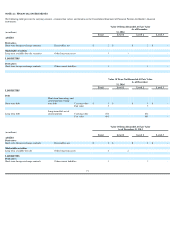

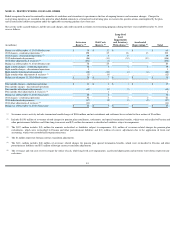

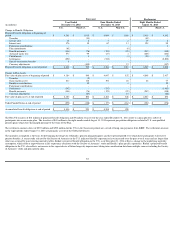

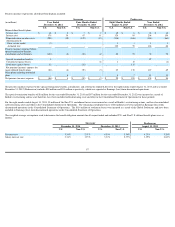

As of December 31,

(in millions)

2014

2013

Deferred tax assets

Pension and postretirement

obligations

$

221

$

219

Restructuring programs

5

6

Foreign tax credit

258

101

Inventories

20

18

Investment tax credit

100

125

Employee deferred compensation

43

60

Depreciation

45

-

Research and development costs

232

276

Tax loss carryforwards

355

372

Other deferred revenue

13

13

Other

111

168

Total deferred tax assets

$

1,403

$

1,358

Deferred tax liabilities

Depreciation

$

-

$

17

Leasing

7

23

Goodwill/Intangibles

51

49

Unremitted foreign earnings

176

236

Other

-

25

Total deferred tax liabilities

234

350

Net deferred tax assets before valuation

allowance

1,169

1,008

Valuation allowance

1,127

953

Net deferred tax assets

$

42

$

55

78