Kodak 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

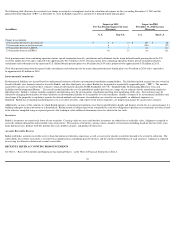

GRAPHICS, ENTERTAINMENT AND COMMERCIAL FILMS

Revenues

Current Year

The decrease in the Graphics, Entertainment and Commercial Films Segment revenues of approximately 5% for the year ended December 31, 2014 reflected volume declines

within Entertainment Imaging & Commercial Films driven by reduced demand for motion picture products (-9%) which was partially offset by increased revenues from third

party manufacturing services performed under supply agreements with Kodak Alaris (+3%). Higher revenues within Intellectual Property and Brand Licensing (+2%) were

partially offset by unfavorable price/mix within Graphics (-2%), largely attributable to pricing pressures in the industry.

Included in revenues were non-recurring intellectual property licensing agreements. Such agreements contributed approximately $70 million to revenues in 2014 and $40

million in 2013.

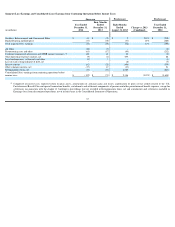

Successor

Predecessor

Predecessor

(in millions)

Year Ended

December

31, 2014

% of Sales

Four

Months

Ended

December

31,

2013

Eight

Months

Ended

August 31,

2013

% of Sales

(Combined)

2014

Change vs.

2013

(Combined)

Year Ended

December

31, 2012

% of Sales

2013

(Combined)

Change vs.

2012

Net sales

$

1,434

$

521

$

987

(5

%)

$

1,680

(10

%)

Cost of sales

1,192

472

805

(7

%)

1,509

(15

%)

Gross profit

242

17

%

49

182

15

%

5

%

171

10

%

35

%

Selling, general

and

administrative

expenses

190

13

%

77

164

16

%

(21

%)

341

20

%

(29

%)

Research and

development

costs

21

1

%

7

13

1

%

5

%

40

2

%

(50

%)

Segment

earnings (loss)

$

31

2

%

$

(35

)

$

5

(2

%)

203

%

$

(210

)

(13

%)

(86

%)

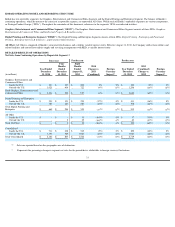

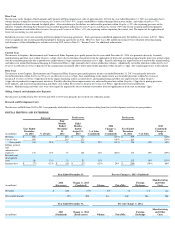

Year Ended December 31,

Percent Change vs. 2013 (Combined)

(in millions)

2014

(Successor)

Change vs. 2013

(Combined)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

1,434

-

5

%

-

5

%

1

%

-

1

%

n/a

Gross profit margin

17

%

2pp

n/a

0pp

0pp

2pp

Year Ended December 31,

Percent Change vs. 2012

(in millions)

2013

(Combined)

Change vs. 2012

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

1,508

-

10

%

-

16

%

7

%

-

1

%

n/a

Gross profit margin

15

%

5pp

n/a

6pp

-

1pp

0pp

38