Kodak 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

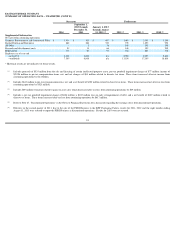

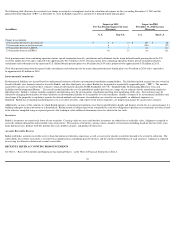

Valuation and Useful Lives of Long-Lived Assets, Including Goodwill and Intangible Assets

Kodak performs a test for goodwill impairment annually on October 1 and whenever events or changes in circumstances occur that would more likely than not reduce the fair

value of the reporting unit below its carrying amount.

Kodak tests goodwill for impairment at a level of reporting referred to as a reporting unit. A reporting unit is an operating segment or one level below an operating segment

(referred to as a component). A component of an operating segment is a reporting unit if the component constitutes a business for which discrete financial information is

available and segment management regularly reviews the operating results of that component. When two or more components of an operating segment have similar economic

characteristics, the components are aggregated and deemed a single reporting unit. An operating segment is deemed to be a reporting unit if all of its components are similar,

if none of its components is a reporting unit, or if the segment comprises only a single component.

As of October 1, 2014, the Graphics, Entertainment and Commercial Films Segment had three goodwill reporting units: Graphics, Entertainment Imaging and Commercial

Films, and Intellectual Property and Brand Licensing. The Digital Printing and Enterprise Segment had four goodwill reporting units: Digital Printing, Packaging and

Functional Printing, Enterprise Services and Solutions, and Consumer Inkjet Systems.

As part of fresh start accounting, Kodak adjusted the carrying value of goodwill to $96 million which represents the reorganizational value of assets in excess of amounts

allocated to identified tangible and intangible assets. Goodwill that was recorded as part of fresh start accounting was allocated to the Graphics, Packaging and Functional

Printing, Intellectual Property and Brand Licensing and Consumer Inkjet Systems reporting units.

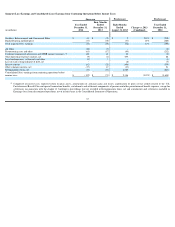

Goodwill is impaired if the fair value of a reporting unit is less than the related carrying value. Kodak may assess qualitative factors for some or all of its reporting units to

determine whether it is more likely than not (that is, a likelihood of more than 50 %) that the fair value of a reporting unit is less than its carrying amount, including

goodwill. If Kodak determines that it is more likely than not that a reporting unit’s fair value is less than its carrying amount, or if Kodak elects to bypass the qualitative

assessment for any of its reporting units, then the fair value of that reporting unit is compared to its carrying value.

If the fair value of a reporting unit is less than its carrying value, Kodak must determine the implied fair value of the goodwill associated with that reporting unit. The implied

fair value of goodwill is determined by first allocating the fair value of the reporting unit to all of its assets and liabilities and then computing the excess of the reporting unit’s

fair value over the amounts assigned to the assets and liabilities. If the carrying value of goodwill exceeds the implied fair value of goodwill, such excess represents the

amount of goodwill impairment charge that must be recognized.

Determining the fair value of a reporting unit involves the use of significant estimates and assumptions. The fair value of a reporting unit refers to the price that would be

received to sell the unit as a whole in an orderly transaction between market participants at the measurement date. Quoted market prices in active markets are the best

evidence of fair value, however the market price of an individual equity security may not be representative of the fair value of the reporting unit as a whole and, therefore need

not be the sole measurement basis of the fair value of a reporting unit.

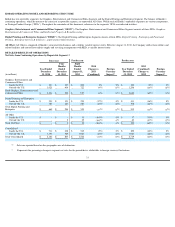

Kodak estimates the fair value of its reporting units using the guideline public company method and discounted cash flow method. To estimate fair value utilizing the

guideline public company method, Kodak applies valuation multiples, derived from the operating data of publicly-traded benchmark companies, to the same operating data of

the reporting units. The valuation multiples are based on financial measures of revenue and earnings before interest, taxes, depreciation and amortization (“EBITDA”). To

estimate fair value utilizing the discounted cash flow method, Kodak establishes an estimate of future cash flows for each reporting unit and discounts those estimated future

cash flows to present value.

Kodak estimated the fair value of each of its reporting units for its 2014 annual goodwill impairment test. Except for the Graphics reporting unit, Kodak did not use the

guideline public company method because reporting unit EBITDA results were negative, which would have only allowed the application of a revenue multiple in determining

fair value under the guideline public company method, and/or reporting units ranked below all the selected market participants for these financial measures. When using the

guideline public company method, multiples should be derived from companies that exhibit a high degree of comparability to the business being valued. Kodak ultimately

gave 100% weighting to the discounted cash flow method for these reporting units. For the Graphics reporting unit, Kodak selected equal weighting of the guideline public

company method and the discounted cash flow method as the valuation approaches produced comparable ranges of fair value.

To estimate fair value utilizing the discounted cash flow method, Kodak established an estimate of future cash flows for the period ranging from October 1, 2014 to December

31, 2023 and discounted the estimated future cash flows to present value. The expected cash flows were derived from earnings forecasts and assumptions regarding growth and

margin projections, as applicable. The discount rates are estimated based on an after-tax weighted average cost of capital (“WACC”) for each reporting unit reflecting the rate

of return that would be expected by a market participant. The WACC also takes into consideration a company specific risk premium for each reporting unit reflecting the risk

associated with the overall uncertainty of the financial projections. Discount rates of 20% to 32% were utilized in the valuation based on Kodak’s best estimates of the after-

tax weighted-average cost of capital of each reporting unit.

27