Kodak 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

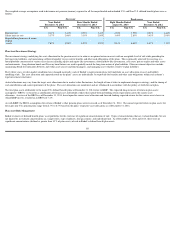

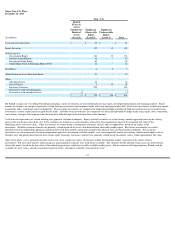

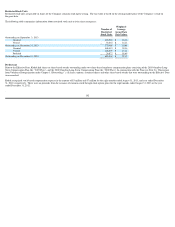

Pre-tax amounts recognized in accumulated other comprehensive loss for the Company's U.S., Canada and U.K. plans consist of:

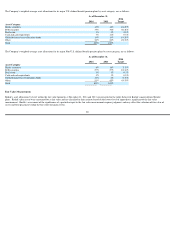

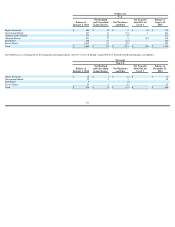

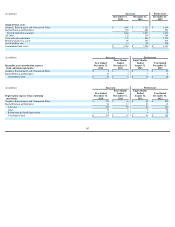

Changes in benefit obligations recognized in Other comprehensive (loss) income consist of:

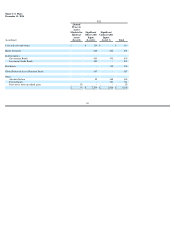

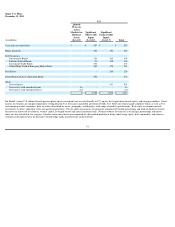

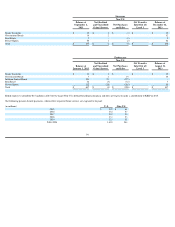

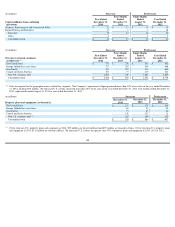

Other postretirement benefit cost for the Company's U.S., Canada and U.K. plans included:

As of December 31,

(in millions)

2014

2013

Net actuarial gain

$

-

$

2

Total recorded in Accumulated other comprehensive income

$

-

$

2

Successor

Predecessor

(in millions)

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Newly established (loss) gain

$

(2

)

$

2

$

49

Amortization of:

Prior service credit

-

-

(77

)

Net actuarial loss

-

-

4

Prior service credit recognized due to curtailment

-

-

(5

)

Total income (loss) recognized in Other comprehensive income (loss) before fresh start accounting

$

(2

)

$

2

$

(29

)

Effect of application of fresh start accounting

$

(1,031

)

Successor

Predecessor

(in millions)

Year Ended

December 31,

2014

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Year Ended

December 31,

2012

Components of net postretirement benefit cost:

Service cost

$

-

$

-

$

-

$

1

Interest cost

4

1

3

44

Amortization of:

Prior service credit

-

-

(75

)

(83

)

Actuarial loss

-

-

3

26

Other postretirement benefit cost (income) before curtailments and settlements

$

4

$

1

$

(69

)

$

(12

)

Curtailment gains

-

-

-

(9

)

Settlement gains

-

-

-

(228

)

Other postretirement benefit cost (income) from continuing operations

$

4

$

1

$

(69

)

$

(249

)

98