Kodak 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

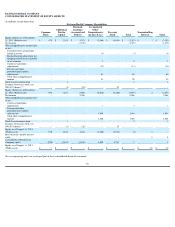

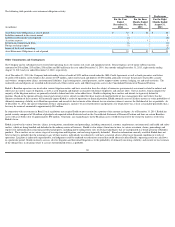

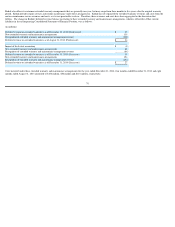

NOTE 2: RECEIVABLES, NET

Approximately $31 million and $39 million of the total trade receivable amounts as of December 31, 2014 and 2013, respectively, will potentially be settled through customer

deductions in lieu of cash payments. Such deductions represent rebates owed to customers and are included in Other current liabilities in the accompanying Consolidated

Statement of Financial Position.

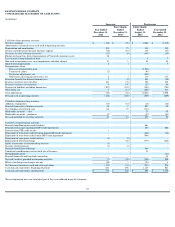

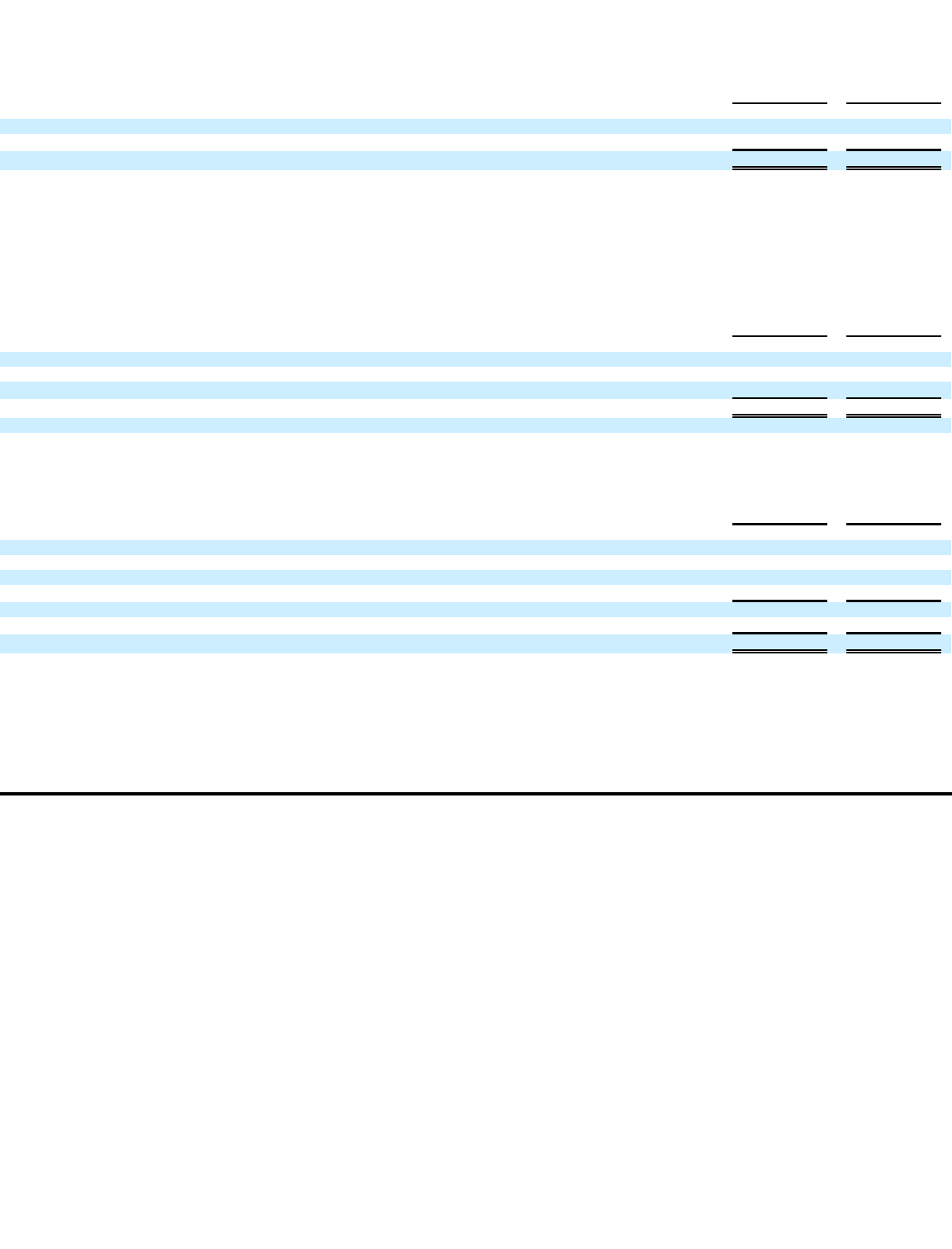

NOTE 3: INVENTORIES, NET

NOTE 4: PROPERTY, PLANT AND EQUIPMENT, NET

Depreciation expense was $174 million, $67 million, $91 million and $182 million for the year ended December 31, 2014, four months ended December 31, 2013, eight

months ended August 31, 2013 and the year ended December 31, 2012, respectively, of which approximately $2 million, $0 million, $4 million and $13 million, respectively,

represented accelerated depreciation in connection with restructuring actions.

(in millions)

As of

December 31,

2014

As of

December 31,

2013

Trade receivables

$

361

$

473

Miscellaneous receivables

53

98

Total (net of allowances of $11 and $6 as of December 31, 2014 and December 31, 2013, respectively)

$

414

$

571

(in millions)

As of

December 31,

2014

As of

December 31,

2013

Finished goods

$

204

$

185

Work in process

73

94

Raw materials

72

79

Total

$

349

$

358

(in millions)

As of

December 31,

2014

As of

December 31,

2013

Land

$

100

$

117

Buildings and building improvements

176

178

Machinery and equipment

432

414

Construction in progress

47

42

755

751

Accumulated depreciation

(231

)

(67

)

Property, plant and equipment, net

$

524

$

684

60