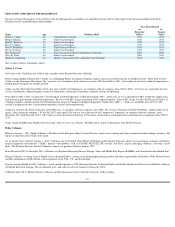

Kodak 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Due to the nature of the products we sell and Kodak

’

s worldwide distribution, we are subject to changes in currency exchange rates, interest rates and commodity costs

that may adversely impact our results of operations and financial position.

As a result of Kodak’s global operating and financing activities, we are exposed to changes in currency exchange rates and interest rates, which may adversely affect our

results of operations and financial position. Exchange rates and interest rates in markets in which we do business tend to be volatile and, at times, our sales can be negatively

impacted across all of the Company’s segments depending upon the value of the U.S. dollar, the Euro and other major currencies. In addition, the Company’s products contain

aluminum, silver, petroleum based or other commodity based raw materials, the prices of which have been, and may continue to be, volatile. If the global economic situation

remains uncertain or worsens, there could be further volatility in changes in currency exchange rates, interest rates and commodity prices, which could have negative effects

on our revenue and earnings.

Weakness or worsening of global economic conditions could adversely affect our financial performance and liquidity.

The global economic environment may adversely affect sales of our products, profitability and liquidity. Global financial markets have been experiencing volatility. Economic

conditions could accelerate any decline in demand for products, which could also place pressure on our results of operations and liquidity. There is no guarantee that

anticipated economic growth levels in markets that have experienced some economic strength will continue in the future, or that we will succeed in expanding sales in these

markets. In addition, accounts receivable and past due accounts could increase due to a decline in our customers’ ability to pay as a result of an economic downturn, and the

Company’s liquidity, including our ability to use credit lines, could be negatively impacted by failures of financial instrument counterparties, including banks and other

financial institutions. If global economic weakness and tightness in the credit markets exist, worsen or are attenuated, the Company’s profitability and related cash generation

capability could be adversely affected and, therefore, affect the Company’s ability to meet the Company’s anticipated cash needs, impair the Company’s liquidity or increase

the Company’s costs of borrowing.

The competitive pressures we face could harm Kodak’s revenue, gross margins and market share.

The markets in which we do business are highly competitive with large, entrenched, and well financed industry participants, many of which are larger than us. In addition, we

encounter aggressive price competition for many of our products and services from numerous companies globally. Any of our competitors may foresee the course of market

developments more accurately than we do; sell superior products and provide superior services or offer a broader variety of products and services; have the ability to produce

or supply similar products and services at a lower cost; have better access to supplies and the ability to acquire supplies at a lower cost; develop stronger relationships with our

suppliers or customers; or adapt more quickly to new technologies or evolving customer requirements than we do or have access to capital markets or other financing sources

on more favorable terms than we can obtain. As a result, we may not be able to compete successfully with our competitors. Finally, we may not be able to maintain our

operating costs or prices at levels that would allow us to compete effectively. Kodak’s results of operations and financial condition may be adversely affected by these and

other industry-wide pricing pressures. If our products, services and pricing are not sufficiently competitive with current and future competitors, we could also lose market

share, adversely affecting our revenue and gross margins.

An inability to provide competitive financing arrangements to Kodak

’

s customers or extension of credit to customers whose creditworthiness deteriorates could adversely

impact our revenue, profitability and financial position.

The competitive environment in which we operate may require us to facilitate or provide financing to our customers in order to win a contract. Customer financing

arrangements may cover all or a portion of the purchase price for the Company’s products and services. We may also assist customers in obtaining financing from banks and

other sources. Our success may be dependent, in part, upon our ability to provide customer financing on competitive terms and on our customers’ creditworthiness. Tightening

of credit in the global financial markets can adversely affect the ability of Kodak’s customers to obtain financing for significant purchases, which may result in a decrease in,

or cancellation of, orders for our products and services. If we are unable to provide competitive financing solutions to our customers or if we extend credit to customers whose

creditworthiness deteriorates, our revenues, profitability and financial position could be adversely impacted.

If the U.K. Kodak Pension Plan Purchasing Parties (

“KPP Purchasing Parties”)

are not able to successfully operate the Personalized Imaging and Document Imaging

Business (the

“PI/DI Business”)

acquired from the Company or meet their commitments under supply, service and transition services and other agreements entered into

with the Company, the Company’s brand, reputation and financial results could suffer.

The Amended and Restated Stock and Asset Purchase Agreement between Eastman Kodak Company, Qualex, Inc., Kodak (Near East), Inc., KPP Trustees Limited, as Trustee

for the Kodak Pension Plan of the United Kingdom, and, solely for the purposes of Section 11.4, KPP Holdco Limited, dated August 30, 2013 (“Amended SAPA”)

and certain

related agreements permit the KPP Purchasing Parties to use the Kodak name and brand in its operations of the PI/DI Business on a going-forward basis. If the KPP

Purchasing Parties are not successful in the operation of the PI/DI Business, the Company’s brand image and reputation as a producer of high quality products could be

harmed, which could affect our financial results or operations. In addition, in connection with the closing under the Amended SAPA, on the Effective Date, the Company

entered into certain supply and transition services agreements with the KPP Purchasing Parties under which the KPP Purchasing Parties are purchasing supplies and services

from the Company. The inability of the KPP Purchasing Parties to make payments as they are due under the supply, service and transition service agreements could negatively

affect our financial results. Further, with respect to a certain jurisdiction for which a deferred closing is expected to occur pursuant to the Amended SAPA in 2015, certain

factors may delay the closing from occurring on the expected date, which could result in costs or operational impacts to Kodak.

11