Kodak 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

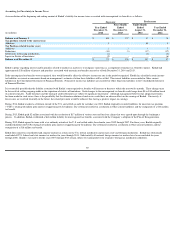

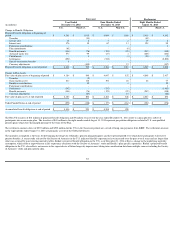

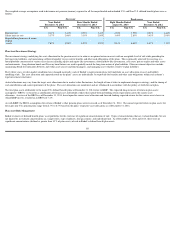

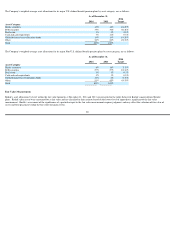

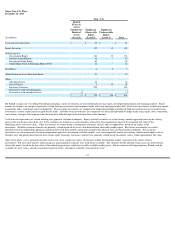

The Non-US transfers of $31 million of projected benefit obligation and $9 million of assets for the year ended December 31, 2014 relate to a plan split for a subset of

participants into a non-major plan. The transfers of $49 million in the eight months ended August 31, 2013 represent pre-petition obligations related to U.S. non-qualified

pension plans which were discharged pursuant to the terms of the Plan.

The settlement amounts above of $292 million and $532 million for the U.S. in the Successor periods are a result of lump sum payments from KRIP. The settlement amounts

in the eight months ended August 31, 2013 are primarily a result of the Global Settlement.

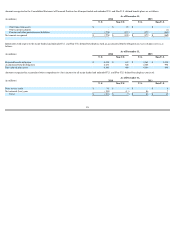

The mortality assumption is the basis for determining the longevity of Kodak’s pension plan participants and the expected period over which those participants will receive

pension benefits. A recent study released by the Society of Actuaries in the U.S. indicated that life expectancies have increased over the past several years and are longer than

what was assumed by most existing mortality tables. Kodak’s projected benefit obligation in the U.S. as of December 31, 2014 reflects a change in the underlying mortality

assumption, which reflects improvements in life expectancy consistent with the Society of Actuaries’ study and Kodak’s plan specific experience. Kodak’s projected benefit

obligation in the U.S. also reflects an increase in the expected rate of future longevity improvement taking into consideration data from multiple sources including the Society

of Actuaries’ study and plan specific data.

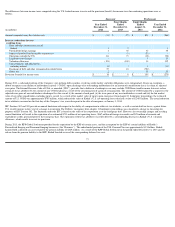

Successor

Predecessor

(in millions)

Year Ended

December 31, 2014

Four Months Ended

December 31, 2013

Eight Months Ended

August 31, 2013

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

Change in Benefit Obligation

Projected benefit obligation at beginning of

period

$

4,361

$

1,010

$

4,969

$

1,008

$

5,415

$

4,192

Transfers

-

(31

)

-

-

(49

)

-

Service cost

18

4

7

2

19

6

Interest cost

176

30

67

11

120

95

Participant contributions

-

-

-

-

-

1

Plan amendments

(61

)

-

-

(6

)

-

-

Benefit payments

(346

)

(76

)

(123

)

(29

)

(247

)

(138

)

Actuarial (gain) loss

574

99

(27

)

4

(269

)

(104

)

Curtailments

-

1

-

(1

)

(20

)

(7

)

Settlements

(292

)

-

(532

)

-

-

(2,890

)

Special termination benefits

8

-

-

-

-

-

Currency adjustments

-

(105

)

-

21

-

(147

)

Projected benefit obligation at end of period

$

4,438

$

932

$

4,361

$

1,010

$

4,969

$

1,008

Change in Plan Assets

Fair value of plan assets at beginning of period

$

4,184

$

848

$

4,647

$

832

$

4,848

$

2,417

Transfers

-

(9

)

-

-

-

-

Gain on plan assets

614

116

192

26

46

77

Employer contributions

-

12

-

4

-

20

Participant contributions

-

-

-

-

-

1

Settlements

(292

)

-

(532

)

-

-

(1,463

)

Benefit payments

(346

)

(76

)

(123

)

(29

)

(247

)

(138

)

Currency adjustments

-

(87

)

-

15

-

(82

)

Fair value of plan assets at end of period

$

4,160

$

804

$

4,184

$

848

$

4,647

$

832

Under Funded Status at end of period

$

(278

)

$

(128

)

$

(177

)

$

(162

)

$

(322

)

$

(176

)

Accumulated benefit obligation at end of period

$

4,436

$

921

$

4,308

$

990

84