Kodak 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

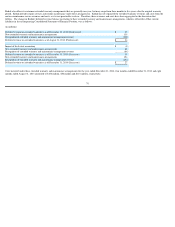

The First Lien Loans bear interest at the rate of LIBOR plus 6.25% per annum, with a LIBOR floor of 1% or Alternate Base Rate (as defined in the First Lien Term Credit

Agreement) plus 5.25%. The Second Lien Loans bear interest at the rate of LIBOR plus 9.5% per annum, with a LIBOR floor of 1.25% or Alternate Base Rate (as defined in

the Second Lien Term Credit Agreement) plus 8.5%. The ABL Loans (other than initial borrowings) bear interest at the rate of LIBOR plus 2.75%-

3.25% per annum or Base

Rate (as defined in the ABL Credit Agreement) plus 1.75%-

2.25% per annum, based on Excess Availability (as defined in the ABL Credit Agreement). Each existing and

future direct or indirect U.S. subsidiary of the Company (other than immaterial subsidiaries, unrestricted subsidiaries and certain other subsidiaries) have agreed to provide

unconditional guarantees of the obligations of the Company under the Credit Agreements. Subject to certain exceptions, obligations under the First Lien Term Credit

Agreement and the Second Lien Term Credit Agreement are secured by: (i) a first lien and a second lien, respectively, on all assets of the Company and the Subsidiary

Guarantors, other than the ABL Collateral (as defined below), including a first and a second lien, respectively, on 100% of the stock of material domestic subsidiaries and 65%

of the stock of material first-tier foreign subsidiaries (the “Term Collateral”)

and (ii) a second lien and a third lien, respectively, on the ABL Collateral (as defined below).

Obligations under the ABL Credit Agreement are secured by: (i) a first lien on cash, accounts receivable, inventory, machinery and equipment (the “ABL Collateral”)

and

(ii) a third lien on the Term Collateral.

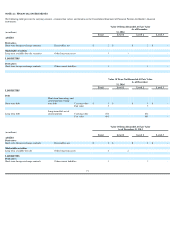

The Company may voluntarily prepay the First Lien Loan subject to a premium payable of 1% of the principal amount being prepaid if the prepayment is made after the first

anniversary of the closing date but prior to the second anniversary of the closing date. The Company may prepay the Second Lien Loan after the first anniversary of the

closing date and prior to the second anniversary date subject to a prepayment premium of 3% of the principal amount prepaid. On and after the second anniversary and prior

to the third anniversary of the closing date a prepayment premium of 1% of the principal amount prepaid is required with respect to the Second Lien Loan.

As defined in each of the Term Credit Agreements, the Company is required to prepay loans with net proceeds from asset sales, recovery events or issuance of indebtedness,

subject to, in the case of net proceeds received from asset sales or recovery events, reinvestment rights by the Company in assets used or usable by the business within certain

time limits. On an annual basis, starting with the fiscal year ending on December 31, 2014, the Company will prepay on June 30 of the following fiscal year loans in an

amount equal to a percentage of Excess Cash Flow (“ECF”) as defined in each of the Term Credit Agreements, provided no such prepayment is required if such prepayment

would cause U.S. liquidity (as defined in each of the Term Credit Agreements) to be less than $100 million. For the year ended December 31, 2014, ECF was a negative

amount, therefore, no prepayment is required in 2015. Any mandatory prepayments as described above shall be reduced by any mandatory prepayments of the First Lien

Loan.

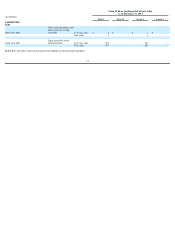

The Credit Agreements limit, among other things, the Company’s and the Subsidiary Guarantors’ ability to (i) incur indebtedness, (ii) incur or create liens, (iii) dispose of

assets, (iv) make restricted payments (including dividend payments, et al.) and (v) make investments. Under the Term Credit Agreements, the Company is required to

maintain minimum U.S. Liquidity (as defined therein) through 2014 and starting December 31, 2014, tested on a quarterly basis, Net Secured Leverage (as defined therein) not

to exceed specified levels. Under the ABL Credit Agreement, if Excess Availability is less than 15% of commitments available, the Company would be required to maintain a

minimum Fixed Charge Coverage Ratio (as defined therein). Kodak was in compliance with all covenants under the Term Credit Agreements and the ABL Credit Agreement

as of December 31, 2014.

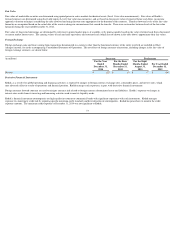

Events of default under the Credit Agreements include, among others, failure to pay any loan, interest or other amount due under the applicable credit agreement, breach of

specific covenants and a change of control of the Company. Upon an event of default, the applicable lenders may declare the outstanding obligations under the applicable

credit agreement to be immediately due and payable and exercise other rights and remedies provided for in such credit agreement.

65