Kodak 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

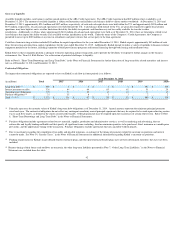

Off-Balance Sheet Arrangements

EKC guarantees obligations to third parties for some of its consolidated subsidiaries. The maximum amount guaranteed is $34 million and the outstanding amount for those

guarantees is $20 million.

Kodak issues indemnifications in certain instances when it sells businesses and real estate, and in the ordinary course of business with its customers, suppliers, service

providers and business partners. Further, the Company indemnifies its directors and officers who are, or were, serving at the Company's request in such

capacities. Historically, costs incurred to settle claims related to these indemnifications have not been material to Kodak’s financial position, results of operations or

cash flows. Additionally, the fair value of the indemnifications that Kodak issued during the year ended December 31, 2014 was not material to Kodak’s financial

position, results of operations or cash flows.

2013

Cash Flow Activity

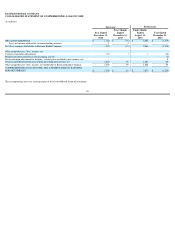

Sources and uses of cash at emergence (including divesture of the Personalized Imaging and Document Imaging businesses) follow:

Operating Activities

Net cash used in operating activities increased $378 million for the year ended December 31, 2013 as compared with the prior year due to emergence related cash outflows and

less cash being provided by working capital changes as compared to the prior year, partially offset by earnings improvement.

Investing Activities

Net cash provided by investing activities increased $708 million for the year ended December 31, 2013 as compared with the prior year, primarily due to the increase in

proceeds from sales of businesses/assets of $746 million. The sale of the digital imaging patent portfolio contributed approximately $530 million and the sale of the

Personalized Imaging and Document Imaging businesses contributed $290 million to investing activities. Partially offsetting these increases was the net funding of restricted

cash and investment accounts of $41 million.

Financing Activities

Net cash used in financing activities increased $874 million for the year ended December 31, 2013 as compared with the prior year due to the net pay

-down of debt in 2013 of

approximately $811 million compared with borrowing under the Original Senior DIP Credit Agreement in 2012. Partially offsetting the increased cash used in financing

activities were the proceeds from the Rights Offering of $406 million and $35 million of contingent cash received related to the sale of the Personalized Imaging and

Document Imaging businesses in 2013.

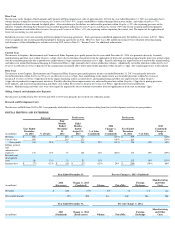

As of December 31,

Successor

Predecessor

(in millions)

2013

2012

Cash and cash equivalents

$

844

$

1,135

Sources:

Net Proceeds from Emergence Credit Facilities

$

664

Proceeds from divestiture

325

Proceeds from Rights Offerings

406

Total sources

$

1,395

Uses:

Repayment of Junior DIP Term Loans

$

844

Repayment of Second Lien Notes

375

Claims paid at emergence

94

Funding of escrow accounts

113

Other fees & expenses

16

Total uses

1,442

Net uses

$

(47

)

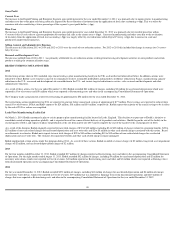

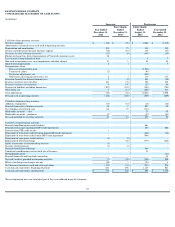

(in millions)

Successor

Predecessor

Predecessor

Four Months

Ended

December 31,

2013

Eight Months

Ended

August 31,

2013

Year Ended

December 31,

2012

Computed

Change vs 2012

(2013

Combined)

Cash flows from operating activities:

Net cash used in operating activities

$

(102

)

$

(565

)

$

(289

)

$

(378

)

Cash flows from investing activities:

Net cash provided by investing activities

81

679

52

708

Cash flows from financing activities:

Net cash (used in) provided by financing activities

(38

)

(328

)

508

(874

)

Effect of exchange rate changes on cash

5

(23

)

3

(21

)

Net (decrease) increase in cash and cash equivalents

$

(54

)

$

(237

)

$

274

$

(565

)

43