Kodak 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A terminal value was included for all reporting units, except for the Consumer Inkjet Systems reporting unit, at the end of the cash flow projection period to reflect the

remaining value that the reporting unit is expected to generate. The terminal value is calculated using the constant growth method (“CGM”) based on the cash flows of the

final year of the discrete period.

Based upon the results of Kodak’s October 1, 2014 analysis, no impairment of goodwill was indicated. Impairment of goodwill could occur in the future if a reporting unit’s

fair value changes significantly, if market or interest rate environments deteriorate, if a reporting unit’s carrying value changes materially compared with changes in its fair

values, or as a result of changes in operating segments or reporting units.

Kodak recorded indefinite-lived intangible assets related to the Kodak trade name and in-process research and development in conjunction with fresh start accounting. The

carrying values of the indefinite-lived intangible assets are evaluated for potential impairment annually on October 1 or whenever events or changes in circumstances indicate

that it is more likely than not that the asset is impaired.

The fair value of the Kodak trade name, which has carrying value of $46 million, was valued using the income approach, specifically the relief from royalty method based on

the following significant assumptions: (a) forecasted revenues ranging from October 1 2014 to December 31, 2023, including a terminal year with growth rates ranging from -

1% to 3%; (b) royalty rates ranging from .5% to 1% of expected net sales determined with regard to comparable market transactions and profitability analysis; and (c) discount

rates ranging from 23% to 41%, which were based on the after-tax weighted-average cost of capital.

Based on the results of Kodak’s October 1, 2014 assessment, no impairment of the Kodak trade name was indicated. Impairment of the Kodak trade name could occur in the

future if expected revenues decline or if there are significant changes in the discount or royalty rates.

The fair value of the in-process research and development intangible asset, with a carrying value of $9 million, was valued using the income approach, specifically the multi-

period excess earnings approach based on the following significant assumptions: (a) forecasted cash flows attributable to the respective research and development project for

the period October 1, 2014 to December 31, 2024; and (b) discount rate of 50% based on the after-tax weighted average cost of capital adjusted for perceived risks inherent in

the overall uncertainty of the financial projections.

Based on the results of Kodak’s October 1, 2014 assessment and due to the change in expected cash flows from the amounts estimated as part of fresh start accounting, Kodak

concluded that the carrying value exceeded its fair value. In the fourth quarter of 2014, Kodak recorded a pre-tax impairment charge of $9 million that is included in Other

operating expense (income), net in the Consolidated Statement of Operations.

Kodak’s long-lived assets other than goodwill and indefinite-lived intangible assets are evaluated for impairment whenever events or changes in circumstances indicate the

carrying value may not be recoverable. When evaluating long-lived assets for impairment, Kodak compares the carrying value of an asset group to its estimated undiscounted

future cash flows. An impairment is indicated if the estimated future cash flows are less than the carrying value of the asset group. The impairment is the excess of the

carrying value over the fair value of the long-lived asset group.

Kodak depreciates the value of property, plant, and equipment over its expected useful life in such a way as to allocate it as equitably as possible to the periods during which

services are obtained from their use, which aims to distribute the value over the remaining estimated useful life of the unit in a systematic and rational manner. An estimate of

useful life not only considers the economic life of the asset, but also the remaining life of the asset to the entity. Impairment of long-lived assets other than goodwill and

indefinite lived intangible assets could occur in the future if expected future cash flows decline or if there are significant changes in the estimated useful life of the assets.

Taxes

Kodak recognizes deferred tax liabilities and assets for the expected future tax consequences of operating losses, credit carry-forwards and temporary differences between the

carrying amounts and tax basis of Kodak’s assets and liabilities. Kodak records a valuation allowance to reduce its net deferred tax assets to the amount that is more likely

than not to be realized. Kodak has considered forecasted earnings, future taxable income, the geographical mix of earnings in the jurisdictions in which Kodak operates and

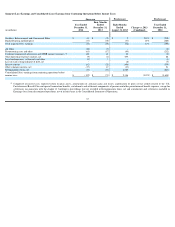

prudent and feasible tax planning strategies in determining the need for these valuation allowances. As of December 31, 2014, Kodak has net deferred tax assets before

valuation allowances of approximately $1,169 million and a valuation allowance related to those net deferred tax assets of approximately $1,127 million, resulting in net

deferred tax assets of approximately $42 million. The net deferred tax assets can be used to offset taxable income in future periods and reduce Kodak’s income tax payable in

those future periods. At this time, it is considered more likely than not that taxable income in the future will be sufficient to allow realization of these net deferred tax

assets. However, if Kodak is unable to generate sufficient taxable income, then a valuation allowance to reduce net deferred tax assets may be required, which could

materially increase expenses in the period the valuation allowance is recognized. Conversely, if Kodak were to make a determination that it is more likely than not that

deferred tax assets, for which there is currently a valuation allowance, would be realized, the related valuation allowance would be reduced and a benefit to earnings would be

recorded. Kodak considers both positive and negative evidence, in determining whether a valuation allowance is needed by territory, including, but not limited to, whether

particular entities are in three year cumulative income positions.

In general, the amount of tax expense or benefit from continuing operations is determined without regard to the tax effects of other categories of income or loss, such as

Other comprehensive (loss) income. However, an exception to this rule applies when there is a loss from continuing operations and income from items outside of

continuing operations that must be considered. This exception requires that income from discontinued operations, extraordinary items, and items charged or credited

directly to other comprehensive income be considered in determining the amount of tax benefit that results from a loss in continuing operations. This exception affects the

allocation of the tax provision amongst categories of income.

The undistributed earnings of Kodak’s foreign subsidiaries are not considered permanently reinvested. Kodak has a deferred tax liability (net of related foreign tax

credits) of $159 million and $213 million on the foreign subsidiaries’ undistributed earnings as of December 31, 2014 and 2013, respectively. Kodak also has a deferred

tax liability of $17 million and $23 million for the potential foreign withholding taxes on the undistributed earnings as of December 31, 2014 and 2013, respectively.

28