Kodak 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Most of Kodak’s equipment has both software and non-software components that function together to deliver the equipment’s essential functionality and therefore they

are accounted for together as non-software deliverables. Non-essential software sold in connection with Kodak’s equipment sales is accounted for as separate

deliverables or elements. In most cases, these software products sold as part of a multiple element arrangement include software maintenance agreements as well as

unspecified upgrades or enhancements on a when-and-if-available basis. In multiple element arrangements where non-essential software deliverables are included,

revenue is allocated to non-software and to software deliverables each as a group based on relative selling prices of each of the deliverables in the arrangement. The

software deliverables are subject to software accounting whereby revenue is allocated based on relative VSOE or based on the residual method when VSOE exists for all

undelivered software elements such as post-contract support. Revenue allocated to the software deliverables is deferred and amortized over the contract period if VSOE

does not exist for post-contract support or at the completion of the contract for non-post-contract support undelivered elements such as specified up-grade

rights. Revenue allocated to software licenses is recognized when all revenue recognition criteria have been met. Revenue generated from maintenance and unspecified

upgrades or updates on a when-and-if-available basis is recognized over the contract period.

RESEARCH AND DEVELOPMENT COSTS

Research and development (“R&D”) costs, which include costs incurred in connection with new product development, fundamental and exploratory research, process

improvement, product use technology and product accreditation, are expensed in the period in which they are incurred. The acquisition-date fair value of R&D assets

acquired in a business combination is capitalized. In connection with fresh start accounting, Kodak capitalized the estimated fair value of certain in-process research and

development projects. Refer to Note 5, “Goodwill and Other Intangible Assets” and Note 25, “Fresh Start Accounting.”

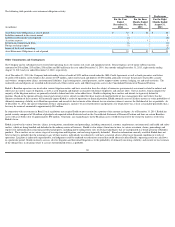

ADVERTISING

Advertising costs are expensed as incurred and are included in Selling, general and administrative expenses in the accompanying Consolidated Statement of

Operations. Advertising expenses amounted to $13 million, $6 million, $14 million and $66 million for the year ended December 31, 2014, four months ended

December 31, 2013, eight months ended August 31, 2013 and year ended December 31, 2012, respectively.

SHIPPING AND HANDLING COSTS

Amounts charged to customers and costs incurred by Kodak related to shipping and handling are included in net sales and cost of sales, respectively.

IMPAIRMENT OF LONG-LIVED ASSETS

Kodak reviews the carrying values of its long-lived assets, other than goodwill and intangible assets with indefinite useful lives, for impairment whenever events or

changes in circumstances indicate that the carrying values may not be recoverable. In connection with fresh start accounting, the carrying values of long-lived assets

were adjusted to estimated fair value as of September 1, 2013 and Kodak revised its estimates of the remaining useful lives of all long-lived assets. Refer to Note 25,

“Fresh Start Accounting.”

Kodak assesses the recoverability of the carrying values of long-lived assets by first grouping its long-lived assets with other assets and liabilities at the lowest level for

which identifiable cash flows are largely independent of the cash flows of other assets and liabilities (the asset group) and, secondly, by estimating the undiscounted

future cash flows that are directly associated with and that are expected to arise from the use of and eventual disposition of such asset group. Kodak estimates the

undiscounted cash flows over the remaining useful life of the primary asset within the asset group. If the carrying value of the asset group exceeds the estimated

undiscounted cash flows, Kodak records an impairment charge to the extent the carrying value of the long-lived asset exceeds its fair value. Kodak determines fair value

through quoted market prices in active markets or, if quoted market prices are unavailable, through the performance of internal analyses of discounted cash flows.

In connection with its assessment of recoverability of its long-lived assets and its ongoing strategic review of the business and its operations, Kodak continually reviews

the remaining useful lives of its long-lived assets. If this review indicates that the remaining useful life of the long-lived asset has changed significantly, Kodak adjusts

the depreciation on that asset to facilitate full cost recovery over its revised estimated remaining useful life.

Kodak recorded indefinite-lived intangible assets related to the Kodak trade name and in-process research and development in conjunction with fresh start accounting. The

carrying values of indefinite-lived intangible assets are evaluated for potential impairment annually on October 1 or whenever events or changes in circumstances indicate that

it is more likely than not that the asset is impaired. Refer to Note 5, “Goodwill and Other Intangible Assets.”

58