Kodak 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

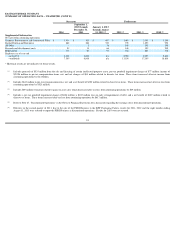

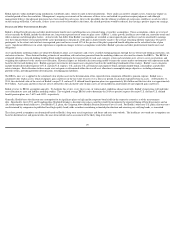

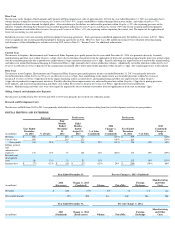

The following table illustrates the sensitivity to a change to certain key assumptions used in the calculation of expense for the year ending December 31, 2015 and the

projected benefit obligation (“PBO”) at December 31, 2014 for Kodak's major U.S. and non-U.S. defined benefit pension plans:

Total pension income from continuing operations before special termination benefits, curtailments and settlements for the major defined benefit pension plan in the U.S.

was $104 million for 2014 and is expected to be approximately $115 million in 2015. Pension income from continuing operations before special termination benefits,

curtailments and settlements for the major non-U.S. defined benefit pension plans was $4 million for 2014 and is projected to be approximately $15 million in 2015.

Total other postretirement benefit expense before curtailments and settlements for the major other postretirement benefit plans was $4 million in 2014 and is expected to

be approximately $5 million in 2015.

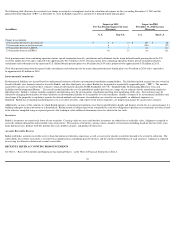

Environmental Commitments

Environmental liabilities are accrued based on undiscounted estimates of known environmental remediation responsibilities. The liabilities include accruals for sites owned or

leased by Kodak, sites formerly owned or leased by Kodak, and other third-party sites where Kodak was designated as a potentially responsible party (“PRP”). The amounts

accrued for such sites are based on these estimates, which are determined using the ASTM Standard E 2137-06, “Standard Guide for Estimating Monetary Costs and

Liabilities for Environmental Matters.” The overall method includes the use of a probabilistic model that forecasts a range of cost estimates for the remediation required at

individual sites. Kodak’s estimate includes equipment and operating costs for investigations, remediation and long-term monitoring of the sites. Such estimates may be

affected by changing determinations of what constitutes an environmental liability or an acceptable level of remediation. Kodak’s estimate of its environmental liabilities may

also change if the proposals to regulatory agencies for desired methods and outcomes of remediation are viewed as not acceptable, or additional exposures are

identified. Kodak has an ongoing monitoring process to assess how activities, with respect to the known exposures, are progressing against the accrued cost estimates.

Additionally, in many of the countries in which Kodak operates, environmental regulations exist that require Kodak to handle and dispose of asbestos in a special manner if a

building undergoes major renovations or is demolished. Kodak records a liability equal to the estimated fair value of its obligation to perform asset retirement activities related

to the asbestos, computed using an expected present value technique, when sufficient information exists to calculate the fair value.

Inventories

Kodak’s inventories are stated at the lower of cost or market. Carrying values of excess and obsolete inventories are reduced to net realizable value. Judgment is required to

assess the ultimate demand for and realizable value of inventory. The analysis of inventory carrying values considers several factors including length of time inventory is on

hand, historical sales, product shelf life, product life cycle, product category, and product obsolescence.

Accounts Receivable Reserves

Kodak establishes accounts receivable reserves based on historical collections experience as well as reserves for specific receivables deemed to be at risk for collection. The

collectability of customer receivables is reviewed on an ongoing basis considering past due invoices and the current creditworthiness of each customer. Judgment is required

in assessing the ultimate realization of accounts receivables.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

See Note 1, “Basis of Presentation and Significant Accounting Policies,” in the Notes to Financial Statements in Item 8.

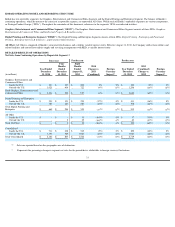

(in millions)

Impact on 2015

Pre-Tax Pension Expense Increase

(Decrease)

Impact on PBO

December 31, 2014 Increase

(Decrease)

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

Change in assumption:

25 basis point decrease in discount rate

$

6

$

(1

)

$

109

$

28

25 basis point increase in discount rate

6

1

(104

)

(27

)

25 basis point decrease in EROA

9

2

n/a

n/a

25 basis point increase in EROA

(9

)

(2

)

n/a

n/a

30