Kodak 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

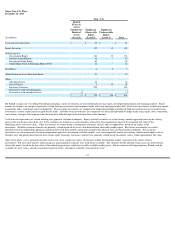

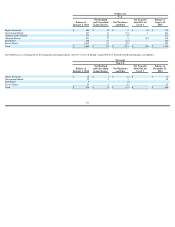

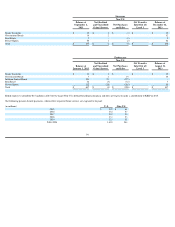

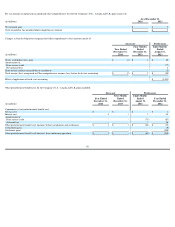

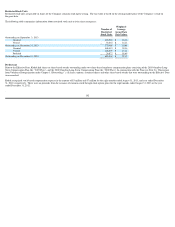

NOTE 20: SHAREHOLDERS’ EQUITY

In connection with the Company’s reorganization and emergence from bankruptcy, all shares of the Predecessor Company’s common stock were canceled. The Successor

Company has 560 million shares of authorized stock, consisting of: (i) 500 million shares of common stock, par value $0.01 per share and (ii) 60 million shares of preferred

stock, no par value, issuable in one or more series. As of December 31, 2014 and December 31, 2013 there were 41.9 million and 41.6 million shares of common stock

outstanding, respectively, and no shares of preferred stock issued and outstanding.

On the Effective Date, the Company issued, to the holders of general unsecured claims and the retiree settlement unsecured claim, net-share settled warrants to purchase:

(i) 2.1 million shares of common stock at an exercise price of $14.93 and (ii) 2.1 million shares of common stock at an exercise price of $16.12. The warrants are classified as

equity instruments and reported within Additional paid in capital in the Consolidated Statement of Financial Position at their fair value as of the Effective Date ($24

million). As of December 31, 2014, there were warrants outstanding to purchase 3.6 million shares of common stock.

During the year ended December 31, 2014, the Company repurchased shares of common stock for approximately $1 million to satisfy tax withholding obligations in

connection with the issuance of stock to employees under the 2013 Plan. During the four months ended December 31, 2013, the Company repurchased shares of common

stock for approximately $3 million to satisfy tax withholding obligations in connection with the issuance of stock to employees under the Plan. Treasury stock consisted of

approximately 0.2 million shares at both December 31, 2014 and December 31, 2013.

103